What is the amount on the promissory note called? What makes a promissory note legal? What should promissory note include? Here are the key components of notes receivable: Principal value : The face value of the note. To a maker, the note is classified as a note payable.

Payee : The person who holds the note and therefore is due to. Thus, a company may have notes receivable or notes payable arising from transactions with customers , suppliers , banks , or individuals. Most promissory notes have an explicit interest charge. Interest is the fee charged for use of money over a period. Under the accrual method of accounting, both the borrower and the lender must report any accrued interest as of each balance sheet date.

Got a question on this topic? The credit can be to Cash, Sales, or Accounts Receivable, depending on the transaction that gives rise to the note. Often a business will allow a customer to convert their overdue accounts into a notes receivable. Doing so gives the debtor more time to pay. Customers frequently sign promissory notes to settle overdue accounts receivable balances.

For example, if a customer named D. Brown signs a six‐month, , $5promissory note after falling days past due on her account, the business records the event by debiting notes receivable for $5and crediting accounts receivable from D. The amount of payment to be made, as listed in the terms of the note, is the principal. If the debt comes with a promissory note, a kind of written IOU, you record it in notes receivable instead. Every promissory note includes the face value of the note , or the amount owe the date due and the interest rate. The notes receivable account represents an asset and maintains a normal debit balance.

Two types of notes receivable Interest-bearing note Noninterest-bearing note. Receivable represented by promissory notes Promissory notes indicate the face amount and due date. Holder of the note will receive interest payment in addition to the face amount of the note. Payee is a party entitled to claim payment against a promissory note at the maturity date.

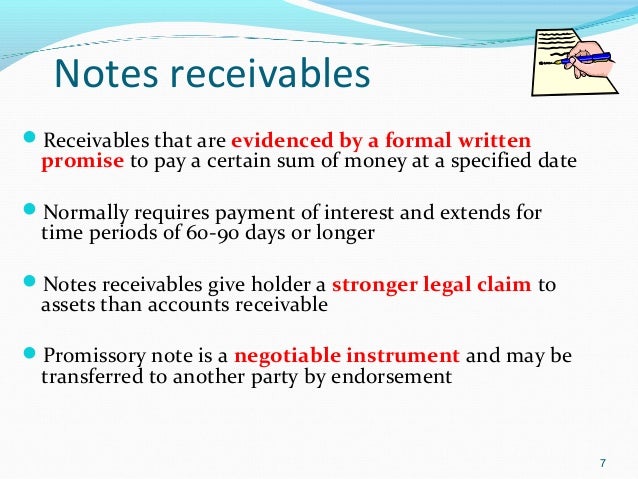

A Promissory Note is an instrument in writing. Maker is a promising. It contains an unconditional undertaking or promise, signed by the maker to pay a certain sum of money to a certain person. He, himself promises to make the payment. It may be defined as a written promise to pay an individual or organization a certain amount of money at a particular date in future.

Notes Receivable Accounting Definition. A promissory note is a properly written document which states clearly the names of issuer and payee, the principal amount, the location and date of payment and a fixed interestrate. Just as accounts receivable can be factore notes can be converted into cash by selling them to a financial institution at a discount. Such agreement is recorded formally as a promissory note.

A promissory note, or “promise to pay”, is a note that details money borrowed from a lender and the repayment structure. The document holds the borrower accountable for paying back the money (plus interest, if any). There are types of promissory notes, secured and unsecured.

Note receivable is a formal promissory note that is written by a debtor in favor of a creditor. After writing the note , the debtor signs and gives it to the creditor. PROMISSORY NOTE Manila, Philippines P15000. In business accounting , notes receivable are promissory notes that represent an asset. These promissory notes are either short-term or long-term and should be recorded on the balance sheet differently.

The amount promised on a note may be receivable in single sum or in multiple installments. Discount on note receivable = $4$4is recognized as interest income over the period Balance Sheet Presentation 1. Suppose a company issues a $10note at annual interest to your.