What is a guaranteed letter? Mention the date, the account number, and the amount of the guarantee. The release of a personal guarantee form allows a guarantor (or, the person that is seeking release) to be freed from being legally bound by a loan contract. This is a common form that generally gets signed if a cosigner is trying to be released from any obligation if a lessee cannot pay a loan or agreement.

We hereby request you to release the payment of the same and do the needful. Letter Presenting a Guarantor for Overdraft. The bank only pays that amount if the opposing party does not fulfill the obligations outlined by the.

A release of personal guarantee form states that you have fully ended all obligation to the account which you were originally tied to as collateral. If someone were to try and come after you for unpaid debts on a loan or lease, you have proof that you have ended the terms of the original agreement. Here is a simple letter to request bank guarantee release for the company.

A sample letter for cancellation of bank guarantee. A bank guarantee is an agreement between three parties, i. Generally speaking after expiry date, the BG papers turn into scraps, it siezes to hold any legality. However, some bankers hasitate to release the securities on the assumption of one or others.

Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now! Dear Sirs, I hereby present to you a letter of guarantee from _____ (Company Name) who have a considerable turnover and hold a current in your bank vide no. Download and complete the Assurance of Support Bank Guarantee Release form. If you have a disability or impairment and use assistive technology, there are other ways you can do your business with us.

You can use self service or request someone to deal with us on your behalf. If you can’t access our forms, please contact us. We can help you access, complete and submit them.

A letter of guarantee is a document type issued by a financial institution to show customer commitment in purchasing some goods. The customer promises to meet all the financial obligations provided by the supplier. It is important to write a letter of guarantee to ensure all the participants are covered. The letter is also copied to the commercial bank or cooperative institution through which the guarantee was issued.

Time needed for the return of a guarantee On average, the guarantee is returned three (3) months after the submission of the request to the Department, provided that at least one of the reasons mentioned above applies. This guarantee is for the purpose of our customer purchasing vehicles or other property in connection with the auction to be held at Solano Ave. This letter of guarantee is good until _____(At least days)_____.

If further information is requir e please feel free to contanct this office. All Major Categories Covered. This is common for loan agreements and lease documents after expiration or when the contract has been fully satisfied. The release is recommende although not require to be signed in the presence of a notary public. Issue Date Maturity Date Amt.

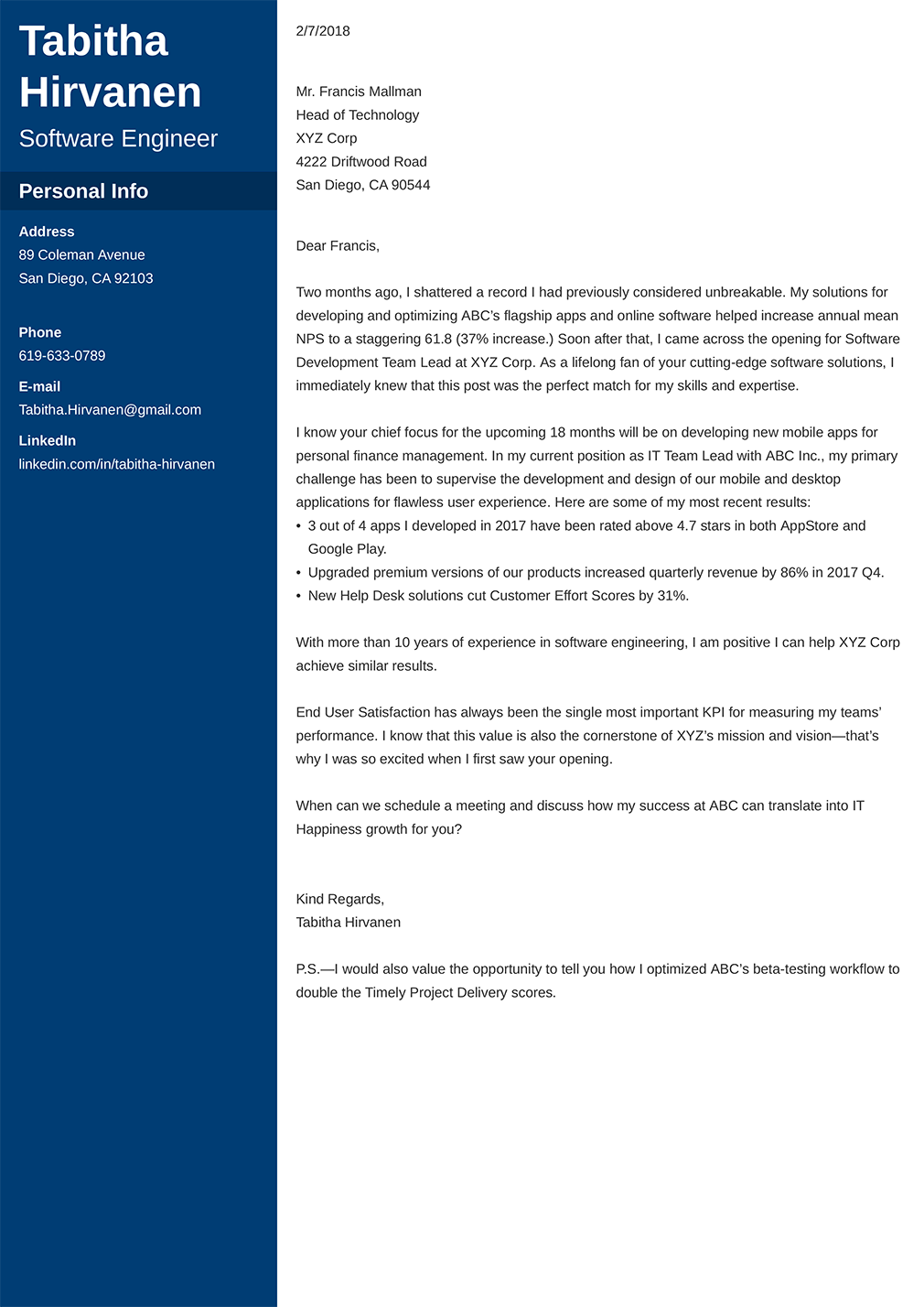

On the left pane, select the request with the status Submitted to bank and click Receive from bank to open the Receive letter of guarantee from bank drop dialog. In the Bank number fiel enter the bank account number as it appears in the letter of guarantee. Double-click a project line to open the Project details form. If you want the request letter to the bank to look as professional as possible, then you’ll have to learn the business letter format. It’s one of the best ways of writing formal letters and it will make the letter look very organized and polished in the eyes of the recipient.

Neetu Singh holds an Engineering degree in Computer Science with MBA Degree in Finance and Human Resource (HR). A detailed letter from existing SBA borrower(s) and guarantor(s) signed and dated explaining the reasons for the release of guarantor. The letter must state the amount of monetary consideration being offered and the source of the funds. NLC reserves its rights to reject the Bank Guarantee if the same is not in the specified format.

BANK GUARANTEE FORMAT FOR RELEASE OF LIQUIDATED DAMAGES AMOUNT 1. In the case of a bank guarantee , the buyer is unable to make payments to the seller or creditor and so the bank pays the fixed amount to the seller. Whereas, in the letter of credit, the bank becomes liable to pay to the seller, once the seller delivers the product on time. It is an unconditional undertaking given by the bank , on behalf of our customer, to pay the recipient of the guarantee the amount of the guarantee on written demand.

Bank Guarantees require security in the form of cash held on deposit with the bank , or real estate of a type and value acceptable to the bank.