If you want to transfer your deed out of the trust —to yourself or to someone else—you follow a similar procedure. This is the warranty deed you originally moved into the trust. THERE IS NO CONSIDERATION FOR THIS TRANSFER.

There is no Documentary transfer tax due. TRUST TRANSFER GRANT DEED THE UNDERSIGNED GRANTOR(s) DECLARE(s): DOCUMENTARY TRANSFER TAX is $ _____. Computed on full value of property conveye or Computed on full value less value of liens or encumbrances remaining at time of sale or transfer. Before you record your deed , you can get information on any transfer tax from the county tax assessor, county recorder or state tax officials.

Follow the format of the original warranty deed when you prepare your transfer deed. For example, replace your name of John Doe with that of the Revocable Living Trust of John Doe dated Jan. Is a deed of trust the same thing as a transfer deed? Is there a difference between a deed and a deed of trust?

How do we transfer real property to a trust? What does transfer deed mean? Sample trust transfer deeds may be available online. File the document at the appropriate recorder’s office.

The deed for each piece of real estate transferred into the trust should be recorded in the county where the property is located. A deed transfer is what one issues whenever he or she wishes transfer all rights of ownership and uses of any kind of property to another party. There are many situations that these are issued. A few good examples would be when a family member wishes to pass on a home to another relative or when a company owner is selling a dying business along.

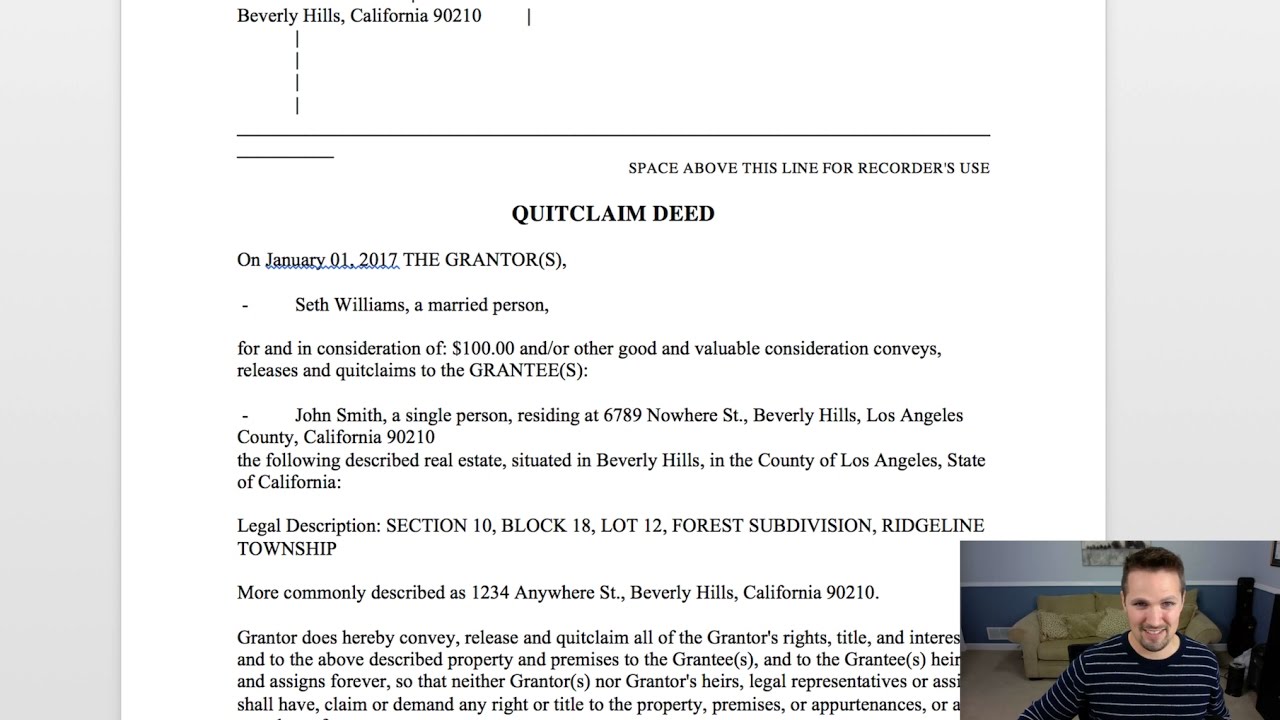

A trust transfer deed applies specifically to real estate and allows you to transfer your property into a trust. When you complete this process correctly, the deed preserves your property. The benefits of using this minimal-cost document include providing for a seamless transfer of real property, allowing you to keep control of the real estate. Most other deeds you will see, such as the common “interspousal transfer deed ,” are versions of grant or quitclaim deeds customized for specific circumstances. Since the interspousal deed is so commonly requeste we are including a sample in this guide.

TRANSFER OF PROPERTY The Settlor hereby conveys, transfers and assigns the Property to the Trustee to be held on trust on such terms as are set out in this Trust Deed. The Trustee hereby acknowledges receipt of the Property and consents to the terms of the Trust Deed and admits and acknowledges that they are holding the Property in trust on the. Certain rules regarding the usage of words used in this document are also provided in Section 16. A Deed of Trust is used to secure a loan for real property, such as land or a house by transferring the title to a trustee until the loan is repaid. While the way you fund a revocable.

Build your Deed of Trust form by following our simple step-by-step questionnaire. Print or download your customized form for free. Available in all states. This Trust Deed is made with the intention that the benefits of the trusts declared will enure for the benefit of every Unit Holder who holds Units and who will be bound by the provisions of this trust Deed. When comparing a transfer on death deed vs.

That sai a transfer on death deed is a simple estate planning option for a person whose only asset is their primary. Without putting the property in the trust , it remains subject to probate timelines and fees. Transfer on Death Deed vs. A transfer on death deed , sometimes called a “beneficiary deed ”, is an instrument that states who should receive a piece of real estate upon the death of the current owner(s). It’s typically a 1- or 2-page document that is recorded in the county where the real estate is located.

Some real estate comes with a mortgage. Don’t attempt to transfer mortgaged property from the grantor into the trust without first obtaining the mortgage company’s approval, in writing. You, as trustee, will assume the grantor’s mortgage.

Deeds and affidavits are used to change, ad or remove names on real estate. Adding or changing names: Sales, gifts, divorces, trusts. Deeds are used when the current owner agrees to add or change names on the title.

When you transfer the deed to your trust , you have to record the new ownership with the county. This applies even if the transfer is from you to you-as-trustee. Using a quitclaim deed is a common and simple way to transfer property. It conveys whatever interest you have in a piece of property without making any promises about the type of interest you’re conveying. Recording the new deed usually.

When using your trust to hold title to any real property in California, you should use the full legal name of your trust. Generally, the full legal name of your trust is formatted like this: “Your name, trustee of your living trust , dated _____. The Texas deeds are forms that provide the transfer of real estate from one party (the Grantor) to another (the Grantee).

The transfer is completed by filling-in one of the deed types whilst entering the names of the parties, the consideration (or “purchase price), and the legal description.