An unsecured promissory note is a financial instrument which showcases some written promise to repay a given amount of money in the future or on-demand. It contains all the tiny details of the loan like how the borrower intends to repay the debt and the associated timeline. Other articles from wordtemplatesonline.

The purpose of this document is to outline how the borrower (the person receiving money from a bank or another lender) promises to pay back the money. As used in this unsecured promissory note (this “ Note ”), the following terms shall have the following meanings: “ Affiliate ” as to any Person, means any other Person that, directly or indirectly through one or more intermediaries, is in control of, is controlled by, or is under direct or indirect common control with, such Person. It states that the borrower is promising to repay the loan to the lender , as specified by the terms detailed in the loan documents and usually repeated briefly in the promissory note itself. A promissory note is an important part of an agreement.

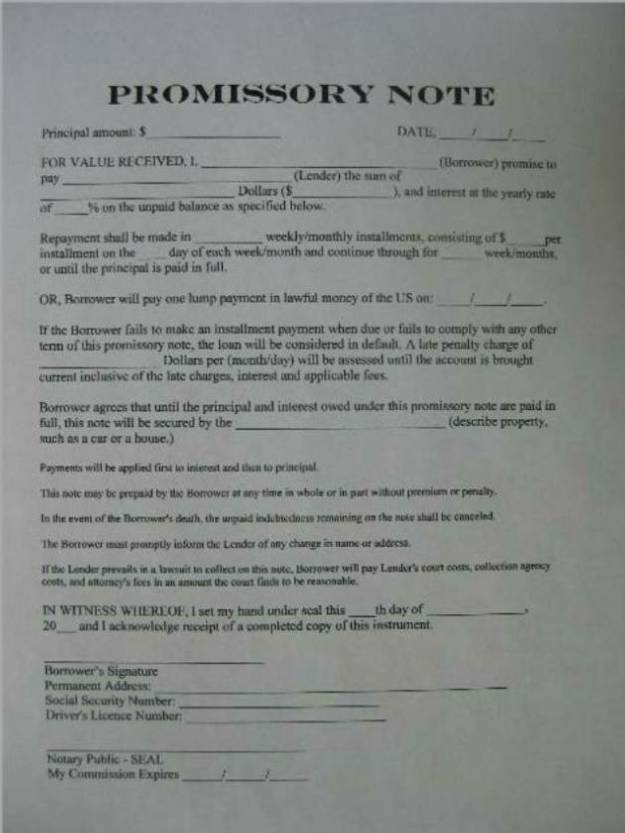

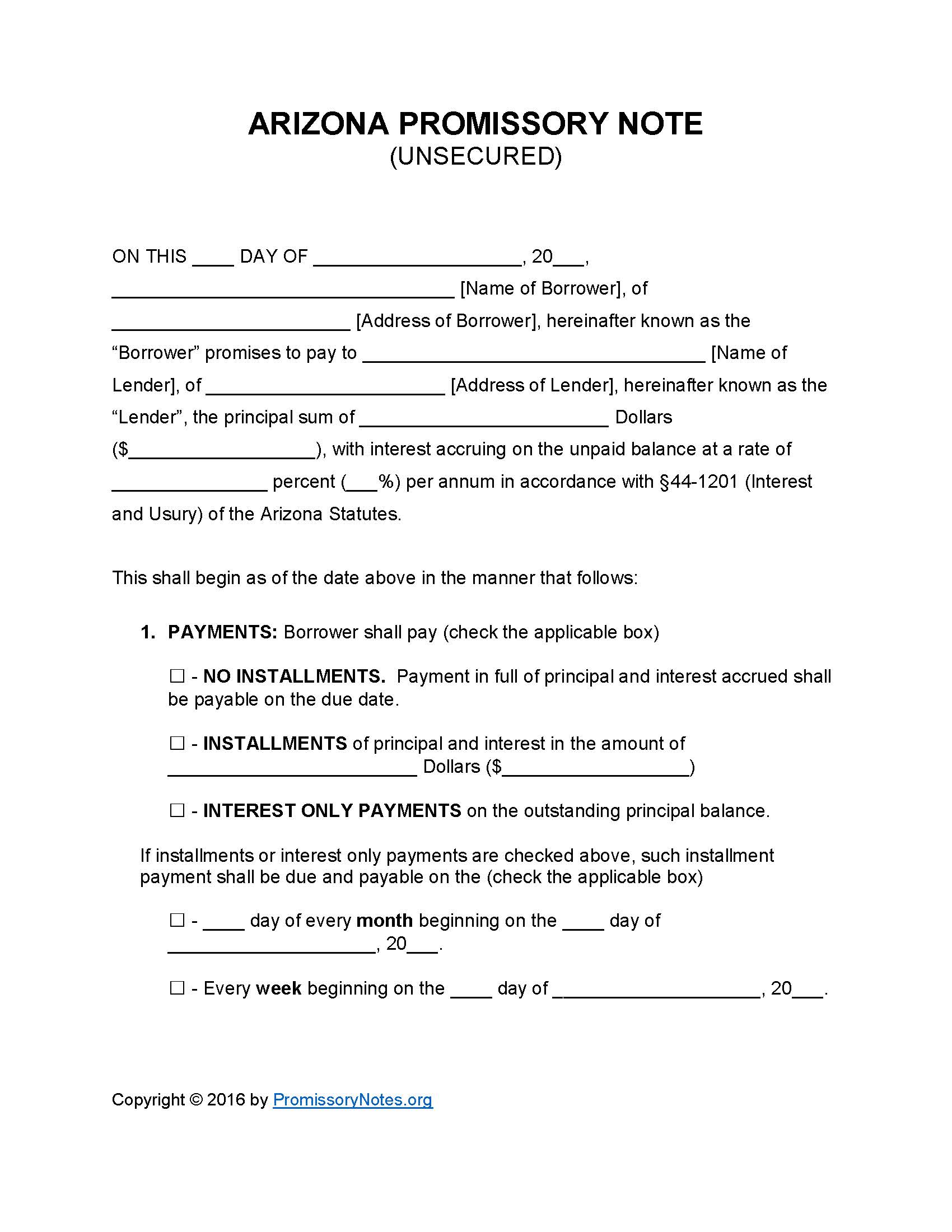

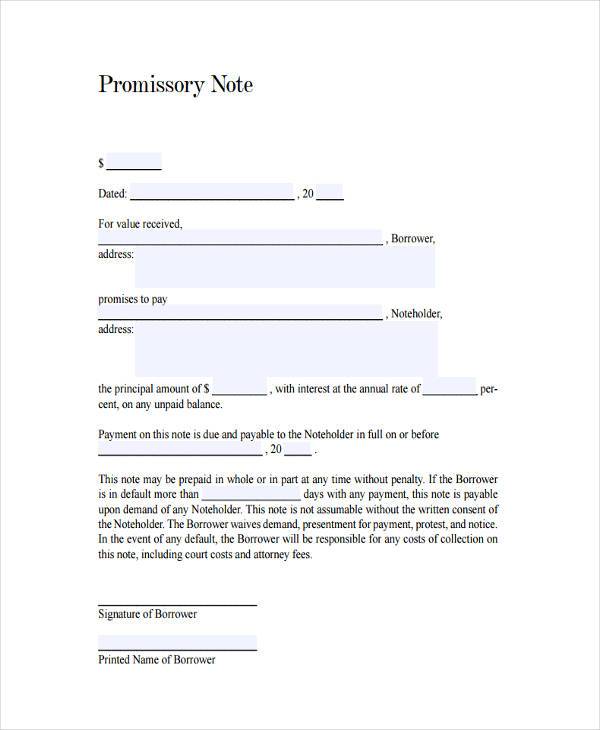

This document establishes the duties and rights of the parties in the contract and must written, date and signed. Can a lender still enforce a debt without the promissory note? How to protect your promissory note? If you need money, you may be able to sell, or borrow against, the note. The unsecured promissory note template is a document that allows a lender to detail an amount of money that is given to someone else (the ‘borrower) with the intention of being reimbursed with interest (if any).

Although, with an unsecured note , the lender is not guaranteed any asset(s) if in the chance the borrower does not pay-back the loan. If the payor fails to pay, the payee must file a lawsuit and hope that the payor has sufficient assets that can be seized to satisfy the loan. The Note will also set out the Conditions of Repayment of this amount of money by the Lender. Before you sell your unsecured promissory note to just anyone, it’s a good idea to check with a number of different potential Louisiana note buyers.

Not all collection agencies and investors will give you the same deal. The document identifies the terms of a loan and the parties to the loan, but it doesn’t detail what will happen if the borrower defaults. The promissory note by itself creates a legal obligation. However, by itself, the promissory note is considered “ unsecured ,” which means that if the borrower is unable to pay, there may not be much that you can do about it.

On the other han a secured promissory note is also made on the basis of the maker’s ability but it is secured by a valuable thing of the debtor, such as their house, car, etc. As you may suspect, an unsecured promissory note does not involve collateral. This type of note is a riskier move for the lender because they stand to get nothing in return should the borrower default.

However, as the saying goes, the greater the risk, the greater the reward. Adapt the language to fit your facts and circumstances. Available in Word and Rich Text formats. The unsecured promissory note form does not promise to turn over any assets to the lender if there is a default, so the lender is left to pursue other avenues to seek remedy for the breach of contract. Although the lender is entering into a more risky environment, it is often considered a favorable situation as they can set higher interest rates due to the associated risks.

Download a free promissory note template below. The terms and values of a legal promissory note are not of consequence when it comes to the enforcement of the note. In the eyes of the law, all promissory notes that are entered into legally are considered the same.

Thus, if an individual who has signed a personal promissory note with another individual enters into bankruptcy, that promissory. Check out our promissory note forms. The note document serves as written evidence of the amount of the debt. Promissory Note Basics. The value of the collateral should be equal to or greater than the principal of the debt.

UNSECURED PROMISSORY NOTE filed by SoCal Harvest, Inc. So, unsecured loans have higher interest rates while secured loans have lower ones. Now that we’ve looked at the skeleton of a promissory note , let’s discuss the four situations where they are often used.

Maybe you are borrowing money from family or lending money to a friend. The first scenario is personal loans. In essence, a promissory note is an agreement listing what is being borrowe from whom and when repayment will be made.

The agreement is then signed and frequently notarize and then the lender will hold the note until the debt is repaid. In many cases, the lender.