If the deceased member’s benefits are subsequently used to commence a new pension to a beneficiary, you will be required to ensure the new minimum annual pension amount is paid in the relevant year. This article outlines the minimum payment requirements when paying a reversionary pension and what happens if those requirements are not met. Speaking in a recent webinar, Accurium general manager Doug McBirnie said that following the passing of an SMSF member, it was still possible to claim exempt current pension income on the deceased member’s pension for the financial year in which they had passed away despite the fact that the minimum payments may not have been met before they died. What happens at death of a SMSF member?

When does a SMSF member die? Can trustee meet the pension payment standards? Depending on the SMSF’s trust deed , the deceased’s super may be paid either as a pension , a lump sum death benefit or both. However, a pension is only available to the deceased’s dependants such as a spouse, a child under the age of 1 a child up to age who was financially dependent on the decease and a child of any age with a disability.

The amount supporting the pension must be allocated to a separate account for each member. There are limited circumstances in which SMSFs can pay non-account-based pensions to members. Pension commencement day 2. Minimum pension standards 3. See full list on ato. For example, if a pension is paid fortnightly, it will commence on day one of the 14-day payment period. Funds generally determine the frequency of payments.

The pension must be account-base except in limited circumstances. You must pay a minimum amount at least once a year. Once the pension has starte you cannot increase the capital supporting the pension using contributions or rollover amounts. Where a member dies, their pension can only be transferredto a dependant beneficiary of that member. You cannot use the capital value of the pensionor the income from it as security for borrowing.

Before you can fully commutea pension, you must pay a minimum amount in certain circumstances. All pensions that satisfy the minimum standards will generally be treated as super income stream benefits for incom. Commutation generally refers to the process of converting a SMSF pension or annuity into a lump sum payment. This payment can be paid to the beneficiary, rolled over to another product within the same super fun or rolled over to another super fund. Making a large pension drawdown (rather than partially commuting) does not reduce your transfer balance and would not bring you under your transfer balance cap.

To reduce your transfer balance, you must commute an amount of your super income stream. Super pensions include market-linked pensions, lifetime pensions and life expectancy pensions. These also include pensions commenced under the transition-to-retirementmeasure.

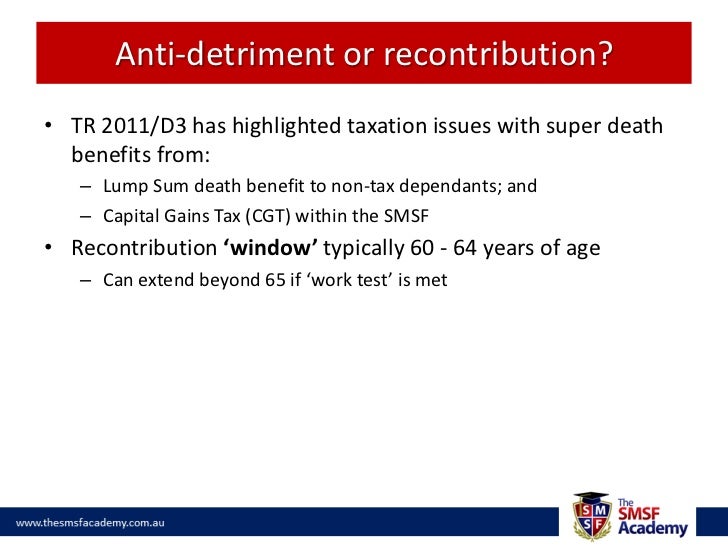

The trustee of a SMSF wrote a cheque for the minimum annual pension payment on June and issued the cheque to the member on June. As at June, the SMSF does not have sufficient available funds to make the pension payment to the member but will have the necessary funds when a term deposit, held by the SMSF, matures on July. If the recipient is a dependant of the decease the death benefit can be paid as a lump sum or income stream.

A BDBN aims to force the SMSF trustee to pay SMSF benefits in a certain way upon a member ’s death. However, BDBNs can become unreliable due to poor drafting, uncertainty as to the applicable laws or a trustee who is not minded to follow the BDBN, even where the BDBN is valid. If one member dies, their member balance of $350must be paid out as soon as practicable. A variety of questions arise when determining how to pay out the members benefit. How will this be paid out?

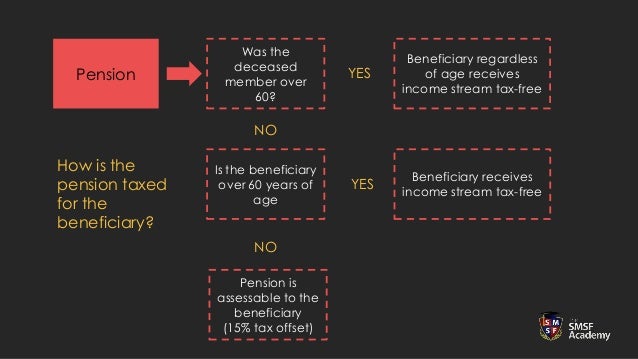

Tax Exemptions: If the deceased member was in receipt of a pension , the tax exemption available on investment income from assets that were supporting the pension will continue to be exempt until the death benefit is paid out of the SMSF. Any capital gains derived from the sale of pension assets will also retain the tax exempt status. Like all super funds, SMSFs can provide you with pension or lump sum benefits in retirement.

Retirement is a condition of super release if you have reached your preservation age. Your preservation age is between and 6 depending on your date of birth. Super benefits are tax-free if you’re over the age of 60.

A reversionary pension is a pension that automatically reverts (continues) to another person (the reversionary beneficiary) following the death of the original pensioner. The payment may be an income stream ( pension ) or a lump sum. There are significant penalties for releasing super benefits without meeting a condition of release.