PAYG payment summary statement. Summary about your PAYG. Let’s make this really simple. They are just words on a document with your annual income and tax paid by your employer to the ATO.

STP they will continue to provide you with a payment summary by July (as they do now). Your employer should let you know if you will receive an income statement or payment summary. You should talk to them if you are unsure.

Thank you very much for your quick response. I really appreciate it. Letter of Compliance (Ask an employer to pay super into your AustralianSuper account) PDF, 94KB. Input the date of the payment and a reference number (Simple Fund 3will automatically produce a reference number, but it is editable ). The last step is stage to upload the file and send it to ATO. When we download the file to save and send to the ATO it says it is corrupt and does not exist.

Types of payment summaries that may need to be reported. Under Payment summary , there are tasks to complete. This includes payments, tax and super information. Employees will have access to their information from one place.

An employer who does report to us this way will not have to give you a payment summary. The Income Statement is only available from your myGov account for both Department and School Local Payroll (SLP) employment. A copy of the Income Statement cannot be generated by the Department or the school.

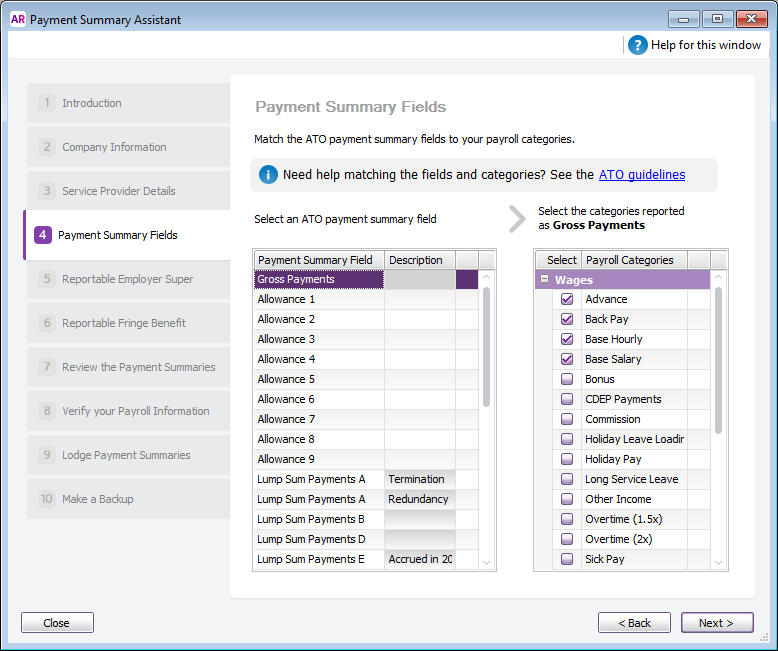

Will there be any additional features in MYOB in a. Auto-suggest helps you quickly narrow down your search by suggesting possible matches as you type. Hi There, Just a bit stuck. If the amount is zero, write ‘0’ in the box. Once a payment to an employee has been generated via a dividen through the pay employee wages function, or via an ad-hoc payment , the amounts being reported on the payment summaries can be adjusted in the cashbook payment entry.

If you need to lodge an individual return by paper, you can print the ATO PDF copy of the worksheets and send them to the tax office. As the minimum payment is $10k Boss will be eligible to receive $10k as a credit on his Activity Statement even though he has only withheld $6k. If you want to include every day worked within the financial year, you might have to split a pay run. General advice warning about using or relying on this information The information in this document is prepared based on our current understanding of regulatory requirements and laws. At the end of each financial year, recipients are automatically advised of the amount of taxable pension or benefit they received during the year.

It is delivered in tranches. Enter this tax offset amount in box S at Question T2. To print the bip worksheet If you have multiple bip worksheets, print them separately. You can now access your summary in a few ways! Online in your myGov account my.

As an employer, if you are using the Single Touch Payroll (STP), you are no longer required to provide your employees with an annual payment summary. Part-year payment summaries. Payg annual payment summary statement. The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. Available for PC, iOS and Android.

This information will be sent directly to the ATO by your employer. You will then be able to view them through your ATO online services. Calculate your take home pay from hourly wage or salary.