Can I remove a beneficiary from an irrevocable? Who owns an irrevocable trust? Does an irrevocable trust ever become revocable? Who needs an irrevocable trust?

Their entitlements are not subject to change and are guaranteed. Changes in a policy must be made before death, or else the.

Other articles from investopedia. That’s why, if you’re considering designating someone as the irrevocable beneficiary of your life insurance policy, it’s best to be darn sure that your relationship with that person will endure, or that you have lasting financial obligations to that person. This is the opposite of a revocable beneficiary, whose benefits may be altered by the person who takes out the policy.

A trust is a legal document where the grantor transfers assets to a trustee, which is the person or entity that acts as the manager of the assets. This person or entity has legal title to the assets for someone else , also known as the beneficiary. The appointment of the beneficiary is an agreement between the insured and the insurer that promises to pay the benefits of the policy to a specific third party as beneficiary. The owner still maintains the policy and has the option of making changes, but changes must be approved by any irrevocable beneficiaries named in the contract.

What is an irrevocable beneficiary ? As an irrevocable beneficiary , the person or entity chosen has certain rights with regard to the death benefit of your policy.

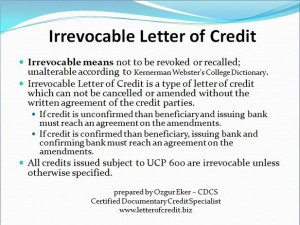

This can impact you in a few ways. For example, if you decide to change a named beneficiary , the current beneficiaries must also sign off on these changes, as well. When the policy owner makes the beneficiary designation without retaining the right to revoke or change the designation, the beneficiary will be an irrevocable beneficiary. Generally, irrevocable beneficiary designations not only require the agreement of the policy holder, but also of the beneficiary. All prior designations of beneficiary (s) are hereby revoked.

If more than one person is named as a class of beneficiary or contingent beneficiary , all death benefits payable to the class will be paid to its survivors in equal. A beneficiary can also be revocable or irrevocable. Naming a beneficiary as revocable relieves you of this restriction.

Irrevocable Beneficiaries. If, for example, your spouse is an irrevocable beneficiary and you divorce, your spouse is still entitled to remain on the policy, regardless of whether you want that. When you applied for the insurance, you may have made the beneficiary designation irrevocable. This means the beneficiary cannot be changed without the consent of that same beneficiary. The policy itself will indicate whether or not a beneficiary is irrevocable.

An irrevocable beneficiary can’t be removed from the policy without the beneficiary providing written consent. A revocable beneficiary has no say in whether they remain as beneficiary. A Contingent Beneficiary is a person or entity entitled to receive benefits from a trust, dependent on a contingency. At the nephew’s death, the remainder passes to Uncle Bob’s church.

Both revocable and irrevocable trusts have their advantages and disadvantages. This also gives the policyholder the option of discontinuing the policy.

With an irrevocable trust, there are actually a few estate and tax benefits. Firstly, a home in an irrevocable trust is not subject to estate tax as you technically no longer own the home. And when the home is passed on to your beneficiaries , they also escape any estate tax. An irrevocable trust is one that can’t be revoked — meaning it cannot be change modified or cancelle except under certain circumstances.

Tax Consequences of Trust Distributions. As noted above, an irrevocable trust must pay income tax on its earnings. However, a trust is also entitled to take a deduction for income distributions made to a beneficiary. The trustee is responsible for reporting all income the trust earns, even if the terms of the trust require beneficiaries to receive all of that income. A irrevocable trust must have specifically named beneficiaries.

For example, you can designate the beneficiary of your trust to be Steve Lyons, but you cannot designate “my best friend and his issue” as your trust beneficiary. Although there are many advantages to setting up an irrevocable trust, they aren’t quite as common as revocable trusts simply because the grantor loses control and rights to any assets transferred to the trust. It’s important to note that trust interpretation is primarily a state law issue. Instea tax regulations will only come into effect once distribution from.

In some states that allow IFTs, a Goods and Services Form (basically an itemized list of what is being paid for) is also required in order to prevent an “improper transfer’, or in other words, a violation of Medicaid. If the beneficiary of a revocable trust dies before the settlor does, the settlor can simply rewrite his trust instrument to address the change.