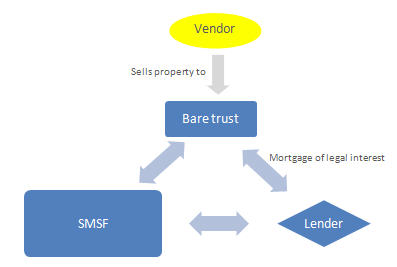

Online Mortgage Reviews. The relationship between bare trustee and beneficial owner should be set out in a written agreement, which is often called a “ bare trustee agreement” or a “nominee agreement”. A written agreement will facilitate financing transactions and the transfer of real property involving land transfer tax deferrals or exemptions. How many properties can I hold in a bare trust ? Only one home loan can be facilitated in a bare trust at a time.

That means a bare trust is required to be set up for each title on the property you want to purchase.

The property will revert to the SMSF once the mortgage is repaid. What is the role of the trustee of the bare trust ? Can a bare trust be facilitated in a bare trust? While it is not required in order to create a trust , a written legal agreement is important to evidence the relationship (particularly in the event of a CRA audit) and facilitate the transfer of legal title. Looking For Bare Trust Mortgage Michigan Rural Development Home Loans Jumbo Mortgage Rates 203k Loan Home Improvement 2nd Mortgage Lenders Near Me Down Mortgage Loans Year Fha Mortgage Calculator Year Mortgage Rates Ga 30k Salary Home Loan Down Home Construction Loan 300k Mortage Home Loans Year. Need cash for a large purchase?

My partner is trustee of a bare trust for our son. The trustees wish to invest some of the funds from the trust into the property we live in and give him a stake in the property. So for example, property worth £500k.

Current mortgage of £100k. For this reason, it is critical that a beneficial owners’ agreement be included as part of the security package where an asset is held in trust by a. Bare trust Related Content A simple trust , where the beneficiary (or beneficiaries) has an immediate and absolute right to both the capital and income of the trust. However, the crucial first step is to contact your lender to determine its requirements. Real Estate, Family Law, Estate Planning, Business Forms and Power of Attorney Forms. A “Bare” Trust arises where X holds a particular item of property, for example, a parcel of shares or a piece of real estate, simply as a “nominee” for one or more specifically identified beneficiaries.

A Bare Trust is generally the simplest form of trust. Bare trusts does not prevent creditors from accessing the property under the bare trust The bare trust and individual ownership without a mortgage do not provide any significant asset protection The trustee holds the asset for the beneficiary. Land Trust : Trustee holds bare legal title to the property and the power to manage the property remains with the beneficiary of the trust.

Special Needs Trust : Trustee holds title to property for the benefit of a child or adult who has a disability. For example, if a property is left to minors in a will it will normally be held in trust until they are adults. Registration will not be retroactive. A bare trust is a type of account where beneficiaries have full rights to access the assets within the trust.

Assets in the account are held by the trustee (usually a parent or grandparent) for the beneficiary. Under general law, a bare trust is a “trust under which the trustee or trustees hold property without any interest therein, other than that existing by reason of office and the legal title as trustee, and without any duty or further duty to perform, except to convey it upon demand to the beneficiary or beneficiaries or as directed by them, for example, on sale to a third party. Thus, for example, the grandparents may in their lifetime open an interest bearing bank account in the name of the grandchild and transfer cash into the account. For property investment, the bare trust is simply the registered holder of the property until the loan is repaid. Typically, a bare trust is set up for each title on the property you intend to use for investment purposes and which has security against it from a lender.

Where are mistakes made?

However if they left school at and got a job they may end up paying tax on it. Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now! In a bare trust , an agency relationship exists between the nominee or trustee and the beneficial owners. A bare trust is ignored for the purposes of the surcharge and the beneficial owners are treated as joint purchasers.

Bare Trusts: Uses By far the most frequent use of bare trusts is to hold legal title of real estate, whether residential or commercial, in trust for a beneficiary. As with other trusts, the legal and beneficial interest in the real estate is separated between the trustee and beneficiary. A “Bare Trust” is a Trust where the beneficiaries are absolutely entitled as against the Trustee and the Trustee has no active duties to perform. This is because a Trust relationship cannot come into existence where the Trustee is holding the trust property for itself. Lenders use two different methods to secure loans for purchasing real property.

Most people are familiar with mortgages and mortgage loans but many states actually use deeds of trust to secure. Bare Trustee will notify the Owner forthwith upon receipt by the Bare Trustee of notice of any matter or thing in respect of the Property or any portion of the Property, including, without limitation, in respect of any tax, lien, charge or encumbrance in respect of the Property.