What is an audit engagement letter? Assortment of tax engagement letter template that will perfectly match your needs. When composing a formal or company letter , discussion style as well as layout is crucial to earning a good impression.

Tax engagement letters CONTRACTUAL STATUS OF ENGAGEMENT LETTERS. An engagement letter is not a contract—or is it? An engagement letter can. It is critical to specifically identify the client or clients.

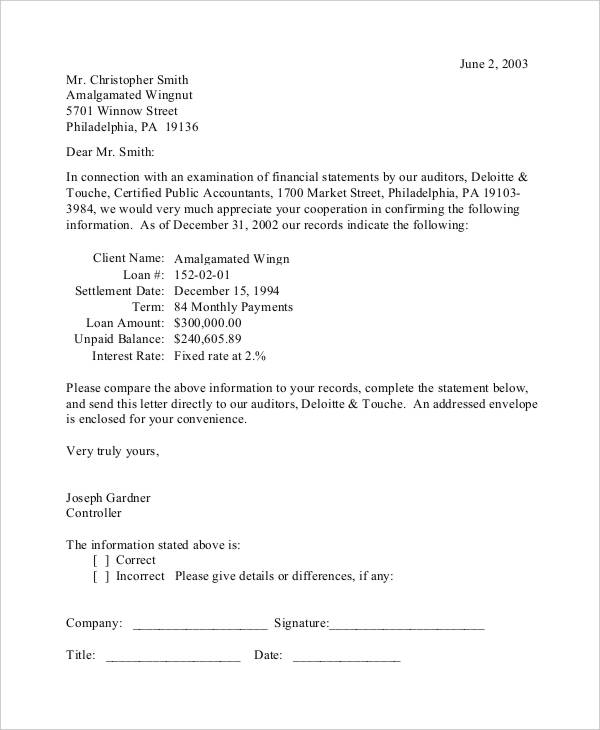

Sometimes in a tax engagement , any. This letter and any other attachments incorporated herein (collectively , “ Agreement” ), confirm our understanding of the terms and objectives of our engagement and the nature and limitations of the services we will provide. The engagement between you and our firm will be governed by the terms of this Agreement. This letter is to confirm our understanding of the terms and objectives of our engagement and the nature and limitations of the services we will provide. Our engagement will be complete upon the delivery of the completed returns to you.

The tax engagement letter is usually the first written communication a tax practice has with its client each year. It is also an important piece of evidence if the firm is ever sued. We will prepare and submit to you for filing the (year) federal and (insert state) state business income tax returnswith supporting schedules. TAX EXAMINATION ENGAGEMENT LETTER Author: Larryz Last modified by: Lawrence S. Information Document Request (IDR) Table of Contents Template : Serves as a cover sheet for all items that the IRS requests during an audit (items should be page numbered and clearly referenced). Sample Engagement Letter Wording.

Audit Engagement Wording. Compilation Engagement Wording – Review Engagement Wording. Tax Return (Personal) Wording 2Tax Return (Business) Wording. For this reason Your Company insists that you read this letter carefully.

With this letter , we appreciate your decision for selecting our company for tax audits of your firm. It spells out what you do for them, what you need the client to provide, how much and how often you get pai and more. Practice Ignition has been a complete game changer for my business. Not only do we receive our payments in a timely manner, because of the direct debits inbuilt into it, we can plan out our bill payments due to the frequency of scheduled invoice disbursals, we can onboard our clients in a more streamlined fashion as it incorporates our engagement letter and confidentiality agreement.

An Engagement Letter is a document that defines the conditions in which a professional provides services to its clients. The letter states the terms and conditions of their engagement , the scope of the services to be rendere the obligations of the parties, the fee structure, the duration of the engagement , etc. Collection of letter of engagement template consultant that will perfectly match your requirements.

When writing an official or company letter , discussion design and also style is key making a great impression. For state and local tax returns, engagement letters should list the state and local income tax returns to be prepared and whether the engagement includes other non— income-based taxes (e.g., excise, franchise, or sales and use tax ) that may be due. Letters should specifically list which state returns and form numbers are included in an. Date:_____Print Name(s)_____ 1. We are pleased to confirm our understanding of the arrangements for your income tax return(s).

This letter confirms the services you have asked our firm to perform and the terms under which we have agreed to do that work. This engagement letter will apply for all future years tax preparation services unless the agreement is terminated in writing or amended in writing by you or the tax preparer. CORPORATION TAX COMPLIANCE: TERMS OF ENGAGEMENT 1. We want to express our appreciation for this opportunity to work with you.

Please keep a copy for your records. Engagement Letter Do’s and Don’ts Engagement letters help CPA firms improve communication with clients, document engagements more effectively, and protect the firm from litigation.