One Visit Could Save You Money on Boat and PWC Insurance! An insurance policy has been created for Mahomes’ record 10-year, $4million contract extension, according to ESPN’s Field Yates. What does insurance policy mean?

Definition of insurance policy: Formal contract-document issued by an insurance company to an insured. It (1) puts an indemnity cover into effect, (2) serves as a legal evidence of the insurance agreement, (3) sets out the exact. In insurance, the insurance policy is a contract (generally a standard form contract) between the insurer and the insured , known as the policyholder , which determines the claims which the insurer is legally required to pay.

In exchange for an initial payment, known as the premium, the insurer promises to pay for loss caused by perils covered under the policy language. There many types of insurance policies. Life, health, homeowners,.

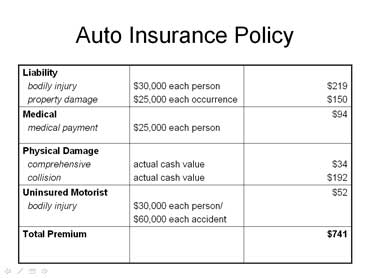

The amount of money charged by the insurer to the policyholder for the coverage set forth in the insurance policy is called the premium. To own umbrella insurance,. Runoff insurance , also known as closeout.

Protect your new tech with ease. No receipts, no expiration dates, no hassles. A contract of insurance , describing the term, coverage, premiums and deductibles.

The start date and end date are the cutoff dates on your documentation, payments, and coverage unless you renew the policy. For life insurance , keep track of the total death benefit, and any additional riders such as a waiver of premium in the event of disability, or the ability to access the death benefit early in the case of being diagnosed with a terminal illness. It is important to know what your policy period is, so you know when your car insurance ends.

In the most simple terms, the insurance premium is defined as the amount of money the insurance company is going to charge you for the insurance policy you are purchasing. A typical insurance policy is a collection of coverages — and each coverage has a limit. The insurance premium is the cost of your insurance. For example, a car insurance policy that includes liability coverage, collision coverage and comprehensive coverage will have three separate limits. A standard policy includes four key types of coverage: dwelling, other structures, personal property and liability.

If your home is damaged by a covered event, like strong winds, dwelling coverage can help pay to repair it. Depending on the contract, other events such as terminal illness or critical illness can also trigger payment. The policy holder typically pays a premium, either regularly or as one lump sum. Other expenses, such as funeral expenses, can also be included in the benefits. If your homeowners insurance company doesn’t offer service line protection, you also have the option of purchasing a service warranty with your local utility company, but service line.

No matter the type of insurance, an insurance policy usually consists of six sections: declarations, definitions, lists of covered items, exclusions, conditions, and endorsements. In insurance , the insurance policy is a contract (generally a standard form contract) between the insurer and the insure known as the policyholder, which determines the claims which the insurer is legally required to pay. Insurance law is the practice of law surrounding insurance , including insurance policies and claims. Insurance buyers are often tricked into paying additional charges by insurance companies or agents. Usually you assume that your insurance policy is issued free of cost in this competitive market place.

Chances are, you may be wrong.

Some insurance companies in a few states charge a fee for issuing or renewing an auto insurance policy , known as. An endorsement can ad remove, or change the coverage in the policy. Insurance endorsements can be standar which means they are published by an industry advisory organization, or non-standar which means they are developed by insurers. A promise of compensation for specific potential future losses in exchange for a periodic payment.

Insurance is designed to protect the financial well-being of an individual, company or other entity in the case of unexpected loss. Some forms of insurance are required by law, while others are optional. First, each insurance policy is a contract between your organization and the insurance company. Secon you want to ensure that the policy is covering what you need and expect it to cover, including specific activities and operations, as well as key personnel associated with the organization.

It tells the policyholder every detail of the coverage, protection and liability. If it is for auto insurance , the policy lists the vehicles covere the amount of coverage and the deductibles. A whole life insurance policy offers life insurance coverage for the whole life of the insured individual. Premiums are level and the death benefit is guaranteed as long as you continue to pay the policy premiums. In addition to whole life policies, they build up a tax-deferred cash value, which is basically savings, over the life of the policy.

It gives you financial protection from losses that can occur during normal business operations. When you buy insurance coverage, the insurance company helps cover the costs of covered losses up to the limits of your policy. Without coverage, you might have to pay for the costs out of pocket.

While there are different types of health plans, you are always issued an insurance policy number by your insurance provider used to identify your account. It covers situations in which the unit owners in a condominium are financially responsible for a shared loss, so long as the issue was a covered peril.