For an inter vivos trust fun the grantor can serve as both the trustee and beneficiary. This reduces available asset protections and takes away most immediate tax benefits, but it can protect the elderly from abusive family or friends. The world of trusts, wills, and testaments can be confusing, but when it comes to inter vivos trusts vs.

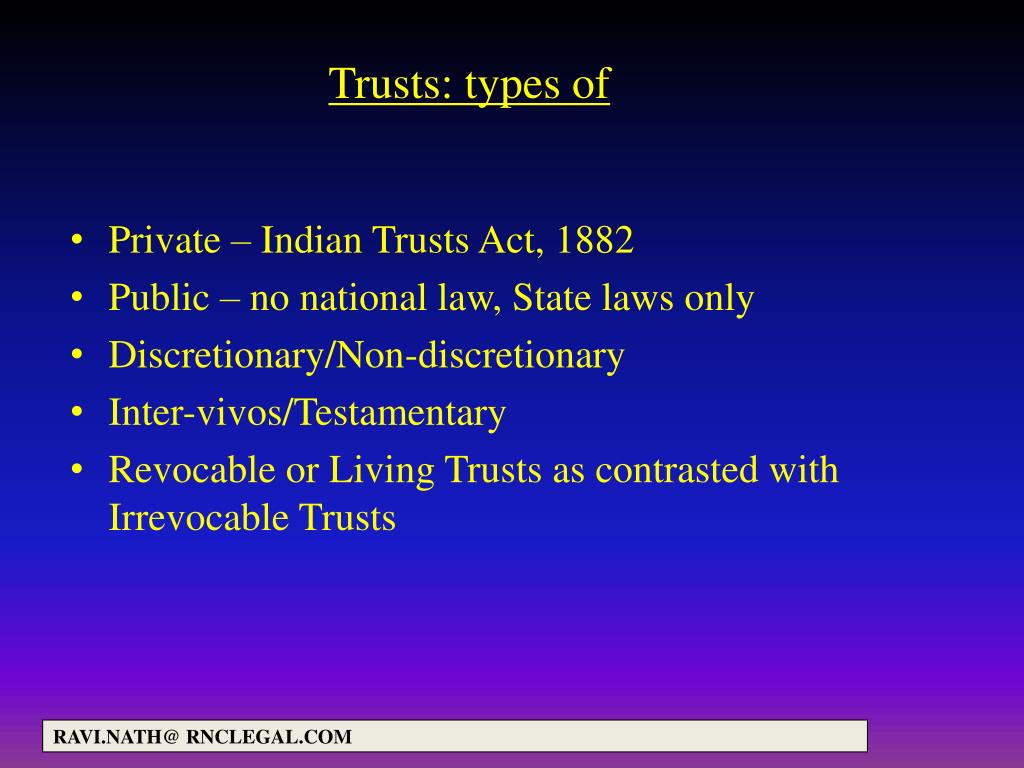

To explore this concept, consider the following inter vivos trust definition. Because the creation of a testamentary trust doesn’t occur until death, it’s irrevocable. The trust is a created by provisions in the will that instruct the executor of the estate to create the trust. Probate is necessary to move that property into the name of the trust , just as it would be to transfer it into the names of living beneficiaries. All trusts are either testamentary or inter vivos.

The best way to describe the difference is to put them in context of a real-life situation. Each trust has different tax rules. At the bottom of this page you will find information on public trusts and public investment trusts and the different trust codes. Discuss your goals with an experienced estate planning attorney to determine the best option to meet your needs.

Trust types Testamentary trust. It also may provide for ongoing trusts for your loved ones upon your death. One benefit of a revocable trust , versus simply using a will, is that the revocable trust plan may allow your estate to avoid a court-administered probate process upon. A testamentary trust is a trust or estate that is generally created on and as result of the death of the.

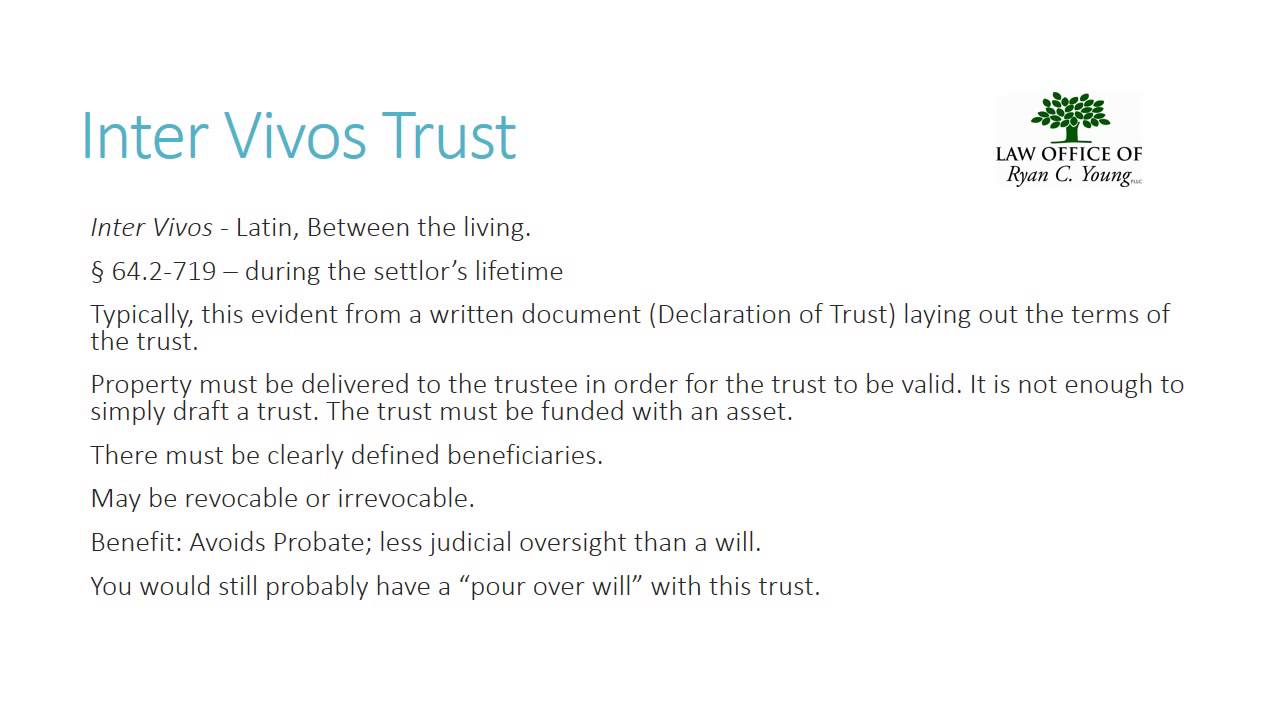

This article is intended to briefly introduce you to the difference between an inter vivos trust and a testamentary trust. There are many different types of trusts and reasons for creating a trust. What’s the difference? The two biggest advantages to using an inter vivos trust is the avoidance of probate at death and the opportunity to reduce estate taxes for married couples.

I have often called a testamentary trust “the attorney’s retirement plan. You can tell if you have a testamentary trust , because the document that created the trust will say “Will …. If your trust is a revocable living trust , it will usually have the word “Living” or “ Inter Vivos ” in the title. The Institute will be pleased to provide additional safe harbor IRS charitable remainder trust forms without cost or other obligation. The beneficiaries you name in your living trust receive the trust property when you die. Irrevocable trust : In contrast to a revocable trust , an irrevocable trust is one in which the terms of the trust cannot be amended or revised until the terms or purposes of the trust have been completed.

The term inter – vivos is a Latin term meaning during life. An Inter Vivos trust can be established as revocable or irrevocable. An inter vivos trust is also known as a living trust. This is a trust that you set up while you are still alive.

This means that you are going to fund the accounts that are going to pay for the care of your pet and set everything up in advance. The other option that you have is to set up a testamentary trust. Contrary to a testamentary trust , a living trust – or inter – vivos trust – takes effect at its creation. These trusts can be either revocable or irrevocable. Inter – vivos is Latin for “among the living persons.

So, if I were to decide to give you my boat, then that would be an inter – vivos transfer. Like testamentary discretionary trusts, inter vivos trusts may provide benefits including asset protection and tax minimisation. By contrast, a trust that only becomes operative when the person dies is a “ testamentary ” trust. A trust someone creates while alive.

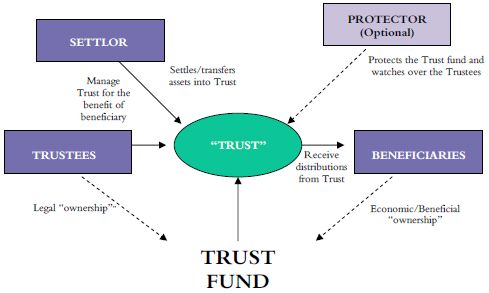

Such as a trust provision in that person’s Last Will and Testament. The trustee has absolute discretion regarding the use of trust funds and the beneficiary has no legal entitlement to the trust funds.