Australia Income Tax Treaty exempts superannuation from U. We can provide a Tax Opinion to secure the legal exemption. A registrable superannuation entity (RSE ) is a regulated superannuation fund or an approved deposit fund or a pooled superannuation trust but does not include a self-managed superannuation fund. Employers can utilise this service to determine whether employer contributions qualify as superannuation guarantee payments.

What is superannuation fund?

Is GS employer superannuation tax deductible? Does superannuation affect retirement? Superannuation or KiwiSaver schemes are established principally to provide retirement benefits. Your employer makes a contribution every year on your behalf towards the group superannuation policy held by the employer. The employer contribution rate has been 9. Generally companies are making this part of the CTC itself.

A super fund that is regulated by APRA must have a trustee with a registrable superannuation entity licence. Non-regulated super fund.

A super fund is non-regulated if it has not made an election to be regulated by APRA or the ATO. If a super fund intends to be regulate it will need to apply as an SMSF or an APRA-regulated super fund. All superannuation schemes must be registered.

The risks for individual schemes vary depending on the scheme structure. Membership was later extended to cover females and also those other than clerks. Its quick and easy, you just need your member number.

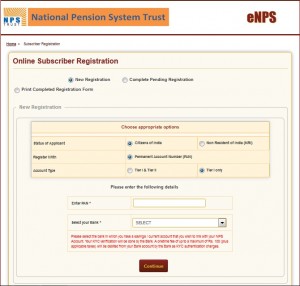

If you have already registered but forgotten your user name or passwor you can reset these online. Questions about superannuation funds. Licensing guidelines Licensing guidelines. The rules pertaining to this can be found in Part B of the Fourth Schedule of the Income Tax Act. Taxation – Contributions, Growth, and Withdrawals.

Are Employer Contributions Taxed? Anyone who runs a self-managed superannuation fund (SMSF) must ensure that a registered SMSF auditor audits the fund annually. This section contains information about SMSF auditor registration including applying for registration, cancelling registration, change of details, annual reporting requirements and ongoing obligations. Read the media release.

Please note that your old login to the member site will no longer work and you will need to register for a new account.

Date of Withdrawal : 01. This plan is different from the traditional Cash Accumulation Plan as the returns under the Plan are linked to the performance of the chosen fund. The ESA is required to receive both electronic messages and payment details when employers make superannuation contributions using SuperStream. Provide eligible employees with a Standard choice form.

If you are new to ASFA, you can set up an account here. Decisions that your superannuation provider has made, including decisions about an application for insurance held through superannuation. Decisions about a disability claim you have made, including where the claim involves insurance cover held through your superannuation fund. Payment of a death benefit.

An unreasonable delay in paying a benefit. Register as an employer. Following are the detailed functionalities of our PF Software. Request Demo Retirement Benefit Solution Single point solution to manage Investment, members and accounting.

Official page of Inland Revenue (IRD) NZ. Here to help during office hours (8am – 5pm) Mon – Fri. This identifier can be obtained by contacting the fund or via gov.

This nomination can be binding or non binding, depending on the fund. PNG with net assets of PGK5. If you’re not yet a member, open an account here, then register for online access.

Set up your online account Use your member number to register for online access.