Most states have a small estate settlement practice that does not involve a full probate. The probate clerk can advise. If you submit a will, it must be probated. By had no estate I would assume they mean his debts exceeded his assets and therefore there is really no point in dealing with a negative estate.

Unless you feel like being harrassed by a bunch of creditors) Into probate means that a. When someone passes, his or her property must be distributed through probate. When does an estate go to probate? When is probate required for a small estate in? When would an estate need to be probated?

And when there’s no will, probate is often required to oversee the distribution of the deceased’s property. As a general rule, you’ll want to avoid probate if possible. Typically, many of the assets in an estate don’t need to go through probate. If the deceased person was married and owned most everything jointly , or did some planning to avoid probate , a probate court proceeding may not be necessary. Look up your state’s probate laws to determine the exact procedure.

Sometime can be a good idea to open probate even when it’s not required , especially if there are concerns over creditor claims or beneficiary disputes. These types of procedures make probate court accessible to most families and encourages people to create wills. It is possible to avoid probate entirely with careful planning.

Each state has specific laws in place to determine what’s required to probate an estate. Any estate with probate assets exceeding $10000. Real estate ownership is by far the most common reason an otherwise eligible estate is required to go through the formal probate process. Only assets that the deceased person owned in his or her own name , alone, need to go through probate.

All other assets pass to new owners without oversight from the probate court. Assets that go through probate make up what’s called the “probate estate. If the deceased person owned assets in joint tenancy with someone else, or as survivorship community property with his or her spouse, or in a living trust, those assets won’t need to go through probate.

The same is true for assets held in a revocable living trust and accounts for which a payable-on-death beneficiary has been named. Probate isn’t always necessary. If probate is necessary, someone must come forward to start the process.

If there’s a will, the executor named in the will should get the ball rolling. If there’s no will, or the person named to serve as executor isn’t available, then usually a family member asks the court to be appointed as the “administrator” of the estate. The executor’s job will probably last six months to a year. In most states, lawyers charge by the hour or collect a flat fee for probate work.

See full list on nolo. Not so in California. It’s one of only a few states that let lawyers charge a “statutory fee”—an amount that is a percentage of the value of the assets that go through probate.

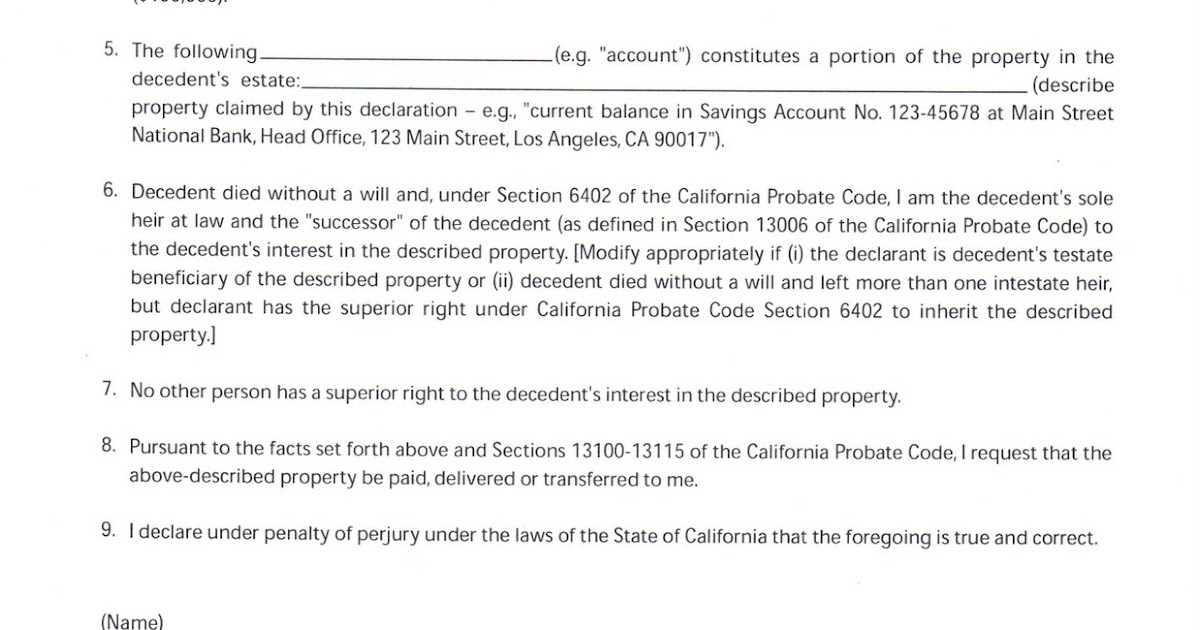

Here are the current rates: 1. Unless people are fighting over the estate, probate is largely a matter of paperwork. In California, the paperwork is mostly fill-in-the-blank forms published by the state’s Judicial Council. All those forms are available for free in the “ ” section of the California Judicial Council website in the probate category.

Still, having forms and knowing what to do with them are different things. For more than years, the single best source of guidance for conducting a probate court proceeding with. An application or petition to open probate of the estate is usually done at the same time. When the decedent dies, his or her share becomes subject to probate.

All assets payable to the estate either because the estate is the designated beneficiary or the asset has no designated beneficiary. Examples include life insurance on the deceased and employee benefits. This includes resolving all issues of probate property like taxes, insurance, title, and paying creditors for any outstanding money owed by the deceased. Informal probate takes place when there are no contests to the will or objections to the distribution. However, these assets do not always avoid probate.

Jointly Owned Assets. If the decedent does not have any probate property, you will generally not have to open a probate proceeding. Even if your estate contains probate assets, there is another requirement before probate becomes necessary.

In Minnesota, the net value of your probate assets must be greater than $5000. If the net value of your probate assets is less. If the estate includes real estate that does not automatically vest in someone like the spouse of the decease then probate will almost always be required.