Australia Income Tax Treaty exempts superannuation from U. We can provide a Tax Opinion to secure the legal exemption. All dollar values are rounded to the whole dollar. Some of the different types of fund expenses are: 1. Operating expenses 2. Investment-related expenses 3. Tax-related expenses (incurred in relation to income tax affairs) 4. Legal expenses (including trust deed amendments) 5. Statutory fees and levies 6. See full list on ato. As a general rule , the trustee can claim the fund’s expenses in the year the trustee incurs them.

If an expense is deductible under the general deduction provision, and the fund has both accumulation and pension members, the expense may need to be apportioned to determine th. Where an expense is deductible under the general deduction, the expenditure is deductible only to the extent to which it is incurred in producing the fund’s assessable income. You must register for GST if your GST turnover is $7000 or more.

GST turnover does not include input-taxed sales, such as financial supplies and renting or selling residential premises. In deciding whether to register you should consider: 1. However, you may choose to register for GST. Generally you make a financial supply if you do either of the following: 1. GST credits on your reduced credit acquisitions. Financial supplies are input taxed. For these purchases you can claim of any GST included in the purchase price.

Common reduced credit acquisitions 2. Things that are not reduced credit acquisitions 3. In speciecontributions and distributions are contributions and distributions of things other than money. Under super law, in speciecontributions that are allowed to be transferred into a fund include listed securities and business real property (including commercial property) at market value. Generally, an in speciecontribution of commercial property or shares a member makes to you has no GST consequences. Private ruling application form (not for tax professionals) 2. In addition, funds can deduct any actuarial costs they incur to determine the amount of tax-exempt income for any of their members.

Monthly charge, Advanced (any provider and investment option) – $ per month. The complexity of its financial arrangements. Whether any assets sales are necessary that will incur brokerage or agent fees. For example, the selling of shares or property so that member benefits can be paid.

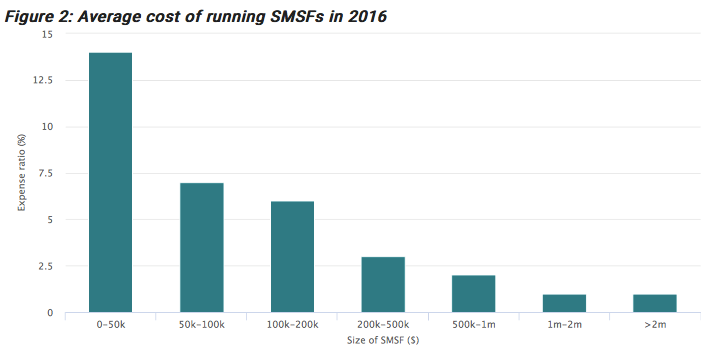

Public super funds typically charge members a percentage fee based on the amount of funds being managed. Ongoing fund management , administration and audit fees , including the preparation of all financial statements to ensure compliance with taxation legislation. The information contained in this article is general in nature. It’s best to seek independent professional advice based on your individual financial circumstances and goals. The total of fees should not exceed $ 0per annum if you have a simple fund and online providers are bringing the costs down dramatically with a $ – $1per month fee covering Admin and Audit.

Washington DC international tax. These ASIC fees are also tax deductible. You may be able to claim a tax exemption for exempt current pension income once your self-managed superannuation fund starts paying retirement phase income streams (commonly referred to as pensions).

Bare Trust Setup $550. Adding or Removing Fund Members $770. The ATO’s list of common costs includes actuarial, accountancy and auditing fees, compliance imposts associated with government regulations, investment research subscriptions and annual lodgement fees. If you’ve paid tax on your superannuation give us a call, we’ll get that back!

SMSF Windup Fee $200.