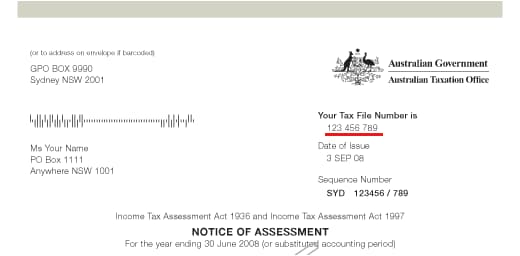

Using an incorrect payment reference number could result in delays to payments being credited to your account and unnecessary debt collection activity. You can go online to get your payment reference number: Individuals and sole traders – to your myGov account linked to the ATO. A tax file number (TFN) is your personal reference number in the tax and superannuation systems.

It is free to apply for a TFN. The ATO staff member will provide a PIN you must enter when prompted. This will ensure you are directed to the most appropriate customer service representative. Your payment reference number (PRN) is your unique reference that ensures your payment is credited to the correct account. The tax reference shown on your documentation will be preceded by three numbers, like 120.

It will then be followed by numbers, letters, or a combination of both. Employers use the tax reference number on all communications to their employees. Note: You do not need to register for GST if the only sales you make are through an online marketplace or electronic distribution platform (EDP) that is responsible for collecting the GST payable.

Simplified registration is a two-step process. In these circumstances, it is the responsibility of the marketplace or EDP. See full list on ato.

Alternatively, you can register using Australia’s standard domestic GST system by visiting abr. You will need to apply for an Australian business number (ABN) before you can register. It could take more than 28 days to process your GST registration using this option. You can choose a registration option that best suits your needs as explained below. Standard GST registration 2. You must register for GST in Australia if: 1. GST turnover from sales that are connected with Australia and made in the course of your enterprise, meets or exceeds the registration turnover threshold of A$70(or A$1500 if you are a non-profit body).

If you are an EDP operator or re-deliverer and are responsible for GST on a sale of low value imported goods, the sale is treated as being made by you instead of the merchant. These sales count towards you. You can change registration systems, but cannot be registered in both at the same time. To change between simplified GST and the standard GST system, contact us and we will help you to change your registration.

Help and information 2. The ATO is the Government’s principal revenue collection agency. Our role is to manage and shape the tax, excise and superannuation systems that fund services for Australians. This number is yours for life, regardless of whether you move, change jobs, or change your name. To get your TFN, file an application with the Australian Taxation Office ( ATO ). ATO ’s number one Properly filing your taxes as a business may seem complicate but with the right information, you can go in prepared and file like a pro. By understanding the various ATO tax file numbers necessary to complete your taxes, you can make both your life and the life of your tax agent easier.

We receive over million payments annually. Of these, approximately of payments require correction due to mistakes made by the client when sending the payment to us. Divide the total of the sum of these digits by 8 and the remainder is the check digit.

Remainder and Check Digit will always be and is not entered into WebPOS. From the Australian Taxation Office ’s Small Business NewsrooLooking for your payment reference number ? Using the right PRN will help us process your. Thanks for contacting ATO Community. We will be updating our content soon, so we suggest that you keep checking our website for updates. If you need to claim a payment, the quickest way to do this is online.

You can establish your identity and get a Centrelink Customer Reference Number (CRN) with myGov. You can then make your claim through your Centrelink online account. An air tasking order ( ATO ) is a means by which the Joint Forces Air Component Commander (JFACC) controls air forces within a joint operations environment. This is an outline of a typical ATO process for a cloud.

All agencies handle the ATO process in their own way, so you should talk with your agency’s security compliance specialists, but this can give you a broad overview.