Anti-Money Laundering (AML) is similar to KYC but with a broader scope: AML refers to measures used by financial institutions and governments to prevent and combat financial crimes , especially crimes involving money laundering , criminal financing , or terrorist activity. An identification number for a U. TIN) (or evidence of an application for one), and an identification number for a non-U. What are AML obligations?

Identification of information required to be obtained (including name, address, taxpayer identification number (TIN), and date of birth, for individuals), and risk-based identity verification procedures (including procedures that address situations in which verification cannot be performed). A financial institution should create AML policies according to AML rules and regulations in the country it operates in. AML and KYC regulations vary across countries, however, the basis is to collect enough information for the purpose of identity verification and ensuring that their activities are legitimate. APLYiD enables our clients to easily and efficiently verify the identity of their customers in a few minutes, from anywhere.

APLYiD uses Facial Match and Liveness technology, alongside data verification with trusted global sources, to enable our clients to complete their customer due diligence in such a way that ensures they comply with their Anti-Money Laundering requirements. Suspicious Activity Monitoring and Reporting 9. Other BSA Reports 10. Due Diligence Programs for Private Banking Accounts 8. Records of Funds Transfers 11.

Information Sharing With Law Enforcement. See full list on sec. It imposed a number of AML obligations directly on broker-dealers, including: 1. Among other things, the USA PATRIOT Act amended and strengthened the BSA.

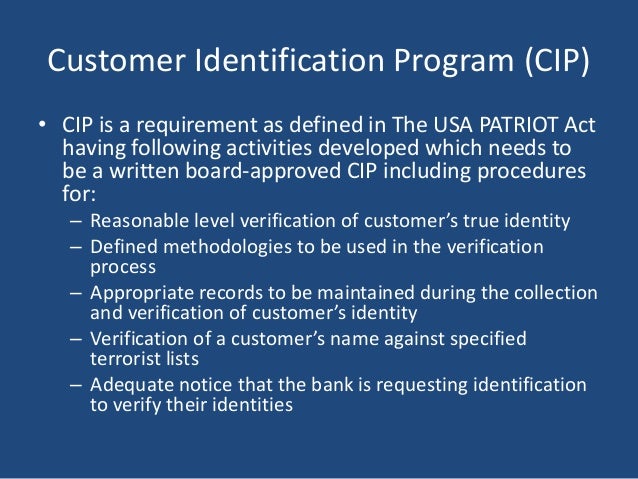

Section 3of the USA PATRIOT ACT amended the BSA to require financial institutions, including broker-dealers, to establish AML programs. An AML program must be in writing and include, at a minimu1. Section 3of the USA PATRIOT Act amended the BSA to require financial institutions, including broker-dealers, to establish written customer identification programs (CIP). Treasury’s implementing rule requires a broker-dealer’s CIP to include, at a minimum, procedures for: 1. Covered financial institutions are required to establish and maintain written procedures that are reasonably designed to identify and verify beneficial owners of legal entity customers and to include such procedures in their anti-money laundering compliance program required under U. Legal entity customer means a corporation, limited liability company, or other entity that is created by the filing of a public document with a Secretary of State or. Section 3of the USA PATRIOT Act amended the BSA to, among other things, impose special due diligence requirements on financial institutions, including broker-dealers, that establish, maintain, administer or manage a private banking account or a “correspondent account” in the United States for a “non-United States person.

Treasury’s regulations provide that a “covered financial institution” is required to maintain a due diligence program that includes policies, procedures, and controls tha. Two provisions relating to information sharing were added to the BSA by the USA PATRIOT Act. Broker-dealers have other reporting obligations imposed by the BSA. One provision requires broker-dealers to respond to mandatory requests for information made by FinCEN on behalf of federal law enforcement agencies. Section 3of the USA PATRIOT Act amended the BSA to authorize the Secretary of the Treasury to require broker-dealers to take “special measures” to address particular money laundering concerns.

There are five “special measures,” including prohibiting U. OFAC is an office within Treasury that administers and enforces economic and trade sanctions based on U. OFAC acts under Presidential wartime and national emergency powers, as well as authority granted by specific legislation, to impose controls on t. SEC Staff Materials: 1. For example, the NASD revised its AML program rule. FinCEN also adopted a number of AML requirements, including the requirement to file suspicious activity reports. As of the date of this guide, there are no designated government lists to verify specifically for CIP purposes. You must document the customer identification procedures you use for different types of customers.

Anti-Money Laundering ( AML ) is similar to KYC but with a broader scope: AML refers to measures used by financial institutions and governments to prevent and combat financial crimes, especially crimes involving money laundering, criminal financing, or terrorist activity. Customer identification and verification. AML Directive acknowledges digital identity techniques can be done in a manner that is just as secure as any paper-based technique – a major step forward in AML compliance. Have the customer identification requirements for opening a DVP account been established?

Anti-money laundering. Bring all your checks into one Amiqus account and turn hours of client and staff onboarding into minutes of online activity. Making good decisions about who to work with shouldn’t delay a sale. Bank Secrecy Act and implementing regulations, including DVP accounts.

Identification or alert of unusual activity (which may include: employee identification , law enforcement inquiries, other referrals, and transaction and surveillance monitoring system output). SAR completion and filing.