In GST, as all, we give information of TDS full form in our past blog TDS means ‘Tax Deducted At Source’ vested on the recipient of goods and services or both. In our today’s article, given information about TCS full form, that means ‘ Tax Collected At Source’ vested on Electronic Commerce Operator. What is TCS under GST?

When was gst rolled out? Tax Collection at Source in respect of GST means an amount of tax collected by the e-commerce operators from the proceeds transferable to actual sellers. Calculation of TCS under GST.

TCS (Tax Collected at Source) is a concept that is covered under both Income Tax Act and GST Act. Form GSTR-contains the details of taxable supplies and the amount of consideration collected by such operator pertaining to the supplies made by other suppliers through such e commerce operator and amount of TCS collected on such supplies. The full form of TCSis “Tax Collected at Source“.

Section 206C of the income-tax act governs the goods on which the seller must collect taxes on buyers. Tata Consultancy Services ( TCS ) is an Indian multinational information technology, business solutions and outsourcing company headquartered in Mumbai, Maharashtra, India. The difference between TDS and TCS can be drawn clearly on the following grounds: TDS implies the amount deducted from the recipient’s income in the form of tax. TCS refers to an amount accumulated by the seller or company as a tax. TCS on this “Sale Value” is Rs 112.

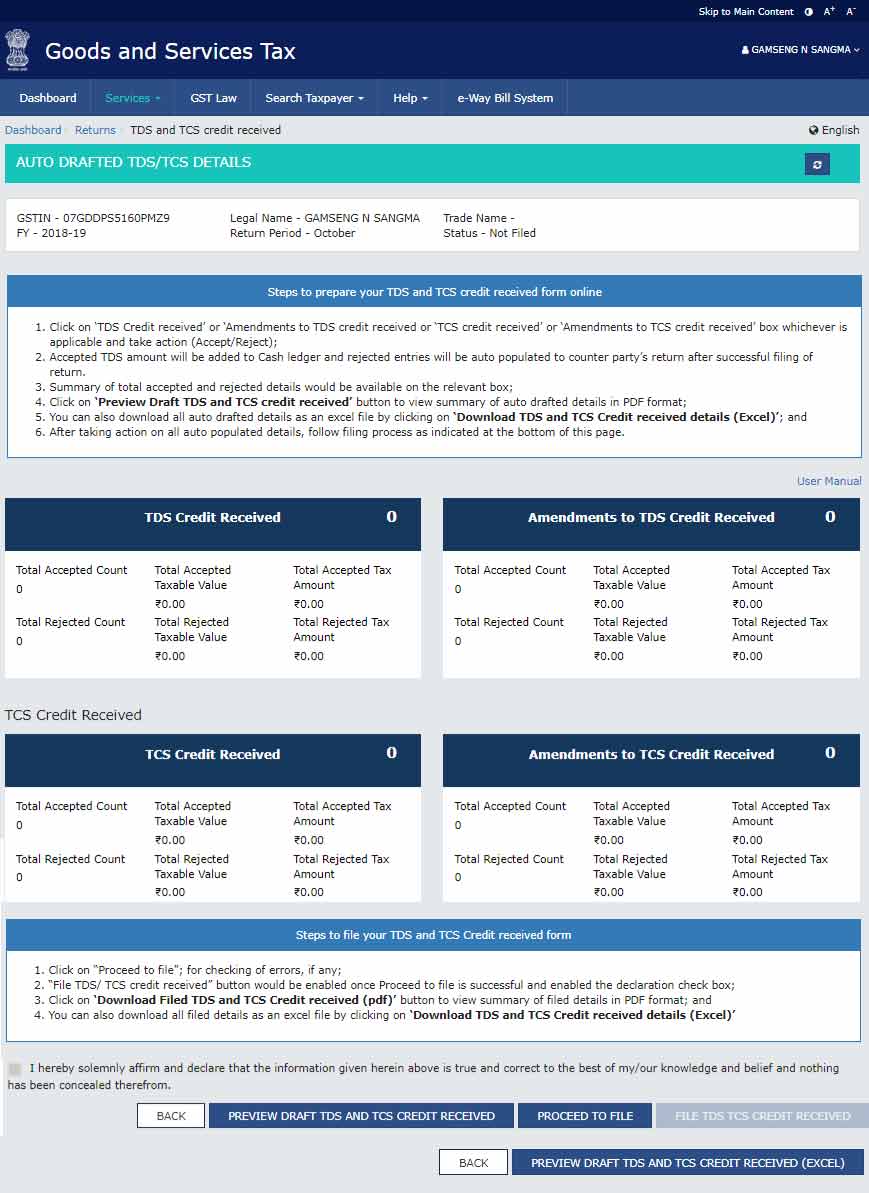

The form gets generated once the deductor furnishes details in Form GSTR-on the common portal. If the details furnished by the deductor are accepted by the deductee, then a TDS certificate is made available to the deductee electronically. TCS is calculated on this amount.

Now, while filing his ITR, Mr. Z will claim the amount of ₹5as credit from the total tax liability. TCS means tax collection at source. It means deduction of tax of the recipient. GST on Help Desk Number:.

Register Now Find a Taxpayer. Form 27EQ, he has to provide a TCS certificate to the purchaser of the goods. Form 27D is the certificate issued for TCS returns filed.

This certificate contains the following details: a. Name of the Seller and Buyer. There are taxpayers who pay TDS (under section 51) or collect TCS (under section 52) under GST. Further, these taxpayers claim the amounts deducted or collected in Form GSTR – 2. Now in such cases, the electronic cash ledgers of taxpayers paying TDS or collecting TDS gets credited. A cess is usually imposed additionally when the state or the central government looks to.

Other collectors have the provision to file TCS returns in physical form or electronic form. Tax Deducted at Source (TDS) is applicable at a maximum rate of under GST. The GST Council, at its 21st meeting in Hyderaba decided to open registration of persons liable to deduct TDS and TCS from September.

Tax Collected at Source ( TCS ) is applicable at a rate of for both intrastate ( CGST and SGST each) and interstate ( IGST)net taxable supplies under GST. As per the Central GST (CGST) Act, the notified entities. All about Form GSTR-7A : System generated TDS Certificate under GST.

Form GSTR-7A is a system generated TDS Certificate which is generated once deductor furnishes a return in Form GSTR-on the GST Portal and the deductee accepts the details uploaded by deductor and files his return. Submit return in Form GSTR-within days after the end of the month in which deduction was made Furnish system generated TDS certificate in Form GSTR-7A to the deductee within days of crediting payment of TDS to the Government i. This a testament to TCS ’ legacy of helping deliver items of exceptional value with utmost care and sensitivity, locally and. Along with the full form , detailed information has been given for every type of abbreviation. Every day used categories, such as science, political, educational, IT, medical and many more. You can read all full forms by category or alphabetically in detail.

Full form – fullform.