Temporary residents and super. When you visit and work in Australia, your employer may be required to make super contributions to a super fund on your behalf. What is a temporary resident?

Who is a temporary resident? Are You a temporary resident in Australia? The most common category of temporary resident is taxpayers from overseas who have come to Australia under a 4visa for work purposes.

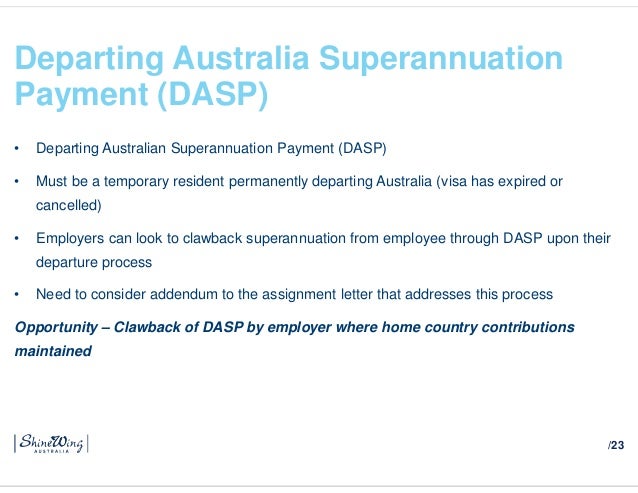

Ask questions, share your knowledge and discuss your experiences with us and our Community. Answered: Hi, Can you please tell me what is the procedure to have a Standard Identity Strength for a person working on a temporary resident visa. I want ask about job keeper I am temporary residency here and I am working as a chef from las year with same employer and we are only people eligible for job keeper but I am not permanent residency here so is there any possibility to convince to ato for my job keeper payment because my employer. Departed temporary residents will be able to claim, for an indefinite perio their superannuation benefits less the DASP tax, back from the ATO.

Any foreign source income the temporary resident derives is not taxed in Australia, unless the income relates to remuneration for employment or services provided in Australia. The payment is subject to special withholding tax. This may be subject to change for temporary residents. New Zealand residents who have super in Australia are also eligible.

Applicants may be required to have a medical examination and chest X-ray before a visa is grante although this isn’t usual when the intended stay is months or less. Some types of temporary residence visa require a fee and most require sponsorship. Unless there is an entitlement to an exemption certificate they are also liable to pay the Medicare Levy. The calculator will use non- resident tax rates and will show your weekly, fortnightly and monthly salary breakdown. Usually there is some confusion when it comes to non- resident or foreign resident for tax purposes in Australia.

This confuses almost everyone who has a temporary work visa so let’s clarify things some before we get into how to file your tax return in Australia. A temporary resident refers to an individual who satisfies the following conditions: The individual must be working in Australia under a temporary resident visa. Generally, this occurs on the issue date of the permanent visa. If you’re a temporary resident working in Australia, your employer may be required to make contributions to a super fund on your behalf.

You can apply to have this super paid to you after you’ve left Australia and your visa has expired or been cancelled. This is a called a ‘departing Australia super payment’ (DASP). In fact, on the tax form, there are only two options: resident and non- resident. Technically a temporary resident is a sub-category of resident to whom special rules apply.

A provisional visa is a temporary visa that may lead to the grant of a permanent visa if the holder meets certain conditions. ATO as unclaimed super. The Tax Shop can help you determine whether you qualify as a temporary resident for tax purposes. Eligible temporary residents are also able to access their retirement savings (superannuation) upon permanent departure from Australia or, in limited circumstances, when. Result: non- resident during the first three years but a resident for the next two years.

If you hold a temporary visa, then you are a temporary resident. Australian Tax Return Online now quick and easy at TaxRunner. If you are a former temporary resident who has left Australia and your visa has expired or been cancelle you can claim your superannuation from us by applying for a Departing Australia Superannuation Payment (DASP). You will need to certify that you meet the eligibility criteria relevant to your circumstances.

Liability to tax is determined on a year by year basis. Residency status for income tax purposes. Cancel your temporary visa.

In some circumstances you may be able to request cancellation of your temporary visa. Apply for your Departing Australia Superannuation Payment. If you’re planning to live or work in Australia for between three months and four years, you must obtain a temporary residence visa.

Applications are made using form 1Application for a temporary residence visa (non-business).