The paper Form 4is no longer available. You need to register to use our online services before you can make any changes. To make changes to company details: 1. See full list on asic. Appoint and cease company officeholders 3. Change company addresses 2. Add or remove ultimate holding company 4. Transferring shares 6. Otherwise, late fees apply: 1. Officeholder details 5. Company financial year 4. Please ensure you register for online access and make all changes in the time allowed.

Use our online services 2. Support for company officeholders lodging transactions online 3. What is the difference between ASIC and ASIC form 484? When to submit ASIC form 484? How to update ASIC form? Confirm company details.

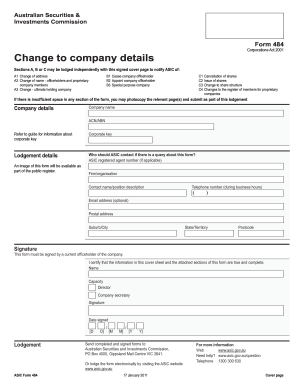

Review the company details. You must submit ASIC form 4when you are: 1. An online portal has replaced form 484. Therefore, you can make these changes in a relatively straightforward way. However, you must still correctly report the changes within ASIC’s guideline of days.

If you fail to do so, you might face some fines. These include having to pay: 1. While informing ASIC of company changes is one reporting obligation, ASIC does not check internal governance procedures. As such, the board or the shareholders of your company will need to make or ratify decisions. If you report a change to ASIC that has not been enacted properly within your company, you may face consequences that are as serious as failing to report a change that has occurred. Assuming that you have satisfied the correct internal procedure, you will need to follow the steps for reporting the change to ASIC.

However, there are three things you require before you can start: 1. The corporate key is a unique eight-digit number that ASIC mailed to your registered office when the company was originally incorporated. The company’s annual statements will also contain this number. Enter your company’s ACN or ABN and then click ‘Next’ and a popup box appears asking for your username and password (set out in step above). Once you access the portal, the menu on th.

Many of the changes that can be made through ASIC’s online portal will often require an internal review of the: 1. Your company may need to pass a board or shareholders’ resolution (either by a majority resolution or special resolution). Your company should refer to its constitution for the correct procedure for undertaking this process. Various changes require different procedures. Any officeholder of the company who has access to the company’s corporate key (the eight digit number) and has registered on the ASIC portal can make changes.

As such, it is wise to make sure that you keep your corporate key secret. The only people you may wish to share your corporate key with are your advisers (for example, your lawyers or accountants) so that they can make changes on your behalf. For some ASIC forms, you will need to authorise your adviser specifically as your company’s agent.

This way, they can submit forms or make changes to your corporate records with ASIC. To update information about your company with ASIC, you will need to use form 484. You can either fill out the physical form or utilise the online portal.

Here, you will need your company’s corporate key. Replaceable rules are a basic set of rules for managing your company. Whichever rules you adopt, you should follow the procedure set out in those rules to resign your position as a company director. As a director, you can notify ASIC of your resignation or removal from the company. To be effective, the notice of resignation must be accompanied by a copy of the letter of resignation given to the company.

If you don’t notify ASIC, the company must inform us within days of the resignation or retirement using this online forRemoving an officeholder. If the company informs us within this time perio they will avoid a late fee. An ASIC Form 3must be accompanied by a copy of the letter of.

Notification by officeholder of resignation or retirement – CCH iKnow – ASIC FORMS. The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. Available for PC, iOS and Android. Start a free trial now to save yourself time and money!

If you need to notify the Australian Securities and Investments Commission (ASIC) of any changes to your company details, you will need to fill out ASIC form 484. While a paper form is available, you can also submit it through an online portal. This article will explain the key information about form 4and outline your requirements as a business owner.

In most cases, the company will update its director’s register and update its ASIC records to reflect your departure. You do not have an obligation to notify ASIC. However, you can submit a completed ASIC Form 3and attach a copy of your resignation letter to the company. Timeframes to submit Form 484.

ASIC applies fixed timeframes for submission of Form 484. Failure to comply with these standards can result in a late penalty. The standard timeframe for Form 4is days from the time the change has occurred.

Late penalties apply: $for up to one month late. Form 3– Resignation of office holders A resigning or retiring company office holder can use a Form 3to notify ASIC of their cessation. The Form 3is signed by the ceasing officer holder and must be accompanied by a copy of the letter of resignation, which should be attached as an annexure.

HEALTH INSURANCE BENEFITS AGREEMENT-AMBULATORY SURGICAL CENTER.