What are the costs involved in starting a business? How to estimate your small business start up costs? How much money does it cost to start a business? Please note that the items listed in this worksheet are just examples and may or may not apply to your business. You will need to figure out other start-up costs that apply to your particular venture.

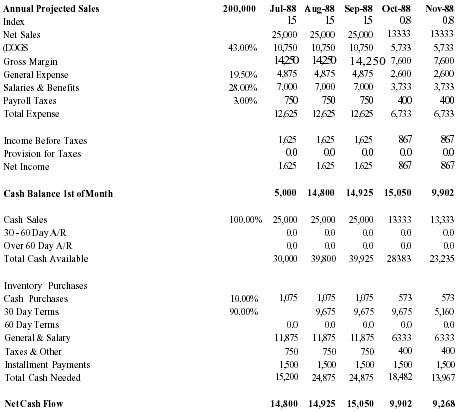

A business budget helps entrepreneurs determine how much money they need to start and operate from the day they decide they want a business , to the day the.

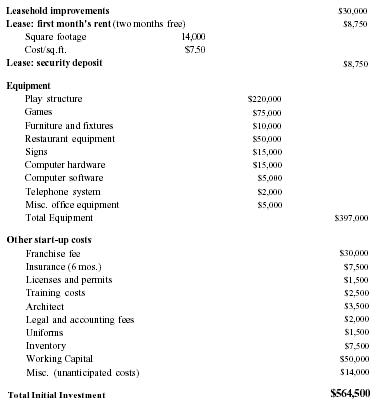

Such examples of typical pre-launch start-up costs include digital and traditional advertising in readiness for launch, office or studio furnishings and equipment, damage deposits with commercial property landlords , salaries for staff training and installation charges for digital infrastructure e. However, according to Intuit QuickBooks, most small businesses start with only $10or less. That’s quite the difference. Here is another simple example : the starting costs worksheet that Magda developed for the restaurant I used for a sample sales forecast.

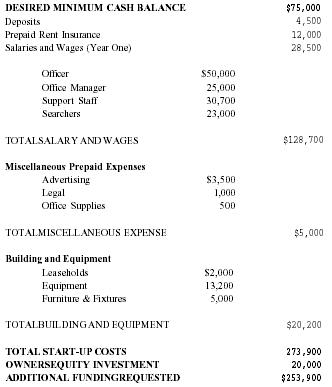

Magda’s list includes rent and payroll , the same as in her monthly spending, but here they are included in starting costs because these expenses happen before the launch. The example here is for a retail bicycle shop. It includes lists of startup expenses in the upper left, startup assets in the lower left, and startup funding on the right.

The total startup costs in this example are $ 126, the sum of expenses ($ 1), and assets ($ 125) required before lunch. One-time expenses are the initial costs needed to start the business.

Buying major equipment, hiring a logo designer, and paying for permits, licenses, and fees are generally considered to be one-time expenses. You can typically deduct one-time expenses for tax purposes, which can save you money on the amount of taxes you’ll owe. You have $ 0in startup costs and $ 0in organizational costs to set up the LLC. If you spent more than $50on your business start-up costs , your first year deduction decreases by $for every dollar you spent over $5000. According to the SBA, about percent of small business startup financing comes from loans, lines of credit, and credit cards.

In addition, consider trying to fund startup costs yourself, and applying for a small business loan once your business is up -and. Small business startup costs can sometimes overlap with fixed assets and inventory costs. Use an accountant to help you properly organize your books. The worksheet outlines advertising and supplies costs , facilities costs , equipment costs and other business start-up costs.

Startup costs examples. Consolidating costs and ensuring their feasibility is usually the most challenging part. Most entrepreneurs tend to underestimate start-up expenses, exposing the business to the danger of being underfunded. Essentially, these costs can be divided in two broad categories: structural costs and productive costs.

The first ones are those incurred to set up the business and the second class is for those that will actually produce the goods or services intende like is the case for fixed assets and inventory. Along with all of the regular costs of starting a business , the template also includes categories for fixed franchise fees as well as monthly franchise dues and marketing co-op fees. But, some business costs are hard to notice.

You need to know the hidden costs of running a small business. Hidden costs of running a small business.

Consider all your business expenses—even the less-obvious ones. Here are examples of business expenses you might miss. As you build your business , you need to protect it. Use it to get started calculating the startup costs for your own business.

Change expense categories or add new ones to fit your business. Enter one-time and monthly expenses in the appropriate columns. An expense is a cost whose utility has been used up.

When it is depreciated to zero dollars, it is fully expensed. For example , if you buy a van to use in your business , you depreciate it over time. Usually, you recover costs for a particular asset through depreciation.

Generally, you cannot recover other costs until you sell the business or otherwise go out of business. However, you can choose to amortize certain costs for setting up your business.