Who can apply for a TFN? How do I find out if I have a TFN? Do you need to quote a TFN? You can apply for a TFN at any age. A child can apply for a tax file number (TFN) – there is no minimum age.

Children are not exempt from quoting a TFN. TFN requirements for minors. However, once they turn they’ll be able to sign the application themselves. If they ever claim a payment in their own right , they’ll need to give us their TFN.

Applying for a tax file number (TFN) is free. The school will verify the child’s identity for you. If the school is not part of the program, they will need to complete an application formand supply three forms of identification.

If the child’s income is under this they will not be taxed. Australian citizenship. A tax file number ( TFN ) is free and identifies you for tax and superannuation purposes.

You keep the same TFN even if you change your name, change jobs, move interstate or go overseas. If your details change, you need to let us know. How you apply for a TFN depends on your circumstances. Regional Administrator, Western Parks and Markets (WPM) Waste Management Limite Karen Clayton (right), hands over a shool bag to street sweeper, Tamara Chambers, during a book drive and back-to-school treat, staged by the entity, at the Sagicor Commercial Complex in Montego Bay on Friday (August 21).

You then need to supply your TFN to your education provider as soon as you get it from the ATO. For secondary school students, the quickest and easiest way for them to get a TFN is via the secondary schools TFN program. It is not necessary to prove any evidence of identity documents. To apply on line: Fill in online form Print the application summary Visit a participating post office with your printed application summary and proof of identity documents within days.

Parents and guardians can also apply for a TFN on behalf of their children. I have two questions: 1) Are these trusts taxed the same as normal income tax rates i. As a permanent migrant or temporary visitor, you do not need to physically provide proof of identity documents if you apply online, or non-resident and need a TFN for purposes other than employment. It is dangerous for a trustee not to apply for a separate TFN and to continue the use of the TFN of the deceased estate.

Testamentary trusts are subject to a Medicare Levy, whereas deceased estates are not. Companies, trusts, partnerships, deceased estates and many other organisations can apply for a tax file number ( TFN ) online. Most businesses or organisations can apply for a TFN while completing their ABN application. When applying for a TFN you must have original documents that prove your identity. You will receive the TFN to the postal address you listed on your application.

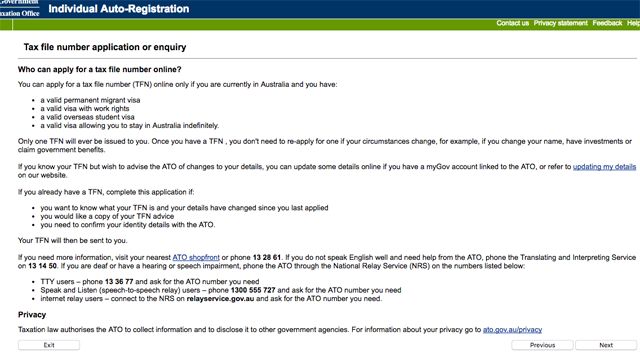

If you know your TFN but wish to advise the ATO of changes to your details, you can update some details online if you have a myGov account linked to the ATO, or refer to. Read more about applying for a TFN on the ATO website. If you’re experiencing difficult or extreme circumstances and can’t organise a TFN, call the families line. We also need your bank account details. Scroll down and click on and click on apply for TNF on the web.

Now it will say there is three step to apply for the tax file number. Step one is to completing the online form. Step two you will be printing the online summary.