See full list on softwaredevelopers. What is the USI result? How can I obtain fund USI details?

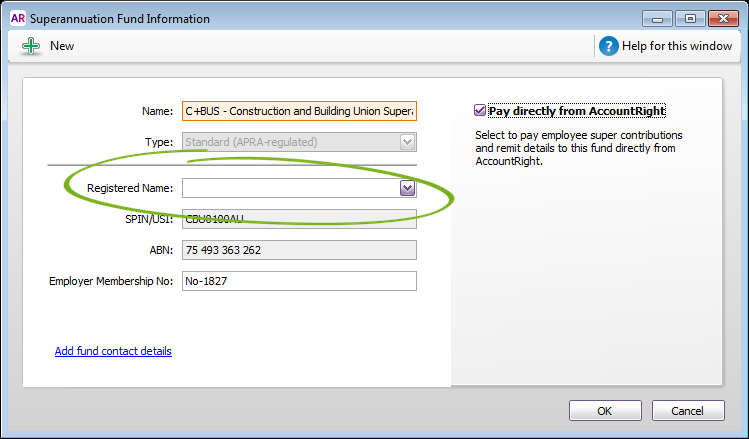

I need to change a USI and ABN for a super fund I have already setup as the fund has merged with another super fund. If I create a new super. Previously you may have used an ABN, SPIN or SFN. The USI has replaced all of these numbers for rollovers.

The USI of your product is shown on your annual statement. The SuperStream system was introduced as a result of the Australian Federal Governments ‘Stronger Super ’ reforms. If you’re planning to transfer your super to another fund , you will need the relevant USI for your super account, which is listed below.

Super Fund Lookup is an online database of superannuation funds, including large APRA-regulated super funds and SMSFs. It can now be searched by USI , in addition to the existing Name and ABN searches. Note, however, that the search defaults to the ‘Active Funds’ tab which shows “no matching funds found” when searching by USI. Registrable superannuation entity (RSE) registration number.

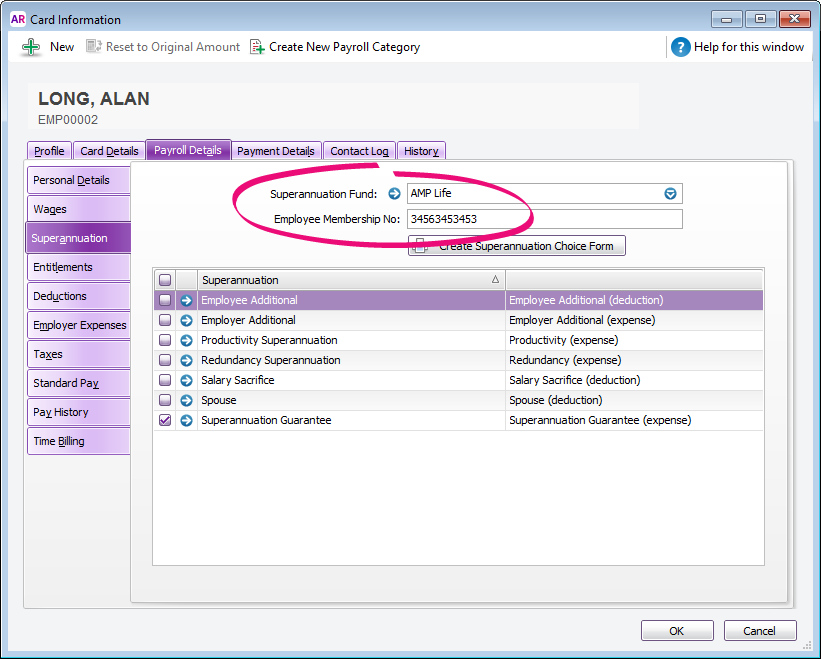

A super fund may have one USI , or it may have a USI for each product. Compare this to the ABN, which is per fund. MySuper authorisation number. They have matched exactly what is indicated on the employee’s super fund details.

Yet when I tried over and over again to lodge a payment instru. Our USI is unique to Verve Super , so as long as you use this you will select the right fund. For more information, download our Letter of Compliancebelow. The ATO has published a Fund USI and SPIN Look-up Table to assist employers obtain new fund data required to send contributions using SuperStream.

A USI is used to identify super funds and individual super fund products for electronic rollovers and contributions. The USI allows monies to be paid to funds at the product or sub- fund level instead of fund level. Unique superannuation identifier ( USI ) Required documentation You need to attach a letter from your fund stating that they are a complying fund and that they will accept contributions from your employer. Correct information about your super fund is needed for your employer to pay super contributions. Below you can find the administration details for United Technologies Corporation Retirement Plan including whether the super fund is open to the general public (Public offer) or not (Non public offer), how the super fund is structured and the super fund ’s Australian Business Number (ABN) and USI.

We call ourselves the Small Business Super Business. I am also missing a APRA Registered fund from the MYOB list. These days, if you start a new job and don’t choose a super fun your employer will put 9. Superannuation Product Identification Number (SPIN). You should read the Product Disclosure Statement, Additional Information Booklet, Insurance Guide and Financial Services Guide before making any financial decisions regarding Simple Choice Super. Macquarie Super Manager.

This is the same whether you are a TWUSUPER, TransPersonal or Transuper member. I wish to nominate GuildSuper as my chosen superannuation fund and request that all my future super contributions be paid to GuildSuper. FirstChoice Personal Super.

If your employee does not or cannot choose a super fund , you must pay their super into a super fund that you have nominated. This is referred to as your employer-nominated or default fund. Catholic Super is an award-winning industry super fund and all profits are returned to members. Suncorp takes a long-term view on superannuation fund investment performance to ensure we are maximising retirement outcomes and managing risks for members.

We continue to evolve our investment offering and performance relative to our member needs and outcomes. Should I choose life insurance through my super fund ? Choosing insurance through your superannuation fund is a personal decision. You can hold life insurance through your super fund or an external policy – or both.

Most super funds offer life insurance, total and permanent disability (TPD) and income protection insurance, with life cover. Run exclusively for current and former Qantas employees, and spouses – our goal is to help members be confident in their financial future. As a not for profit, our fees go straight back into providing the very best super and retirement products, service and outcomes for members.