When does a trust transfer property to a beneficiary? What is the stamp duty exemption? Does stamp duty apply to property transfers? A transfer from a discretionary trust (the trust ) to a beneficiary absolutely (where the beneficiary is a natural person). For the purposes of s36A: Dscretionary trust and beneficiary are defined in s36A(3).

The discretionary trust from which property is being transferred to a beneficiary of that trust is called the principal trust. To set up a trust , a trust deed is prepared which sets out the parties and rules of the trust. Once drafte the trust deed will need to be signe settle and may be subject to stamp duty. The exemptions from Victorian stamp duty relating to transfers of property from a trustee to a beneficiary of a trust are very important considerations for clients and their advisers. The surrender of a beneficiary ’s trust interest as a result of the transfer is also exempt from duty.

Stamp duty exemptions and concessions in NSW. Broadly, there are five different classes of stamp duty exemptions or concessions that are available in the State of New South Wales. The purpose of the various trust exemptions under the Act is to provide an exemption for the transfer from a specific type of trust to the beneficiaries of that trust. Each exemption section must be read as a whole.

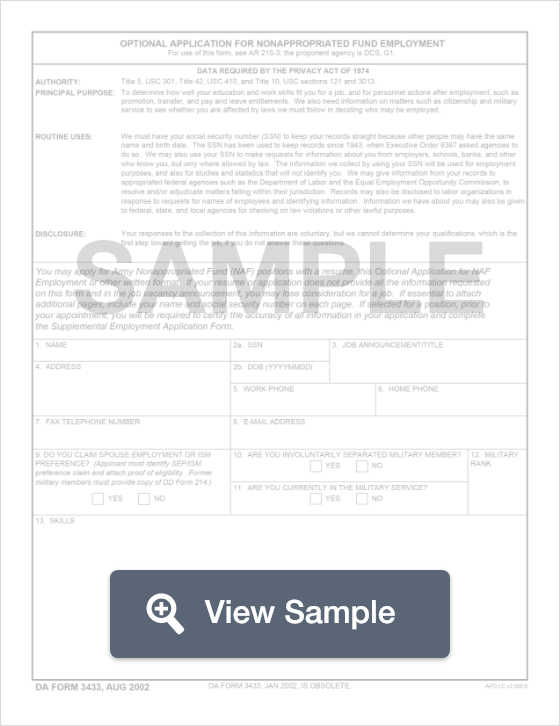

A transferor trust and a transferee must satisfy all the conditions of a relevant exemption for it to apply. If you have received property from a deceased estate “in accordance with the terms of the will” you will pay transfer duty at a concessional rate of $50. Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now!

A discretionary trust is a structure used to hold property on behalf of one or more people (the beneficiaries). The exemption applies in certain situations where dutiable trust property is transferred to a beneficiary of the trust. If it is commercial property then a rate of applies.

If cash is transferre no stamp duty applies. No stamp duty applies to assets transferred to a trust created under a Will. When assets are transferred to beneficiaries in accordance with the terms of the trust , no stamp duty arises. In the ACT, while there is no exemption from stamp duty , concessional duty of $will be charged on the transfer of property by a legal personal representative to a beneficiary of a deceased estate. The basic requirements to access the concessional rate are the same as in Victoria.

A trust is an arrangement where a trustee manage or hold a property for the benefit of one or more individuals or organisations (known as a beneficiary ). The trustees have a duty to the beneficiaries , who are the ‘beneficial’ owners of the trust property. I could easily put the property into a trust where my mother is the trustee and beneficiary , and modify the trust later in life. An exemption clause can protect the trustee from breach of trust claims made against them, with potential financial reimbursement from the trust itself. While it is understandable that settlors choose to include an exemption clause within a trust agreement, it has been argued that these clauses may prejudice beneficiaries.

Distribution of completed properties relies on duty exemption. A –transfer of property to beneficiary of a discretionary trust. B –transfer of property to beneficiary of a unit trust.

Exemption from stamp duty. Transactions from the trustee to the beneficiary. Nominal duty is chargeable on a transfer of property by the trustee of a trust , other than a unit trust scheme or a discretionary trust , to a beneficiary of the trust if.

Florida Department of Revenue – The Florida Department of Revenue has three primary lines of business: (1) Administer tax law for taxes and fees, processing nearly $37. Enforce child support law on behalf of about 020children with $1. In particular, whether an exemption may apply and therefore the real property can be transferred duty -free. The effect of this is that foreign purchasers of residential land are subject to additional duty of on top of existing stamp duty. The only exemption to this rule currently, is where the property would otherwise be exempt from stamp duty.

In this case, the additional duty does not apply. This could be significant. Where a Will establishes a testamentary trust , the exemption on payment of stamp duty also applies where the legal personal representative transfers land to the trustee of the testamentary trust.

The later transfer from the trustee of the trust to the beneficiary may be dutiable, unless another exemption applies. A non-judicial stamp paper is required to form a trust dee stamp duty on stamp paper varies from state to state. Duty is exempted under S 36B. Transfer of a property from a discretionary trust to an individual beneficiary.

Contribution of property from an individual to their SMSF. Conveyance duty is not payable on a transfer of property to a beneficiary , executor or administrator of a deceased estate, where the transfer is made under and in conformity with the trusts contained in the Will of the deceased person, Probate Application, Letters of Administration or Codicil of the estate. Real Estate, Family Law, Estate Planning, Business Forms and Power of Attorney Forms.