How does a mortgage differ from a promissory note? What are the advantages and disadvantages of promissory notes? Are Bank issued promissory notes legal? Is an IOU considered a legal promissory note?

Pros: They are a “ pay when you can” type of note, with no concrete repayment date. This allows borrowers to make good on the loan when they are financially able. Personal : These are notes signed by friends, family members or acquaintances that promise repayment of a loan. Such documents can appear informal, but they are still legally binding. The two most common types are those that are a type of investment in the company , and those that go along with a loan.

Depending upon the kind of promissory loan, notes are of different types. Few are mentioned below. Though people avoid legal writings when seeking a loan from close contact, the promissory note shows belief and trust in the interest of the borrower.

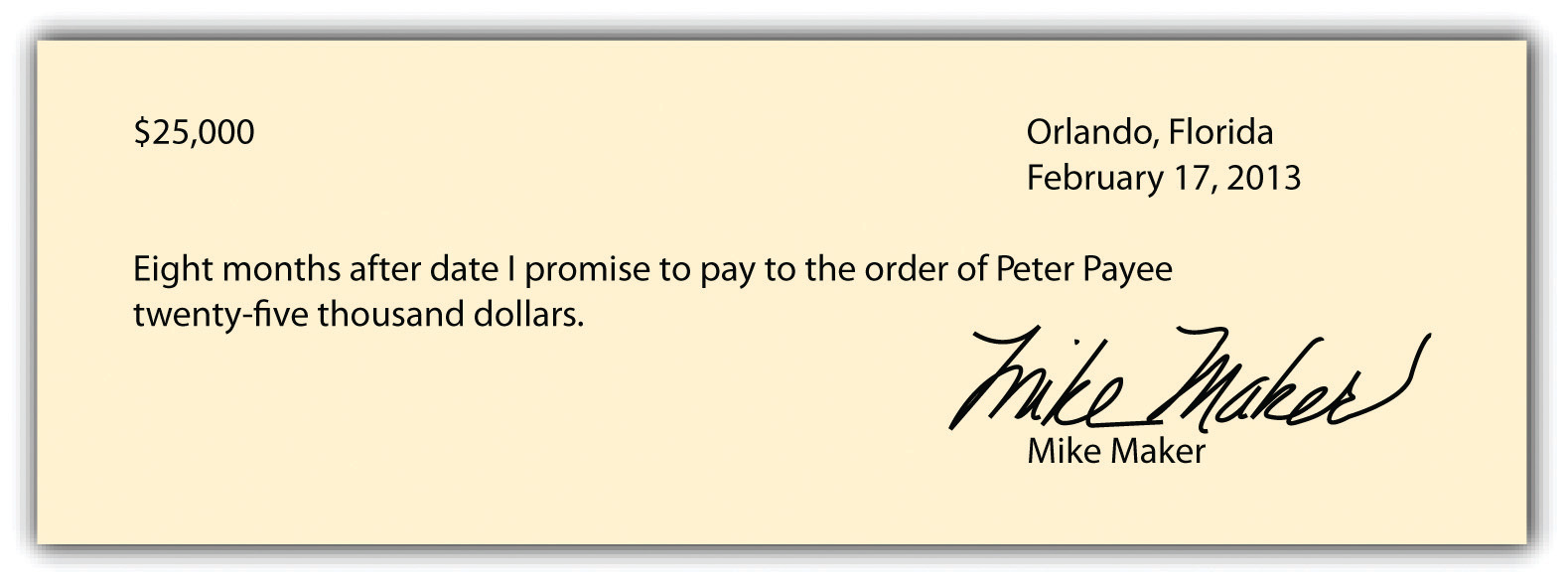

A promissory note is a written and signed contract in which one party promises to pay a specified amount of money to the other party. The terms of a promissory can be tailored to the parties needs, as far as the amount borrowe whether interest will be charge the schedule or date by which the money must be repai and any other needed particulars. See full list on legaldictionary.

He had John sign the coaster and stuck it in his pocket. When John had not repaid the money by July, and avoided making a commitment to a payment arrangement, Mike filed a civil lawsuit. At the small claims court trial, Mike gives the promissory note drink coaster, with Johns signature on it, to the judge. The judge rules that the coaster is a valid contract, and that John must repay Mike the entire amount of the loan immediately. The executor asked the borrowers to repay the debt, but they refuse claiming that Marion had forgiven the debt.

Because there was no record of Marion having ever forgiven the debt, and she did carefully document the promissory note and payments receive her executor hired an attorney to enforce the note on behalf of the estate. Though every good promissory note contains certain elements, there are several types of promissory note. These notes are largely classified by the type of loan issue or purpose for the loan. All of the following types of promissory note are legally binding contracts. A real estate promissory note is similar to a commercial note, as it often stipulates that a lien can be placed on the borrowers home or other property if he defaults.

If the borrower does default on a real estate loan, the information can become public record. An investment promissory note is often used in a business transaction. While promissory notes may be used in certain formal loans, they are commonly seen when friends, family, or acquaintances loan one another money.

Because each of these situations is different, the parties are free to write their loan agreement in any manner they choose. This includes using a variety of promissory note payment options to suit the needs of both parties. In addition to the amount of the loan, it is important to include very specific terms for repayment. The borrower is given a reasonable amount of time before such a demand may be made.

A due on demand note specifies that the borrower must repay the loan when the lender asks for it. In some cases, the lender is given the option of asking for payments before demanding the balance in full. While it is acceptable for the parties to wing it, so to speak, there are sample promissory notes available from a variety of sources. When creating a promissory note, it is important for both parties to be sure each detail of the transaction is clearly stated in the contract. Promissory notes may vary greatly in their wording.

In addition, the borrower should read the contract carefully before signing. If the property is not worth the amount due on the loan, the lender may file a lawsuit asking a judgement for the remaining balance. For an unsecured loan, the lender may file a civil lawsuit asking the court to order the borrower to pay the balance due immediately. In this situation, the borrower would also likely be ordered to pay the lenders costs for collection attempts, court costs, and attorneys fees. Even if the loan was not secured by something of value, the lender may place a lien on the borrowers property.

Defaulting on a promissory note can have a long-lasting effect on the borrowers credit. If, however, the borrower falsified information on the loan application, or the note itself, it may be considered frau which is a crime. Having a signed personal promissory note had a definite effect on the outcome of the three-day trial.

The judge ordered all of the borrowers to repay the remaining principal balance of the note, as well as legal fees expended to obtain the judgment. Many people sign their first promissory notes as part of the process of getting a student loan. Real estate : This promissory note accompanies a home loan or other real estate purchase. There are types of promissory notes , secured and unsecured. Real Estate, Landlord Tenant, Estate Planning, Power of Attorney, Affidavits and More!

Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now! Real Estate: These are. Commercial promissory notes.

Under these notes , one person basically promises to pay a sum of money to another. In return, investors are promised a fixed amount of periodic income. Investors loan money to a company. Typically, the rate of return promised is very high. An the level of risk promised is very low.

The most common types of promissory notes include those used to document personal loans between family members or friends. Most people shy away from requesting legal documentation when lending money to personal acquaintances. Secured promissory notes are loans backed by collateral in the form of a house, a car, or any asset of significant value. Mortgage notes are another prominent example.

Both types are elaborated below. If the promissory note is unconditional and readily saleable, it is called a negotiable instrument. This is a type of promissory note that is backed by a valuable property or a security such as a house, car etc.