Automated Clearing House ( ACH ) transactions. ACH transactions are set up using your checking account number and routing number – NOT a debit card number. Our most popular small business checking account offers exceptional value and flexibility for your growing business. See the common fees for this account (PDF). You can setup eligible business bills so they’re paid directly from your business checking account.

Simply provide the biller your account and bank routing numbers, and they do the rest. They can setup one-time or schedule automatic payments to occur on a set date each month. Please refer to the Merchant Services Terms and Conditions and Operating Rules or Program Guide for additional information. Clover devices require a Clover software plan for an additional fee.

Beginning of popup Notice. To send a domestic ACH transfer, you’ll need to use the ACH routing number which differs from state to state. To find your ACH routing number, check the table above.

ACH rules state that unauthorized debits to corporate accounts must be returned by midnight of the second banking day following the effective date of the original entry. Checks paid from your new account (deposited and cashed) Mobile deposits. They will deposit the bonus into your new Business Checking account within days of meeting all the bonus eligibility and qualifications. This just happened to me. The only thing is that the CU contacted the Federal Reserves (FR).

On the FR printout it clearly shows who did it. I also called the police and got a case number but the CU still making me wait days. Simplify payment processes by seamlessly integrating ACH payments straight into your app, website or business flow. Wells Fargo wholesale accounts. An ACH transfer is a convenient and relatively quick way to move money from one bank account to another.

There are a lot of options at your fingertips, and not all of them are free, so be sure to do your homework — especially where bank-to-bank transfers are concerned. Please contact your own legal, tax, or financial advisors regarding your specific business needs before taking any action based upon this information. There are two types of free business checking accounts : those that don’t charge monthly account fees and others that do but make it relatively easy to avoid them by meeting minimum balance requirements. Pacific Time on all business days and end processingat a. Processing does not occur on Saturdays or Sundays. If you are wiring money to someone in the U. Many business owners use ACH transfers to pay monthly and recurring bills—once these transfers are set up, you really never have to think about it again.

Are banks starting to understand that they can use. If you’re not sure which code you should use, check with your recipient or with the bank directly. Knowing this, you may want to receive multiple return deliveries from your banks. Requirements may vary by financial institution. WELLS FARGO BANK routing numbers list.

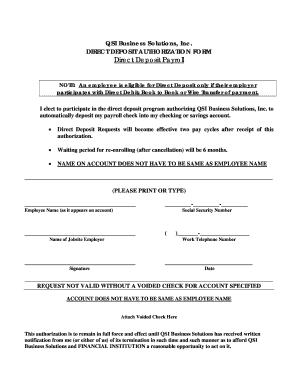

ACH Routing Numbers are used for direct deposit of payroll, dividends, annuities, monthly payments and collections, federal and state tax payments etc. Fedwire Routing Number: Fedwire Transfer service is the fastest method for transferring funds between business account and other bank accounts. It is used for domestic or international.

Setting up your business to accept ACH payments gives you an alternative to credit cards, cash or checks. Because the payments are not as easily reversed as credit cards, the transfers come with fees much lower than those for a credit card. For your security, you must enable JavaScript to sign on to your account.