Statement of tax record screen, select Apply on the Requests bar towards the bottom of the screen. Not-for-profit organisations have similar reporting obligations to businesses, covering their income tax (if not exempt) and other obligations such as GST, fringe benefits tax and pay as you go (PAYG). Ancillary funds must lodge an annual information return. If your employer is reporting through STP, you receive an income statement. You will be able to find your income statement through your ATO online services via myGov.

Instea your payment summary information will be available in ATO online services through myGov. If your organisation reports and pays monthly, its activity statement and payment is due on the 21st day of the following month. For example, a July monthly activity statement is due on August.

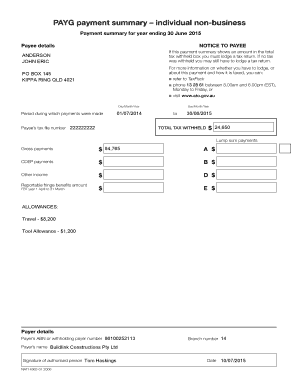

It’s a summary of your income and tax earned throughout the year. Your income statement is like a PAYG. An if you use Etax, your Income Statement details are added automatically, to make things easy and accurate. To try it, you can start here. If you develop your own payroll software package, this schedule provides the formulas that you will need to calculate the amounts to be withheld from payments made on a weekly, fortnightly, monthly or quarterly basis.

To assist employers who do not have a payroll software package our website makes available: 1. Payments covered include: 1. See full list on ato. Amounts to be withheld from payments made weekly, fortnightly, monthly and quarterly, as set out in the relevant PAYG withholding tax table, can be calculated using the formulas and coefficients contained in this schedule. Separate formulas apply to: 1. Tax file number (TFN) declarations 2. Withholding declarations 3. Holiday pay, long service leave and employment termination payments 5. Claiming tax offsets 6. It is responsible for providing safe and efficient air navigation services to 29. Customer ATO that inherits from cloud. ATO (ideal) Here’s what this can look like for the first system to use cloud.

In this diagram, AOs stands for Authorizing Officials – people who can ATO a system. Single Touch Payroll. The ATO staff member will provide a PIN you must enter when prompted. Schedule – Statement of formulas for calculating amounts to be withheld.

Find out the revenue, expenses and profit or loss over the last fiscal year. View the latest ATO financial statements , income statements and financial ratios. There are two types of activity statements – an instalment activity statement (IAS) and a business activity statement (BAS). Activity statements are personalised to each business or individual to support reporting against identified obligations. The ATO is the authority to operate decision that culminates from the security authorization process of an information technology system in the US federal government, which is a unique industry requiring specialized practices.

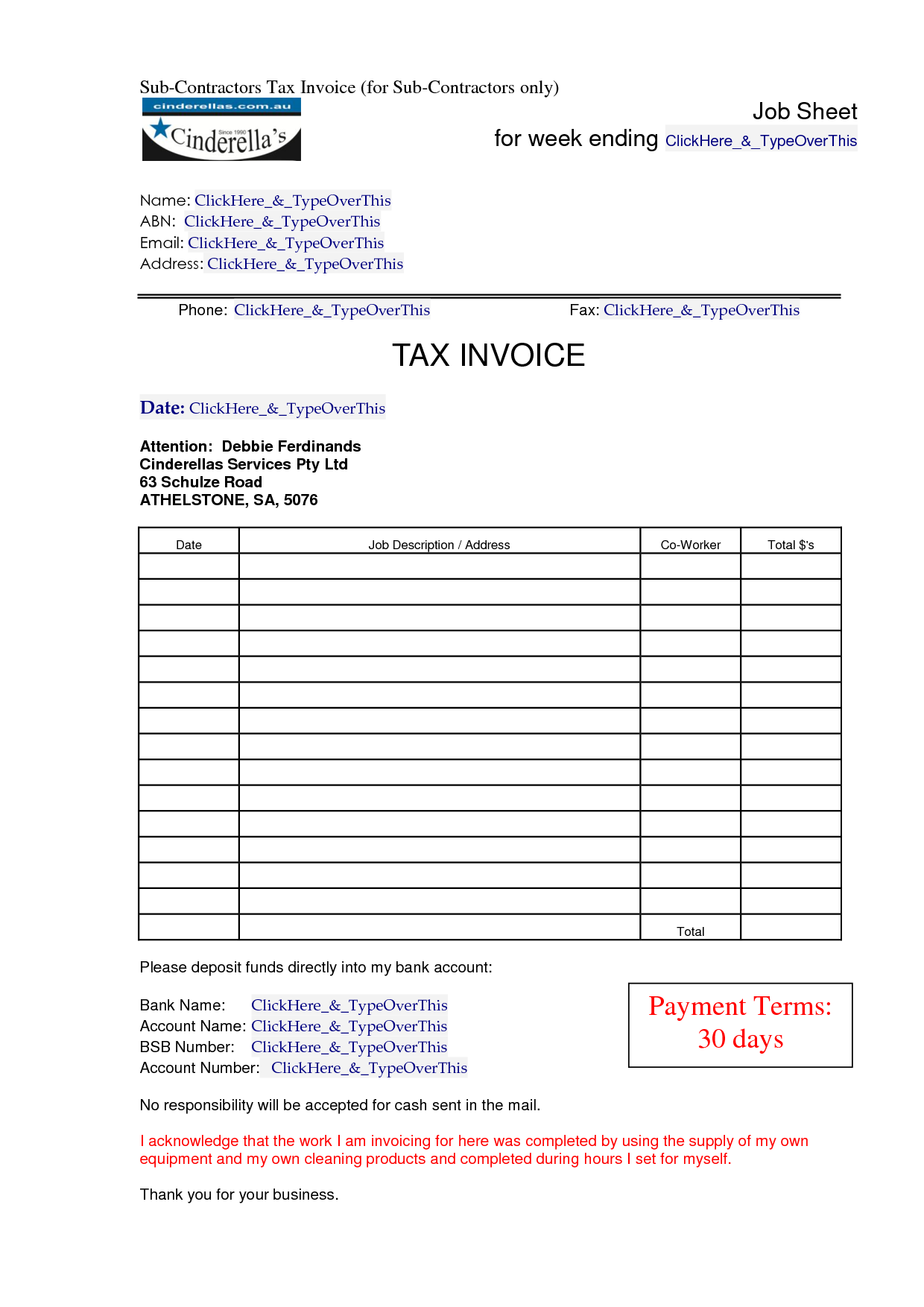

Figure provides information about an ATO. The Australian Tax Office ( ATO ) requires businesses to submit a business activity statement (BAS) monthly, quarterly or annually (annual GST return, if eligible). It is used to report and pay goods and services tax (GST), pay as you go (PAYG) instalments, PAYG withholding tax and other tax obligations. As America’s Leadership Development Fraternity, ATO provides a great opportunity for young men who are looking for a truly unique fraternity experience. You don’t have permission to access this page using the credentials you supplied.

In Online services for agents: select Reports and forms then Reports. How you complete your BAS depends generally on your business registrations and whether you lodge your statement monthly or quarterly. ATO : Atmos Energy Corporation (stock symbol) ATO : Automatic Top Off System (water level controller) ATO : Aborted Take-Off (aviation) ATO : Asset Turnover: ATO : All Things Organic: ATO : Austria Ticket Online: ATO : Alternative Trading Organization (fair trade organization) ATO : Authorization to Offer: ATO : Administrative Time Off: ATO : Airport.

Ensure you have provided all relevant information to the ATO If you didn’t automatically receive the initial boost when you lodged your activity statement , it doesn’t mean you’re not eligible. In January I amended the last two years Tax returns. Both have been processed and appear on my Statement of Account. However one years amended refund was paid into my bank account but the second years refund is just sitting in my account as credit. Will this amount be paid out?

Ask questions, share your knowledge and discuss your experiences with us and our Community. We know that many businesses and communities are being heavily affected by the challenging economic conditions created by the outbreak of COVID-1” he said in a statement.