The template provides language concerning, among other things, the final customer identification rule. Did the firm identify the AMLCO on the FINRA NCS Questionnaire? This form must be completed by the agency.

A separate form should also be completed for each party to the agreement (e.g joint owners, purchasers or customers). By combating money laundering the government also aims to reduce crime and prevent the use of funds to finance terrorist. What is AML compliance program? How do you explain anti-money laundering?

Which course to pursue for anti money laundering? How to prevent money laundering in your company? FinCEN develops to Frequently Asked Questions to assist in complying with the responsibilities under the Bank Secrecy Act (BSA). The funds and property may be from either legitimate or criminal sources. The world of money laundering is a fast-paced and ever evolving, which can make it difficult for a financial firm to develop and maintain a strong anti – money laundering program.

On this episode, two FINRA anti – money laundering experts discuss current priorities and best practices when it comes to AML regulation. Anti – Money Laundering Compliance Unit, Department of Justice and Equality, Floor Montague Court, Montague Street, Dublin DFT9 Ireland. Examples of different forms of money laundering involving the FI’s products and services.

Internal policies to prevent money laundering. Does the FI retain records of its training sessions including attendance records and relevant training materials used? Money is laundered to conceal illegal activity, including the crimes that generate the money itself, such. In order to comply with our legal obligations under the USA Patriot Act and Anti Money Laundering laws we ask you to provide the following information.

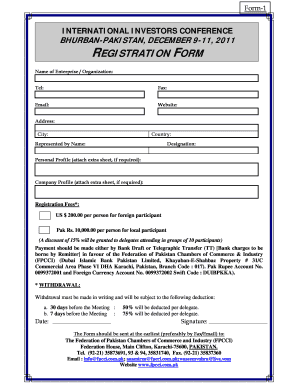

Please complete this form. We encourage all of our customers and suppliers to adopt and implement anti corruption measures. On-line checks to quickly meet your obligations for individuals and companies. Through money laundering , the launderer transforms the monetary proceeds derived from criminal activity into funds with an apparently legal source. Financial Terrorism means financial support to, in any form of terrorism or to those who encourage, plan or engage in terrorism.

Money launderers send illicit funds through legal channels in order. While these crimes can occur in any country, they have particularly significant economic and social consequences for. The most secure digital platform to get legally binding, electronically signed documents in just a few seconds.

Available for PC, iOS and Android. Start a free trial now to save yourself time and money ! Copies of the selected documents are attached to this form. This examination manual, issued by the federal banking regulators regarding the AML requirements applicable to banks, contains guidance that may be of interest to securities firms. Criminals have long used money laundering schemes to conceal or “clean” the source of fraudulently obtained or stolen funds. Money Laundering Manual): money services businesses, casinos, dealers in precious metals, stones or jewels and cash intensive business (e.g., convenience stores, restaurants and retail stores) Identification of suspicious activity must be reported to the Company’s AML Compliance Officer.

Adherence to this policy is absolutely funda-mental to ensuring that Lescovex complies fully with anti – money laundering and terrorism financinglegislation. The Company should there-fore be actively involved in the policy’s implemen-tation and development. The anti – money laundering training your staff will be receiving The policy should end with details on how and when the policy will be reviewe as well as the contact details of the Nominated Officer, in the case that staff would like more information or would like to raise a concern.

It includes all forms of using or possessing criminal property (as well as facilitating the use or possession) regardless of how it was obtained. Doing so potentially can conceal the identities of bad actors and avoid banks’ anti – money laundering programs. To better understand this risk and help law enforcement investigate money laundering , FinCEN issued its real estate GTO. United States Department of the Treasury Financial Crimes.

This course is intended to provide agents and brokers with knowledge of money laundering and terrorist financing and the ways in which the insurance industry might be used to engage in such activities. AHL’s anti – money laundering policies and procedures.