What is account operating authority? Who can access my account? Can an authorised signatory use an account separately?

If you wish to avoid all of this, simply transfer a certain amount of cash into a special account, and make it a joint account. Add your appointed representative as a co-owner of the account. This way, they’ll be able to handle transactions and no letter will be necessary. Whether you are empowering your appointed representative to have access to one account at one bank , or several accounts at different banks, it is important that you first contact each financial institution, to inquire if they have special forms to fill out.

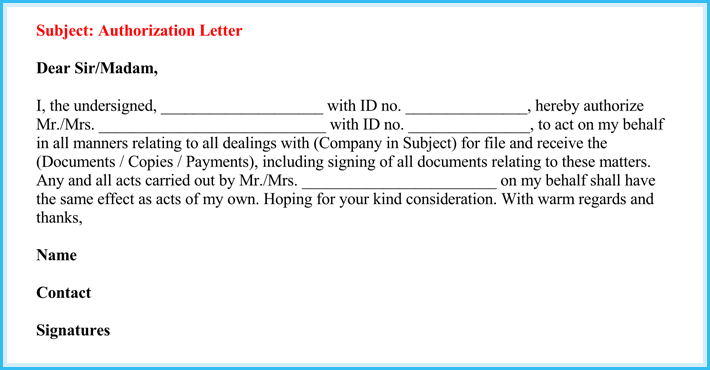

If your financial institution does not have a form, simply write the authorization letter yourself. See full list on wordtemplatesonline. I will be out of town for an extended business.

Thank you for your kind attention to t. Since this is considered a legal document, it should always be typed in an acceptable business letter format, such as a blocked style. Here, all the information you include will be justified to the left, with no indentations, single-space and spaces in between sections. This letter should always be type and never hand-written. Check with your state requirements, as you may need to have this letter notarized.

Keep the letter business-like in tone, short and concise. Never leave room for anyone to make their own interpretations. Name all accounts they are to have access to , and name all transactions, accounts, safety deposit boxes, they are not allowed to have access to , if any. It’s never easy to realize that you’ll need to compose one of these letters. However, as these are your finances, you must do so and do it with a clear and level head.

In other words, don’t be afraid to place limits on what the individual can do. Feel free to contact your lawyer as well, to inform him or her of the FPOA. With all precautions taken, you should be able to have peace of min knowing your finances will be taken care of in the proper manner, as you requested.

Withdraw from all your specified accounts. Sign , deposit or stop cheques. Endorse cheques payable to the account holder. The ATO form is only available on request. How do I set up authority to operate?

All sections must be completed (see overleaf for instructions for completion). Individual authorised signatories can use an account separately if the mandate says “ several” , “ any” or “either” authorised signatory can sign (that is, operate the account). A mandate that requires “joint”, “both” or “all” (or in some cases “any two”) authorised signatories to sign or access the account together means one authorised signatory alone cannot use the account.

An authorization letter for bank is a letter written to the Bank by an owner or a Signatory of a bank account to allow the bank do transactions on the account. If you wish to grant a power of attorney to a third party to manage your bank account, you must write a letter and send it to your banker. Authority to Operate Form. As NRI live outside India, they submit such authorisations in advance with the bank so that there is no trouble in making payments or withdrawing money from the account while they are. RESOLVE that the Corporation execute and deliver to said bank a duly signed original of the completed banking resolution as is annexed thereto, and that the authority to transact business, including but not limited to the maintenance of savings, checking and other accounts as well as borrowing by the Corporation, shall be as contained in said resolution with the named officers therein authorized to so act on behalf of the Corporation as specified hereto.

A power of attorney allows an agent to access the principal’s bank accounts, either as a general power or a specific power. Not to be used for lending or credit facilities e. If the document grants an agent power over that account , they must provide a copy of the document along with appropriate identification to access the bank account. It is important to note that there is a key distinction between adding an individual to a bank account as a joint owner and adding an individual to an account as an authorized signer.

Covering letter to bank for change in authorised signatory is a letter to the banker of the company requesting the bank to change (either add or remove) the list of signatories and their limits who are authorised to operate the account of the company maintained in that bank. The Board of Directors in its meeting can pass a resolution in order to change the authorised signatory for operating the bank account of the company including the limits of such authorisation.