A tax file number (TFN ) is your personal reference number in the tax and superannuation systems. It is freeto apply for a TFN. Your TFN is: an important part of your tax and super records. For previous identification cards the passport or travel. Once you have a tax file number, you have it for life no matter what changes happen in your life.

What is a TFN number for banking in Australia? How to file for a tax ID? Not all individuals have a TFN, and a business has both a TFN and an Australian Business Number (ABN).

While employees don’t have to provide an individual TFN, it makes your job easier and allows them to pay less in taxes. It can also make the process of creating a super fund more efficient. Generally, for you to use for taxation and superannuation purposes throughout your life. So, it’s a very important number.

Indigenous Helpline for Aboriginal and Torres Strait Islander peoples. Registering for a TFN is an important step when starting your business. You can then give it to: investment bodies responsible for paying interest, dividends and unit trust distributions. ATO, when applying for an Australian business number (ABN) or lodging income tax returns.

It’s an important part of your tax and super records so keep your TFN secure. You keep the same TFN for life – even if you change your name, address or job. If you don’t have a TFN, you can apply for one online.

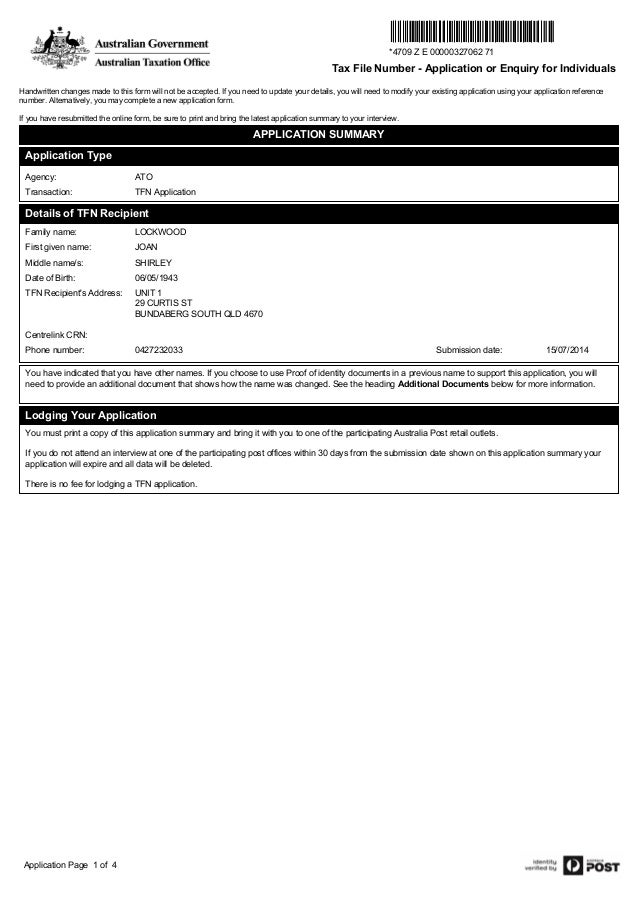

The ATO is keen to track down unauthorised TFN use as soon as possible. Companies, trusts, partnerships, deceased estates and many other organisations can apply for a tax file number ( TFN ) online. Most businesses or organisations can apply for a TFN while completing their ABN application. Apply for a tax file number ( TFN ) online and verify your identity at Australia Post. Find a participating post office near you.

I have also included some helpful information on how your staff member can apply for a tax file number. A TFN is issued by the Australian Tax Office (ATO) to any taxpaying individual or organisation. You need this number whether you work for someone else or run your own business.

This number allows you to file a tax return at the end of the financial year. I believe this link will give you the answer to your question. Generally speaking if a tax file number comes up as invali this means that the ta file number on the employees card doesn’t meet the validation rules within the program for the tax file number. A TFNis a number issued to a person by the Commissioner of Taxation and is used to verify client identity and establish their income levels. Its use in software is recommended as it will minimise TFN errors and may subsequently reduce the need for contact between your organisation or your clients and the ATO.

The tax file number ( TFN ) algorithm is a mathematical formula that tests the validity of numbers quoted as TFNs. Breezedocs permanently and accurately removes all TFN from documents such as tax returns, PAYG summaries and ATO Notices of Assessment. It’s a unique reference number that is used as part of your super and tax records.

This factsheet has information on why your tax file number ( TFN ) may not be working when applying for a HELP loan. TFN has the same meaning as ‘tax file number’ in the Privacy Act. Employee without a TFN ( Tax File Number ) This thread is now closed to new comments.

Some of the links and information provided in this thread may no longer be available or relevant. To get your TFN , file an application with the Australian Taxation Office (ATO). Tax file number , issued by the Australian Taxation Office. The TFN Group, a facility management company based in France.

Thanks for Nothing (disambiguation), multiple uses. The TFN is a unique and personal 9-digit number issued by the Australian authorities. The number does not change and is assigned for life (it does not matter whether you change your name, visa, address, etc.). A Tax File Number (TFN) is like a fingerprint – it’s unique to you. Once you are issued a TFN it is yours for life, regardless of whether you change jobs or move countries.

A TFN is used for all your tax records, as well as many other documents. Partnerships, trusts and companies are required to have a separate TFN to individual TFNs. Tax File Number – TFN In order to work in Australia legally you will need to apply for a TFN (Tax File Number).

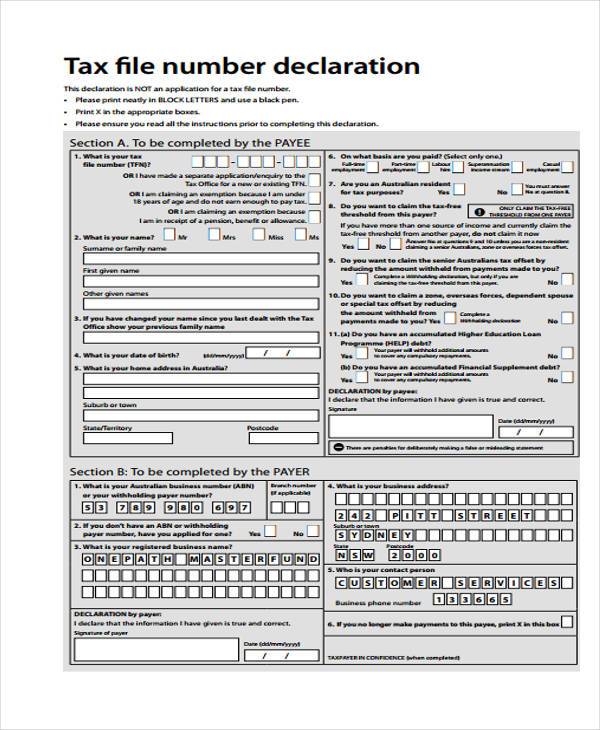

Lodge Tax File Number (TFN) Declaration – Reckon Help and Support Centre This feature is available on Reckon One Payroll Medium module. In Reckon One Payroll, you can submit your employees Tax File Number (TFN) Declaration using Reckon GovConnect. You can apply for an individual Tax File Number (TFN) from the Australian Tax Office (ATO). Tax File Number Australia – The trusted Tax File Number ( TFN ) service for travellers who plan to work in Australia. A Taxpayer Identification Number (TIN) is an identification number used by the Internal Revenue Service (IRS) in the administration of tax laws.

A Social Security number (SSN) is issued by the SSA whereas all other TINs are issued by the IRS.