How to start a business in Hong Kong? Can foreigner own in hong kong? Can I open a limited company in Hong Kong?

Therefore, opening a limited company is simple, fast and cheap (the government requires a fee of 7HKD for the Company Registration and a fee of 2HKD for the Business Registration Certificate). As a foreigner, you can register and open a Limited Company in Hong Kong. You can appoint yourself as the sole director and shareholder of your Hong Kong company with no local directors required.

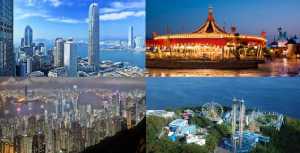

Hong Kong has a dynamic economic and has become a hub for the start -ups and starting Hong Kong limited company. Hong – Kong enjoys taxation on foreign profits and no paid-up capital requirement. Hong Kong is a shopping paradise and one of the most beautiful tourist destinations. Taxation on Hong Kong Limited Companies is unique in that it’s based on source and not on residence.

Getting started is relatively quick and easy, setup costs are low and the overall environment encourages businesses to thrive. InvestHK is always available to assist businesses in Hong Kong. Profits from a Hong Kong business are subject to profits tax (currently at a rate of 1 ) but foreign -source income is not taxable even if remitted to Hong Kong.

There is no capital gains tax, no sales tax, no withholding tax on dividends or interest and no inheritance tax.

Plus, you can get to Mainland China easily when you get a Hong. It depends on what work means in your case. There are business travelers everyday going overseas to do some work, and even when they are working inside a foreign country, they are still doing working for and on behalf of their own company. Perfect for China company registration and China company formation.

Really great if you plan to start your own business or do freelance work in China. Very reasonable rates too. I will definitely be back again for their Chinese tax and accounting service. Unlike many other countries who put a lot of restrictions on foreigners to open a business, China welcomes foreign entrepreneurs and business owners to develop their businesses in Hong Kong and provides them with the tools to grow successfully with little stress in the registry process of the business – a commodity that many countries do not offer to foreigners so easily.

Hong Kong allows 1 foreign ownership of companies, which implies that you can set up a wholly-owned subsidiary company in Hong Kong. Setting up a subsidiary is the most common and preferred option for most foreign companies, as it provides limited liability and numerous tax advantages. A non- Hong Kong company is a company that is incorporated outside of Hong Kong but it has an established place of business in Hong Kong.

It is compulsory to apply for registration as a non- Hong Kong company within a month of its establishment as a place of business in Hong Kong. Before starting a new business in Hong Kong , you will also need to enroll your employees in an MPF scheme (Mandatory Provident Fund). This is a requirement under the ordinance of Employees Compensation and guarantees that you have a proper policy in place to cover all the employees of your business entity.

Anyone can also be a shareholder, director or secretary of a company in Hong Kong , as long as she is legally recognized as a citizen or foreigner. Feel free to get in touch if you need help. Reasons like these make Hong Kong a great place to start a business and setup private limited company.

A foreigner is permitted to own 1 of a Hong Kong company , and they are able to be the sole director and shareholder in a Hong Kong company.

There are no requirements to be local resident or a specific nationality. After the WFOE, the FIE (Foreign Invested Enterprise) most common is the Joint-Venture, or a company controlled by both foreign and Chinese partners. Starting a company in China: Joint-Venture.

In order to start your business in Hong Kong , you will need to register your company with the Companies Registry. The Companies Registry is responsible for processing applications for the incorporation of local limited companies, as well as the registration of non- Hong Kong companies which were incorporated outside Hong Kong and have established a place of business in Hong Kong. The foreign company is completely liable for all debts the Hong Kong branch takes on. Annual audits for branch offices are not necessary. Additionally, the Hong Kong tax bureau usually accepts unaudited branch management accounts once the branch office submits its annual tax.

In an era of globalization, Hong Kong has proved to be the perfect place to conduct your business. Over the past one or two decades, Hong Kong has seen a steady rise in the number of people starting their business in their lan both locally and internationally. In order to legally start working in Hong Kong as a foreigner , you will need to apply for a work permit under the General Employment Policy. Networking Tips Just like in China , networking is very important in Hong Kong and it can lead you to a great job opportunity. Hong Kong Offshore Company Formation requires local secretary company , we will be your secretary company.

You can select level of services you nee normal with working day or hours in urgent case. In comparison to the surrounding countries, Hong Kong provides stability.