Generally, super you access as a DASP will be taxed at if you’ve been paid any of that super while on a subclass 4or 4visa or an associated bridging visa. There are eligibility requirements you will need to meet to claim your DASP. Please take some time to read through this section so you know what information you will need to provide to apply for your superannuation benefits using this system.

Superannuation is a way to save for retirement. You are entitled to receive super contributions from an employer if you are at least years ol and receive a salary of $4or more (before tax) per month. You’ll need a myGovID and be linked to an ABN in Relationship Authorisation Manager (RAM) to use this system. If you’re over and earn more than $4a month before tax then your.

Climate change – transitioning to a low carbon economy. Our climate change report tracks our climate change progress and explains how we’re reducing carbon emissions. Investment returns are not guaranteed.

If you leave the country while your visa still active, you can either decide to wait until your visa expires or cancel your visa. You can request the Department of Immigration and Border Protection to cancel your visa so that you can claim a DASP. AustralianSuper is run only for members.

The taxed element is the amount of the taxable component of the super lump sum that represents the return of amounts that have been subject to tax in the fun for example, taxable. The DASP form is available online, see “Applications” below. Conditions of release are largely related to your retirement age, specific medical conditions or severe financial hardship. Select from the below options to manage super payments online for your employees.

There are requirements which you will need to meet to claim your DASP. In this case it looks like the entire super refund will be taxed at as the fund was opened on working holiday visa. The temporary resident will be able to reclaim their super benefit (less the DASP withholding tax) directly from the ATO at any time where certain conditions have been satisfied. Once you’ve submitted your DASP form, the request will be forwarded to your super fund and the ATO. You can view the applicable tax rates on DASP withdrawals here.

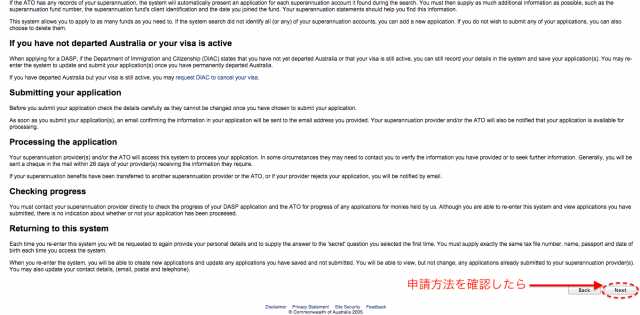

Only when you can’t use the ATO Online Service. Send your super fund or the ATO the correct ATO paper form (fees may apply) 2. Kindly take the time to take a look through this part so you are aware what info you will have to provide in order to apply for the super benefits by means of this system. You can find information to help you claim a DASP in our guides on our Community. To complete your application, you will need to confirYour personal details (name, date of birth) Your.

To claim your super under other circumstances, you’ll need to complete the appropriate form. If you want to open a CareSuper Pension account you don’t need to complete this form. Watch out for cold-call offers to help you get early access to your super The only way to apply to withdraw your super if you are eligible under the COVID-early release scheme is free and through my. Du kannst dein Visa abbrechen indem du das Department of Immigration and Border Protection darüber informierst. Der Vorgang ist kostenlos.

We’ll help organize your superannuation refund. Unlike other types of member benefits paid from a superannuation fun a DASP is not included in the member’s assessable income, but is subject to the final withholding tax rates. The payment is only available if certain conditions are satisfied. In case you leave the nation while your own visa still active, you may either choose to wait until your own visa expires or even cancel your visa. You can check the tax components of your account in Tasplan Online, or by calling us.

Trust WA Super , your local WA government super. The funds are not transferred to the individual’s account. If you’re moving to New Zealand you may be able to take advantage of the Trans-Tasman portability scheme, allowing you to transfer your super to a KiwiSaver account. I found out how you can claim the superannuation back before retirement once you leave the country and want to share it with you step by step!

Back to select tasks.