To access our online services and other government online services you will need to use: myGovID – the Australian Government’s digital identity provider that allows you to prove who you are online. It’s an app that you download to your smart device and is different to your myGov account. Visit our COVID-page for information and advice on the assistance available for NSW residents and businesses. At this page, you’ll see some instructions and a yellow button at the bottom of the page. The AUSKey method of access has been used for many years but the ATO is very concerned with the lack of security of this method in relation to the current technological world.

New partners cannot be added in a partnership. You will need to cancel the existing ABN and register for a new ABN if there is a change in partners. If you have made changes, select Declaration. Tick the box to accept the declaration and select Submit.

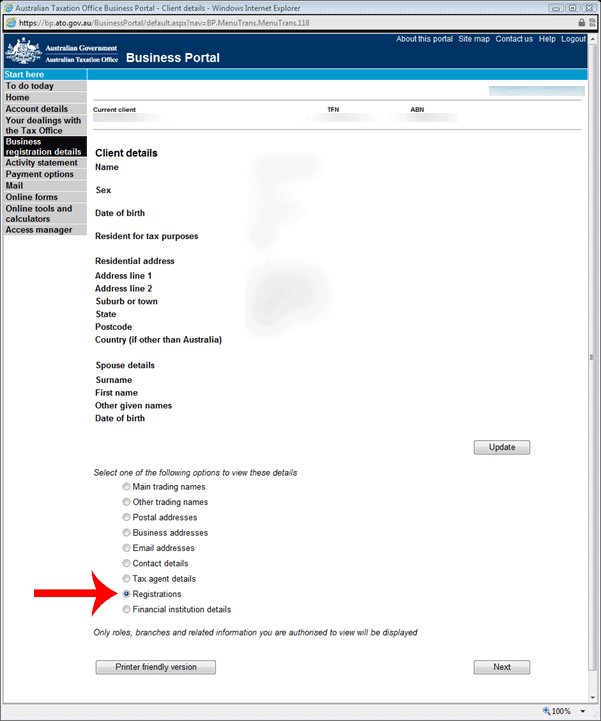

Thinking of changing your business structure. You may need to cancel your Australian business number (ABN) and apply for a new one. The Business Portal is a free secure website for managing your business tax affairs with us. Use it to lodge activity statements, request refunds and more.

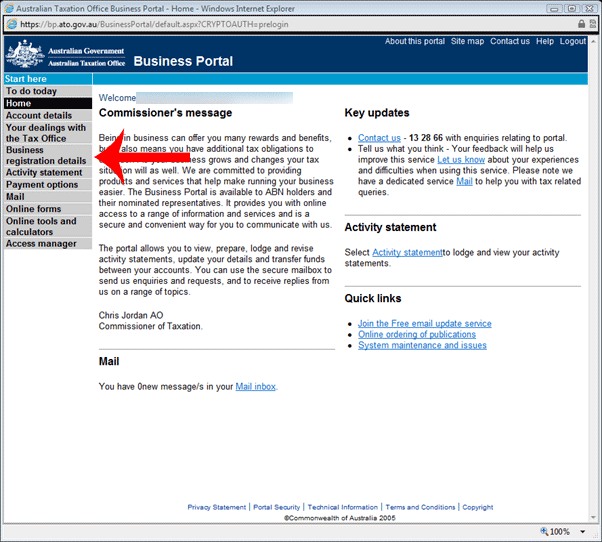

Auto-suggest helps you quickly narrow down your search by suggesting possible matches as you type. To continue accessing the Business Portal on behalf of a business, you now need to use myGovID and Relationship Authorisation Manager (RAM). AUSkey no longer available for use. Each individual who accesses the Business Portal will need their own myGovID External Link. Start page for the Business Portal.

By logging in you agree to the terms and conditions Set up your myGovID and establish your authorisations using Relationship Authorisation Manager (RAM). Unique Student Identifier validations you need to add an Auskey , do this by: Visit abr. Follow the Auskey Manager Login link. The combination of the two uniquely identifies a user for their organisation. Register for the Portal.

I had to reapply and get the ATO to send the link to download it again, and then it only worked once! Together, these services offer an easy, secure and more flexible authentication and authorisation solution. You must register for PAYG withholding if you need to withhold tax from payments made to your workers and businesses you deal with. High call volumes may result in long wait times.

Before calling us, visit COVID-, Tax time essentials , or find to our Top call centre questions. Access Business Hub or read more about how to transition from CBOS to Business Hub. Here’s what you need to know. Step two: Ensure you have the right information to register for an AUSKey.

Refer to attached article by Colin Walker, Assistant Commissioner, ATO here. Auskey Many of you access various government portal services through the Auskey facility, however the way you access your government online services is changing. You can also contact us without logging in.

We recently updated this website. We have forms for new businesses, existing businesses returning to apply for tax registrations or businesses who simply need myGovID account. For assistance and support, contact us. An AusKey provides you with a secure login for accessing certain government online services on behalf of the business.

To be eligible for an AusKey , you must have an ABN. Autoplay When autoplay is enable a suggested video.