A Promissory Note is an instrument in writing. It contains an unconditional undertaking or promise , signed by the maker to pay a certain sum of money to a certain person. Unlike, Bills of exchange, there is no need of acceptance of Promissory Notes as here the payer is himself the maker of the note.

He, himself promises to make the payment. A promissory note is a written promise to pay an amount of money by a specified date (or perhaps on demand ). The maker of the promissory note agrees to pay the principal amount and interest. The purpose of issuing a note payable is to obtain loan form a lender (i.e., banks or other financial institution) or buy something on credit. The companies usually issue notes payable when they: 1. See full list on accountingformanagement. In this note, the Western Products Inc.

Southern Company an amount of fifty thousand dollars plus interest after six month of the date of preparation of the note. Smith who is the treasurer of the company. The note has been signed by A. The National Company prepares its financial statements on December 3 each year.

Required:For National Company, prepare: 1. The difference between the face value of the note and the loan obtained against it is debited to discount on notes payable. The discount on notes payable in above entry represents the cost of obtaining a loan of $100for a period of months. Therefore, it should be charged to expense over the life of the note rather than at the time of ob. Journal Entry for Bills of Exchange The drawer is the person who draws or makes the bill and sends it to the drawee or the payer for the acceptance.

Once accepte the bill becomes Bills Receivable for the drawer and Bills Payable for the drawee or payee. The drawer may endorse the bill to another person who becomes the holder of the bill. How to write a promissory note?

If a customer signs a promissory note in exchange for merchandise, the entry is recorded by debiting notes receivable and crediting sales. What are promissory notes? A company that frequently exchanges goods or services for notes would probably include a debit column for notes receivable in the sales journal so that such transactions would not need to be recorded in the general journal.

Suppose for example, a business issues a note payable for 10due in months at simple interest in order to obtain a loan, then the total interest due at the end of the months is. On a balance sheet, the discount would be reported as contra liability. Each year, in a ledger format, record the beginning value of the loan and the market interest rate.

Figure out the length of the loan and the AFR. The date may be a fixed date sometime in the future, or on demand. John signs the note and agrees to pay Michelle $100six months later (January through June 30). Additionally, John also agrees to pay Michelle a interest rate every months.

The concept of accounts payable and notes payable are often. Also Check: Factor accounts receivable. It can be monthly, yearly, or some other term specified in the note. Most installment loans are types of promissory notes.

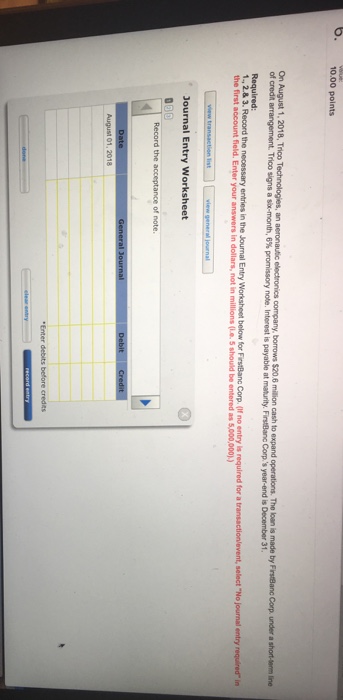

When a company lends cash to one of its employees, the entry will include a credit to Cash and a debit to an asset account such as Notes Receivable from Employees (if a promissory note is involved) or Other Receivables-Advances to Employees (if a note is not involved). How much accrued interest (rounded to the nearest cent) will be recorded as an adjusting entry on December 3 the end of the accounting period? Notes Payable On December a company accepted a $00 , 90-day note.

Record the interest income as a credit to interest income and a debit to an asset account for the investment in the note.