Insurance, peace of mind for. Does australia have universal healthcare? See full list on finder. Therefore, all expats who qualify as permanent residents are eligible for coverage.

While policies vary, most will cover you for a portion of your doctor’s fees as well as necessary hospital admissions.

Roughly half the country has private health insurance on top of this. It provides free or subsidised cover for certain healthcare services, which means it pays all or part of the costs. You can also choose to take out private health insurance to give you more health care options and to cover items which are not covered by Medicare. The number to dial in case of an emergency is 000.

If you’re a lawfully present immigrant , you can buy private health insurance on the Marketplace. You may be eligible for lower costs on monthly premiums and lower out-of-pocket costs based on your income. Skip the month waits on Extras with nib when you join a combined cover.

Limited Time Offer, ends August 31.

It is important to find out about the local healthcare system first. Permanent residents and Citizens are entitled to Medicare. You are free to buy medical insurance if you wish, but the public system is usually better than the private system.

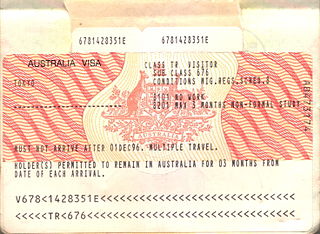

Restricted access is provided to citizens of certain other countries through. This will depend on what visa you apply for. Whether you’ve recently arrived in the United States or are a long-term permanent resident , the U. In fact, the choices are largely the same as for U. Call or Compare Online.

Overview of Health System. When considering any health insurance take care to ensure the cover you select is suitable for your needs. Make sure that you are aware of the waiting periods of the policy you purchase. Most insurers will impose a month waiting period for cover on pre-existing conditions, and some will not cover them at all.

If you are here on a student, visitor or working visa, you may not qualify for Medicare. How does private health insurance work? It also covers some or all of the costs of other health services.

These can include services provided by GPs and medical specialists. By definition, children are unmarried and under years of age.

Australia boasts universal public healthcare. Private health insurance policies cover some of the costs of treatment in a private hospital. Find out how Health helps to improve the private health insurance industry. Medicare covers all of the cost of public hospital services.

A combination of Medicare, private health insurance and personal payments covers the cost of treatment as a private patient in a public or private hospital. However, select insurers do offer non- residents cover when they meet specific criteria. The most common permanent visas include some skilled work and family visas. To find a visa that suits your needs explore visa options. Typically, you need proof that you have residency or are far enough down the path to obtaining residency that they can justify bringing you into the system.

Has A Range Of Extras Cover Options To Suit Your Needs. Get The Most Out Of Your Cover. In addition to proving you meet the above health requirements you are also expected to prove that you will have an adequate level of health insurance for yourself and anyone included on your visa. You will need to make sure you have adequate cover for you and your family whilst on the TSS visa.

Residents of Norfolk Island can purchase the same policies as residents of NSW. The higher the amount of policies sol the more likely it generally is that the health insurer is receiving higher profits, which could lead to lower premiums and more benefits for its members. The exception is Queenslan which does provide a free ambulance service to the lucky (or unlucky!) residents who need it. However, newcomers are not eligible for coverage unless they achieve permanent residency status, and.

Buy comprehensive private health insurance. One way forward is to purchase private health insurance from a private company. This is relatively cheap if you are young and healthy.

It may be prohibitively expensive or even impossible if you are older or already ill. When you have a private insurance you can use it to cover possible medical emergency expenses while your provincial insurance is not active for the.