Australia Income Tax Treaty exempts superannuation from U. Washington DC international tax. Some of the different types of fund expenses are: 1. Operating expenses 2. Investment-related expenses 3. Tax-related expenses (incurred in relation to income tax affairs) 4. Legal expenses (including trust deed amendments) 5. Statutory fees and levies 6. See full list on ato. As a general rule , the trustee can claim the fund’s expenses in the year the trustee incurs them.

However, deductions for the decline in value of certain depreciating assets (such as plant and equipment) are claimed over the effective life of the asset rather than at the time the trustee incurs the expenditure. Invoices and receipts must be in the name of the SMSF, and wherever possible, the expense should be p. If an expense is deductible under the general deduction provision, and the fund has both accumulation and pension members, the expense may need to be apportioned to determine th. Where an expense is deductible under the general deduction, the expenditure is deductible only to the extent to which it is incurred in producing the fund’s assessable income.

The $19figure was highlighted as a total average expense figure on a recent SMSF factsheet. What is SMSF expense? How much does a SMSF cost? Can SMSF claim legal expenses?

Another point to understand is the difference between total SMSF costs and bare minimum operating costs. SMSF set-up costs include fees for professional advice, such as legal and accounting charges. The complexity of its financial arrangements. The costs of winding up an SMSF depends upon: 1. Whether any assets sales are necessary that will incur brokerage or agent fees.

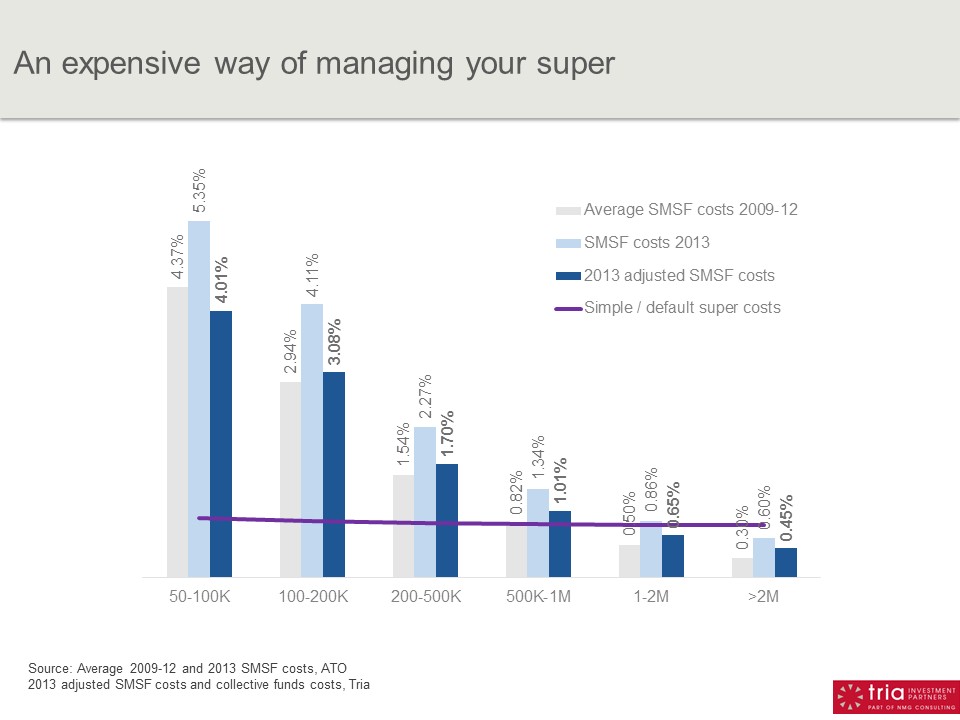

For example, the selling of shares or property so that member benefits can be paid. The time involved in the fund’s approved SMSF auditor ensuring the legal compliance of all wind-up activities. Public super funds typically charge members a percentage fee based on the amount of funds being managed. SMSF fees typically aren’t charged on fund balances (i.e. they are charged flat advice and services fees instead), although funds with larger balances are likely to require more complex professional advice. It’s worth comparing statistics on the average fees charged at different member balance levels in both public and SMSF funds.

It also needs to be remembered that most ongoing SMSF costs are tax deductible from the fund’s earnings, provided they are consistent with executing the fund’s investment strategy (as outlined in its trust deed). Common tax deductible SMSF expenses include: 1. Ongoing fund management , administration and audit fees , including the preparation of all financial statements to ensure compliance with taxation legislation. The ongoing costs of running an SMSF will vary depending on the complexity of the fund’s investment activities and the balance of the fund. SMSFs may not be cost-effective for people with low superannuation balances. The information contained in this article is general in nature.

It’s best to seek independent professional advice based on your individual financial circumstances and goals. There’s always a lot of focus on some of ‘headline’ statistics, which this year was around operating expenses. Statistics from the ATO here. Interestingly, the average cost of SMSF audits has come down over the last years.

In part, this could be due to improvements in technology and communication, which saves processing time for SMSF auditors. A further cost under $499. In addition, funds can deduct any actuarial costs they incur to determine the amount of tax-exempt income for any of their members.

Software providers to DIY funds say annual operating costs are much lower than the $19cited by ASIC. We welcome this latest data from the ATO on operating expenses as it reflects a far more realistic assessment of what it costs to operate an SMSF ,” he said. Some costs applicable to setting up, operating and winding up an SMSF are unavoidable, while other costs are optional and depend on decisions the trustee makes.

These are not deductible under tax law. The ATO is the regulator of self-managed super funds ( SMSFs ). A key element of our role is to collect and publish data about the health and performance of the SMSF sector.