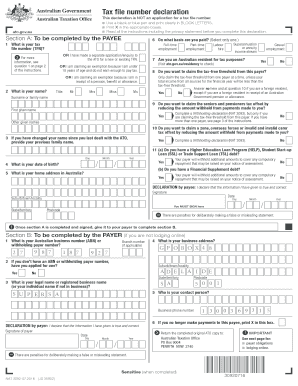

ATO online services linked to myGov External Link. How to order tax forms? What is tax filing number declaration? This is not a TFN application form. To apply for a TFN, go to ato.

This form is used by tax professionals and ATO staff in assisting clients who have lost their tax records as a result of a natural disaster. Recipient-created tax invoices A form you can use as a template for creating a recipient created tax invoice. Copies of tax documents requestMost requests for copies of tax documents can be made using our online services. Nomination of parliamentary representativeUse this form to nominate a member of parliament as a representative to deal with the ATO on your behalf and receive information about your taxation affairs. The list below is of the more frequently needed forms.

For general tax return lodgement requirements see here. FBT – a guide for employers: Chapter – Fringe benefits tax record-keeping –see 4. Employee declarations, 4. You must obtain all employee declarations no later than the day on which your FBT return is due to be lodged. Ask questions, share your knowledge and discuss your experiences with us and our Community. You can find our most popular forms listed here, or refine your search options below.

Prevent new tax liens from being imposed on you. While many employers still distribute paper forms to new employees, the ATO will now accept a digitally signed form which is a welcome advancement. The ATO reviews the form annually, so order only what you need.

If you have employees you should be registered for PAYG and will generally withhold money from the payments you make to them on behalf of the ATO. Make any other relevant changes to your TFN declaration questions. Welcome to our Community and thanks for your question! If so, you can find information and a link to the form on our website. TFN Declaration Form ( ATO ) Allowances.

It is not an offence not to quote your tax file number (TFN). Tax Instalment Tables. This declaration is NOT an application for a tax file number. Please print neatly in BLOCK LETTERS and use a BLACK pen. You will need to provide proof of identity documents as outlined on the application form.

Make sure you read all the instructions before you complete this declaration. The information in the completed Withholding declaration – short version for seniors and pensioners form must be treated as sensitive. SBR product list by form.

Australian Taxation Office ( ATO ) – browse by form. See next page for: payer obligations lodging online. Use a black or blue pen and print clearly in BLOCK LETTERS.

You need to complete all the questions on this form. X in the appropriate boxes. Make use of the Sign Tool to add and create your electronic signature to certify the Ato tax file declaration form. Press Done after you fill out the form. Now you may print, downloa or share the document.

Address the Support section or get in touch with our Support staff in case you have got any questions. New employees download the form and then complete the form on-line. The ATO have listened to you and developed a fillable TFN declaration form which is available on the ATO website. The employer should keep a copy of the form on file. For information about storage and disposal, see below.

You may lodge the information: online – lodge your TFN declaration reports using software that complies with our specifications. There is no need to complete section B of each form as the payer information is supplied by your software. ATO have developed a fillable TFN declaration form which is available on ATO’s website.

Just download it from ato.