This form is required for all organizations exempt under Code Section 5(a). Wealthy individuals are selling off investment portfolios and second homes in fear of massive tax. Hopefully you were able to relax and stay cool this Labor Day weekend. Check out the California National Guard pilots who flew into the Creek Fire over and over to rescue hundreds of stranded.

The coronavirus pandemic crippled production around the world across many months, enforcing an.

The net rate after cess amounts to 31. What qualifies you to be tax exempt? How can I be tax exempt? What taxes are considered tax exempt? What does a tax exempt status mean?

The exemption was eliminated for private‑sector employers with annual Ontario payrolls over $million. Also, exemptions may be specific to a state, county, city or special district. Call For A Free Analysis Of Your Tax Debt Resolution Options.

To be exempt from withholding, both of the following must be true: You owed no federal income tax in the prior tax year, and You expect to owe no federal income tax in the current tax year. End Your IRS Tax Problems. Money Back Guarantee – Free Consultation.

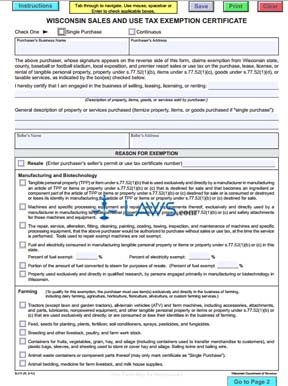

Stop Wage Garnishments. Property tax exemption program for senior citizens and disabled persons. Available To: Taxpayers who meet one of the following requirements as of December of the year before the taxes are due: at least years of age or older. The following is a list of items that are exempt from Connecticut sales and use taxes.

Exemptions from Sales and Use Taxes. This is not a complete list of exemptions but it does include purchases commonly made by individual consumers. For a complete list of exemptions from Connecticut sales taxes, refer to Conn. Complete, Edit or Print Tax Forms Instantly.

Access IRS Tax Forms. This limit is for normal age citizens. Your home can be a house, apartment, condominium, stock-cooperative, or mobile home fixed to land.

A seller is presumed to not be pursuing a vocation, occupation or business as a vendor of taxable products if its sales of taxable products and services are less than $0per year. CAUTION: If sales exceed the $0threshol the seller is liable for tax on all of its sales, including its first $0of sales.

If you’re a homeowner this is the one tax law you need to thoroughly understand. The Two Year Ownership and Use Rule. There are six primary programs. Deferral of Taxes for Homeowners with Limited Income.

Florida law grants governmental entities, including states, counties, municipalities, and political subdivisions (e.g., school districts or municipal libraries), an exemption from Florida sales and use tax. For homeowners years and older the home exemption is $14000. To qualify for this exemption , you must be years or older on or before June preceding the tax year for which the exemption is claimed. Property owners with an existing home exemption , with their date of birth on file, do not need to re-apply for the new exemption amounts.

Resale exemptions, which are usually in the form of a resale certificate, allow your customer to acquire property tax -free if it will later be resold. Disabled Veterans can apply for exemption status online with OkTAP. The online application can be used to apply for a new permit, cease an existing permit, update an existing permit, or order a replacement permit card.