Edit PDF Files on the Go. Create An Invoice With Our Step-By-Step Process. How to generate PDF of an invoice? What is a sample invoice?

To make your work easy and use this invoice as a template for future invoices , you can use formulas. For instance, use the product formula if you have multiple SKUs and their prices. Say, you have to provide units of an item at Rs.

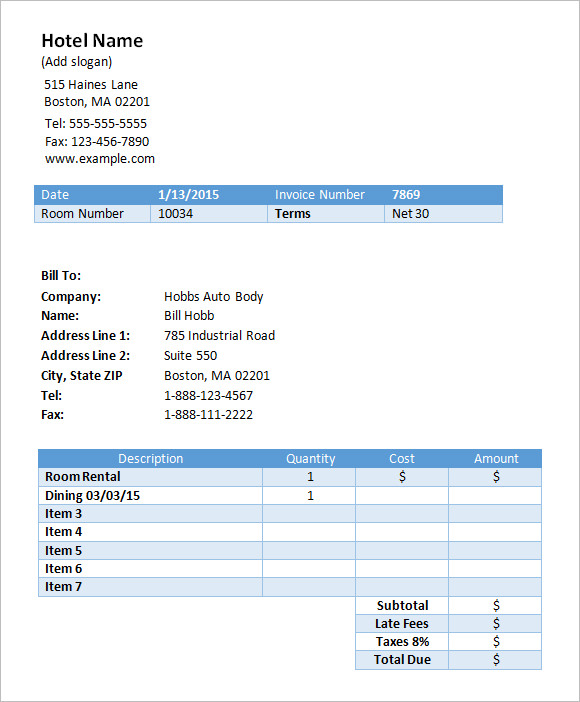

PRODUCT function to calculate total price of units as Rs. Our free Word invoice templates are a simple and easy way to send a professional-looking invoice to clients. Tax Invoice Template. Simply download the file you want and fill out the customizable fields. This printable invoice works perfectly for standard 8. Stand Out With Custom Invoices.

Separate yourself from your competition using one of Invoice Home’s 1beautifully designed templates. Bill or Invoice Number and Date 2. Lastly, a tax invoice requires to be triplicated for documentation, while the retail invoice only needs to be duplicated for the seller and the buyer’s copy. With service-specific templates for invoices , you can enter quantities and unit costs for labor and sales and even adjust the invoice template to double as a receipt.

You’ll also find invoicing templates and billing statements that deduct deposits or provide tax calculations. This needs to be raised at the end of the month. If the document is other than a tax invoice , it must contain all the other required information for a tax invoice.

Optional information like serial number and recipient address is not required in this case. Downloadable Excel Invoice Templates. Here’s our compilation of Excel invoice templates.

Feel free to downloa modify and use any you like. For more templates refer to our main page here. Click on a template image to download the respective Excel file. The database sheet contains the list of the names of your customers. These customers are those whom we issue the invoices for the goods supplied or services rendered.

Introduction: E- Invoice is a standard format of the invoice recommended by the GSTN for the GST registered suppliers. There is a myth or misconception that e-invoicing means the generation of invoices from a central portal of the tax department (GSTN Portal). E invoice does not mean the.

Your customer needs to keep this tax invoice as a supporting document to claim input tax on his standard-rated purchases. A tax invoice must be issued when your customer is GST registered. In general, a tax invoice should be issued within days from the time of supply. Free Invoice templates.

This file is a VAT Invoice Template. After a quick review, you can find that this template adds the tax information to the basic format of an invoice , which usually consists of four parts, including the contact information, the invoice information, details of the transaction and the payment information. A invoice allows you to bill your clients, collect payment, organize your accounts, stay on top of your business finances and keep information on-hand come tax time. The right invoice format will help you stay organized and get paid correctly. How do I choose the right invoice format for my business?

The tax is calculated from the subtotal of amounts listed in the invoice table, not the SH or Discount. It includes the description, quantity, value of goods and services and the tax charged. If you make a taxable sale, your tax -registered customers need an invoice from you to claim their tax credits for purchases.

Taxable income sale of 82. GST, then tax invoice must be prepared. TAX INVOICE Business name. Due date: Notes: Title: Invoice Author: Business.

Subject: Use this free template to create your invoices. Modified tax invoices Sellers who cannot meet our usual requirements for tax invoices can apply for approval to issue modified tax invoices. Shared tax invoices In some situations two or more related sellers can issue a single tax invoice to a buyer.