If you apply for an ABN and you’re not entitled to one, your application may be refused. The reason for refusal will be explained to you by the Australian Taxation Office. Before you register for an ABN , make sure you’ve got the required information. ABN Australia is a privately run, family-owned business registration and compliance business that has been operating in Australia for over years. Our longevity in the industry reflects our commitment to amazing customer service and industry-leading legal documents.

If you are experiencing an issue accessing the ABN application please use this alternative link.

The ABN is a unique digit number that identifies your business or organisation to the government and community. Apply or reapply for an ABN using the application below: Apply or reapply for an ABN. Watch this video to find out more about ABNs. What is the difference between an ABN and ACN? Use the ABN registration form to provide the information required.

It is in many cases necessary for business owners because it helps people to access tax credits and fuel credits. Generally you do not need to check if the ABN quoted to you by a supplier is correct. If it looks reasonable, you can accept it.

However if you have reason to suspect that it might not be genuine or that it does not belong to the supplier who quoted it, you should check it out. Australian business number ( ABN ) for non-residents If you’re in business you may need an Australian business number ( ABN ) and to register for certain tax and super obligations. RSA Plaza, Suite 25 7Washington Ave. Helping you start business in Australia.

Everything online, and simplified. Avoid any mistakes and live in Australia smoothly! Business number and tax assistance assistance.

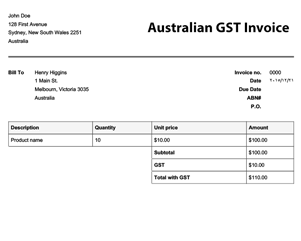

To be entitled to an ABN you must be carrying on a business in Australia. The ABR facilitates and streamlines many Australian business-to-government and government-to-business processes, such as Australian Tax Office transactions involving the collection and remittance of the Goods and Services Tax ( GST ). An ABN is the public identification number of Australian businesses. All sole-traders, business owners and companies also have a Tax File Number, but a TFN is private and confidential.

ABN serves a number of purposes, such as claiming goods and services tax (GST) credits and getting an Australian domain name. We start more than 100Australian businesses every year. Your ABN direct to your inbox in just minutes. This unique 11-digit number is the key means of identifying a business and is provided when you register your business. Sole traders, partnerships and companies are all required to have an ABN.

All data we provide is public sector information and is made available under the Creative Commons Attribution 3. Despite our efforts to provide our guests with error-free and up-to-date data, the databases this information is extracted from are not free of errors.

This helps in the easy identification of your business, as well as easy submission for taxes as a business. Applying for an ABN is free, but not everyone is entitled to one. An ABN number can be issued to many types of business entities including sole traders, corporations, partnerships, unincorporated associations and body corporates.

There are other options available to cancel your ABN. You must be recorded as authorised to update ABN details for your business. You’ll also need to prove your identity. Every business which operates in Australia will have an ABN. It is an eleven-digit number that all businesses must obtain.

It identifies the business and is used in commercial transactions and dealings with the Australian Taxation Office.