An inter vivo, or living trust , is another provision where lenders must allow transfer of title without calling a due-on-sale clause. You and your spouse may have decided to form a living trust , via a trust agreement, to hold your real property or other assets. If you are the mortgagee, or holder of an existing mortgage made by someone else to you, you may desire to transfer that mortgage into your trust as an asset.

When the property is sol however, the house is taxed on its market value. An if you refinance the house at some future time, the lender may ask you to take the house out of the trust to get the new loan, then put it back in.

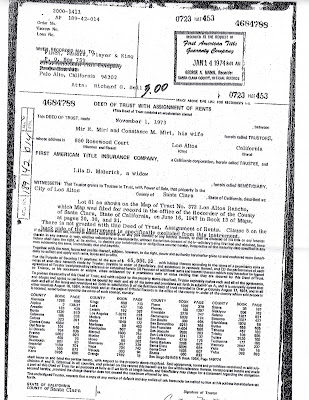

Can I transfer my mortgage to a trust? How to transfer real estate into a trust? Can a home with a mortgage be placed in a trust? What is a grantor transfer? Record the new deed with the Registry of Deeds or the land court to complete the transfer.

Some real estate comes with a mortgage. Don’t attempt to transfer mortgaged property from the grantor into the trust without first obtaining the mortgage company’s approval, in writing.

You, as trustee, will assume the grantor’s mortgage. If you find the need to refinance your home after it has been transferred to a living trust , your lender might require you to remove the home from the trust , obtain a new loan, and then transfer the home back to the. To transfer a property to trust with a mortgage still in place, you’ll simply need to set up a trust and sign a new deed putting the home in the trust ’s name.

Tip You can put a home with a mortgage into a revocable trust , but you may have to transfer it out in order to refinance or take a loan against the equity. Transferring some property with mortgages can also be simple, thanks to the federal Garn-St. Germaine Act, which specifies that you can transfer certain real estate into your trust without. Transfer property to a living trust for estate planning purposes.

In each of these situations, you will need a deed to change the title to the property. Once the original trustee of a revocable living trust has die the property in the trust transfers to a successor. Before this can happen, two things must take place.

The title to the property must transfer from the original agent (i.e., Mary Sue Anderson, trustee of the Sue Anderson living trust ) to the name of the successor. You can set up a living trust to distribute property after your death without going through probate. You can do this without affecting your ability to control and use your assets and. One of the largest assets most people own is their home and this is likely an asset you want to transfer into your trust.

You can transfer your home (or any real property ) to the trust with a dee a document that transfers ownership to the trust. This means that, for the trust to be registered correctly, the legal owner needs to transfer their title to the trustees.

They almost always refuse to pass title from the mortgagor to their chosen trustees. Make sure the second deed is recorded immediately after your refinance is completed. But the mortgage need not. Additionally, you may need to have your attorney draw up a warranty stating that the property can be used as collateral on the new loan. Often, a funding a primary residence will involve fewer steps than funding a rental property or a timeshare.

Mortgage lenders get nervous about using real property held in trust as security for a loan. In that case, the standard practice is to have the trustee transfer the property back to you so that the loan can be processed and a new mortgage deed signed and recorded. Then you can transfer the property back to the trustee. Real Property located in.

Generally speaking, if you transfer a piece of real property subject to a mortgage to another person, that transfer violates the due on sale clause in your mortgage , essentially making the mortgage immediately due in full. In the course of buying or selling property , you would pay off the mortgage upon the sale of the property. Generally, the answer is that the mortgage stays with the property. Executors, Keep Current on Mortgage Payments. While the real estate is in the estate or trust —before you transfer title to the person who inherits it—you should keep making mortgage payments, using estate or trust funds.

You don’t want to incur late fees or worse, default. However, when rates rise, this option looks more attractive.