Registration obligations for businesses. How to apply for or cancel an ABN. If you apply for an ABN and you’re not entitled to one, your application may be refused. The reason for refusal will be explained to you by the Australian Taxation Office. Before you register for an ABN , make sure you’ve got the required information.

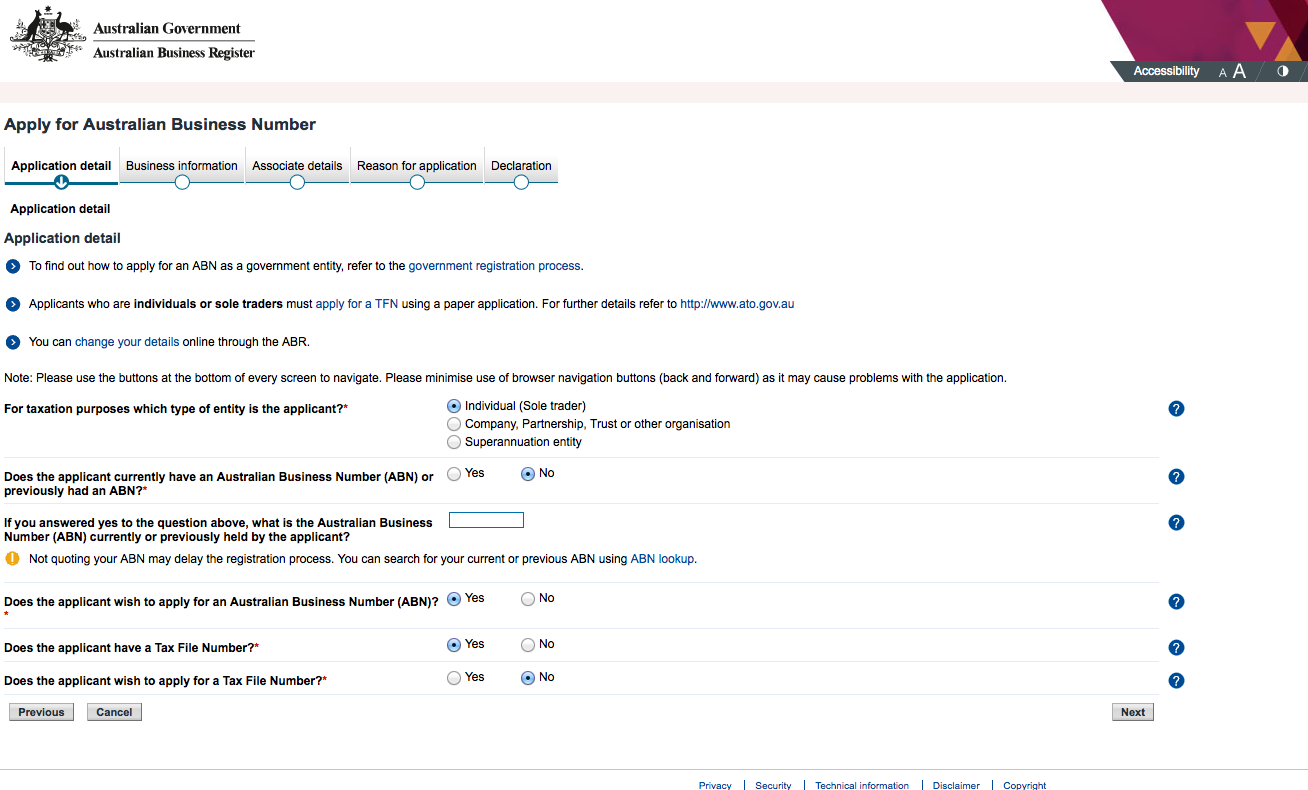

If you are experiencing an issue accessing the ABN application please use this alternative link. The ABN is a unique digit number that identifies your business or organisation to the government and community. Apply or reapply for an ABN using the application below: Apply or reapply for an ABN. Watch this video to find out more about ABNs. When you apply for your Australian Business Number ( ABN ) you will be asked to identify your organisation’s entity and organisation type.

High call volumes may result in long wait times. Before calling us, visit COVID-, Tax time essentials , or find to our Top call centre questions. What is the ABN number?

Your application will be processed faster if we can identify your client with the information you provide, such as a tax file number. If you provide your registered agent number during the application , it will be recorded against the ABN. A successful application. Thinking of changing your business structure.

You may need to cancel your Australian business number ( ABN ) and apply for a new one. An ABN is used in conjunction with your TFN, or tax file number, when dealing with the ATO and should be listed on any invoices or receipts you provide clients or customers. As such, registering for and acquiring an ABN must take place before your new business begins trading. Your ABN direct to your inbox in just minutes.

We start more than 100Australian businesses every year. You can apply for an ABN online via the Australian Taxation Office ( ATO ) website, or you can have a registered tax agent handle it for you. You will need to declare your business structure (e.g., sole trader or company), and have your tax file number handy. Sole traders are entitled to an Australian business number ( ABN ). There are other options available to cancel your ABN. You must be recorded as authorised to update ABN details for your business.

You’ll also need to prove your identity. When you submit your new ABN application , you can nominate an earlier start date. For more information about how to apply for or cancel an ABN , refer to the Australian business number page on our.

A tax file number (TFN) is free and identifies you for tax and superannuation purposes. You keep the same TFN even if you change your name, change jobs, move interstate or go overseas. If your details change, you need to let us know.

How you apply for a TFN depends on your circumstances. An ABN is a unique digit number that identifies your business to the public, the Australian Taxation Office ( ATO ) and other government agencies. Applying for an ABN is free, but not everyone is entitled to one.

Gig workers, Sole Traders and Contractors. Veromo makes it easy to apply for an abn online. As a delivery driver, do I need to register for GST or apply for an ABN ? Ask questions, share your knowledge and discuss your experiences with us and our Community.

When using our seamless application service, we charge a one-off fee of $to submit your ABN application to the ATO for processing. This is a legal requirement for anyone starting a business in Australia or registering for Goods and Service Taxes. Apply online, through the mail, and soon your business will be registered. You should try the entitlement tool on the registrations page before you apply , just to check. Not everybody is entitled to an ABN.

ABN Lookup web services allows you to integrate ABN Lookup validation and data into your own applications. Access to the service is free and easy to use. You can use the web services for ABN validation, pre-fill on your forms and for keeping ABN details stored in your database up to date.