If you have more than nine contractors, you will need to order more than one form. Keep a copy of the completed form for your records. Taxable payments annual report (TPAR) If your business makes payments to contractors or subcontractors you may need to lodge a Taxable payments annual report (TPAR) by August each year.

How to fill out a subcontractor statement? Can a supplier use a statement by a supplier form? What is a subcontractor agreement? High call volumes may result in long wait times.

Before calling us, visit COVID-, Tax time essentials , or find to our Top call centre questions. SUBCONTRACTOR ’S STATEMENT. REGARDING WORKER’S COMPENSATION, PAYROLL TAX AND REMUNERATION (Note– see back of form ) For the purposes of this Statement a “ subcontractor” is a person (or other legal entity) that has entered into a contract with a “principal contractor” to carry out work. This Statement must be signed by a “ subcontractor” (or by a person who is authorise or held out as being authorise to sign the statement by the subcontractor) referred to in any of s175B.

This guide provides information on Rollover benefits statement and Death benefit rollover statement forms and instructions. These forms are to be used by trustees of superannuation funds or retirement savings account (RSA) providers when rolling over benefits to another fund. On the website with the form , choose Start Now and pass for the editor. Use the clues to fill out the pertinent fields. Include your personal data and contact data.

If the supplier is operating a business or is entitled to register for an ABN, they cannot use the Statement by a supplier form. If you are reporting using ATO paper forms , the pay as you go (PAYG) payment summary statement , along with the originals of all payment summaries you issued for the financial year, make up your PAYG withholding annual report. Download and complete the Profit and Loss Statement form. You should also use this form if your level of business activity or income from self-employment has changed.

The Business Portal is a free secure website for managing your business tax affairs with us. Use it to lodge activity statements, request refunds and more. To assist businesses, the ATO has developed a payee information statement.

However, you may request this information from them. You may need to report any payments you make to other contractors, to the ATO. The taxable payments reporting system (TPRS) requires businesses to report to the ATO all payments made to contractors during an income year. This additional reporting is in the form of an annual report that is used by the ATO to cross check that contracting income is being correctly declared by contractors.

Some industries, including building and construction, cleaning or courier services, or government entities, are required to report to the ATO the amount of payments made to contractors for services (such as labour). Payments need to be reported to the Australian Taxation Office ( ATO ) on the Taxable Payments Annual Report, or electronically. The first statement will define the frequency of pay as periodic. If the Professional will be paid regularly throughout this agreement then, mark the first checkbox. This means you need to define if the payments will be submitted “Weekly,” “Monthly,” or on a “Quarterly Basis Beginning On the date you specify.

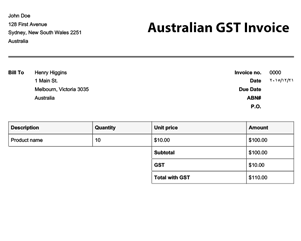

When registering for GST, contractors can elect to lodge BAS forms manually or electronically via the ATO business portal. The BAS is usually due days after the end of each quarter but lodging it via an accountant provides additional time to lodge. Subcontractor Statement. This form is prepared for the purpose of section. Businesses in the building and construction industry now have to report to the Australian Taxation Office ( ATO ) the total amount they have paid contractors each year for building and construction services.

This invoice is a helpful tool as a whole. What are the requirements of a Sub-Contractor ? An independent contractor (sometimes known as a freelancer or consultant) is a business, corporation, or self-employed individual that provides services as required by a client in exchange for. Specific AOR training content may be directed by the USEUCOM Commander, with the USAREUR ATO being the local POC. Ask questions, share your knowledge and discuss your experiences with us and our Community. Answered: Hi, My partner is a subcontractor working on his own ABN and I am trying to do his tax return.

The forms provided (below) are designed to serve the needs of two (or more) DOE Headquarters or field organizations. Last year, the government introduced taxable payments reporting to improve tax compliance within the building and construction industry. It is taxable income.

The slip is for informational purposes only on payments over $5to a subcontractor that provided construction services.