You can use the same form to register for other taxes at the same time. Don’t have an ABN yet? You can register for GST at the same time you register for an ABN.

Where the unit has a GST turnover of $ 150or more, it must register separately for GST purposes and will have the same rights and obligations as other GST registered entities. ABN registration as a non-profit sub-entity for GST purposes cannot be used by the sub-entity for any other purpose, for example, to apply for endorsement as a DGR. How to register for GST online?

Do I need an Australian business number to register for GST? What is my GST account number? This allows you to receive GST tax credits on all business-related expenses, potentially increasing your margins. The easiest way to register for GST is through GSTregister. Simply fill out our form and you will be registered in as little as business hours.

Applying for GST, PAYG and business names. To save time you are able to apply for other business registrations as a part of your Australian business number (ABN) application. If you need to apply for business registrations separately, you need to register directly with the relevant government agency. If you apply for an ABN and you’re not entitled to one, your application may be refused.

The reason for refusal will be explained to you by the Australian Taxation Office. ABN Lookup web services allows you to integrate ABN Lookup validation and data into your own applications. Access to the service is free and easy to use. You must have an ABN to register for GST.

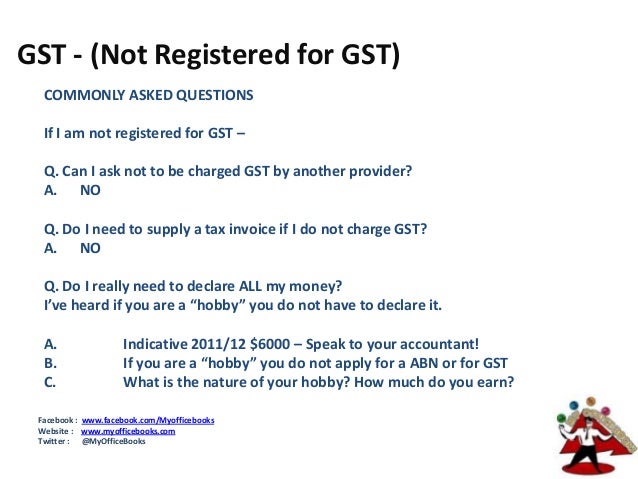

However, you can have an ABN and not register for the GST if your business income is below the $70per annum threshold. Standard GST registration is for businesses that have an Australian business number ( ABN ), make supplies connected with Australia, issue tax invoices, and want to claim GST credits. You will need to meet proof of identity requirements if you choose this option.

To register for standard GST registration you first need to apply for an ABN. You can get your ACN, ABN and register for GST with the Business Registration Service. You can also register for GST through the ATO business portal. The business portal is the main way for businesses to communicate with the ATO.

It’s also where you will submit your business activity statements (BAS). Select Registrationsfrom the options at the bottom, then click Next. Select Activity Stmnt 1from the list at the bottom of the page, and click Tax Type Summary.

If you think you need to register for GST , here’s a guide to walk you through the process. Click Add tax typeto register for GST. Before undertaking this process, it’s important you consult with an accountant to discuss your individual circumstances. Before you can register for GST , you need to have an ABN. If you want to apply for your client at a later stage, you need to register directly with the relevant government agency.

Join hundreds of non-resident businesses, including companies and sole traders, who have successfully applied for their ABN through ABNAustralia. Start your business today by using our easy online registration form, reviewed by licensed Tax agents, submitted directly to the ABN Register. It also provides an easy way for your clients to confirm your business by doing an ABN lookup. If a customer requests tax invoice, a supplier must provide one within days from the request.

Use this form if you need a new Australian Business Number ( ABN ). All applications for GST registration are to be submitted online via myTax Portal.