It can be contrasted with a testamentary transfer , which is a transfer made in a will after death. A revocable trust is considered an inter vivos transfer even though the benefit of the trust is not enjoyed by the beneficiary until after the death of the donor. Following a gift inter vivos , the grantor no longer has any rights to the property, and can not get it back without the permission of.

An inter vivos gift is distinguishable from a gift causa mortis, which is. What does inter vivos trust mean? How is an inter vivos trust funded?

Everything we have discussed in this section applies to gifts between living people, or “ inter – vivos ” gifts. The words “ inter – vivos ” are Latin for “between living people. The term “ inter – vivos gift” is a slight misnomer because, in fact, all gifts must be between living people. First, the transfer to the daughter inter vivos firmly engaged the presumption of resulting trust as set out in the seminal case of Pecore v. Secon the onus was on the daughter who held title to the which passed to her by survivorship on her mother’s death to rebut the presumption. For example , where you give someone a flat-out gift of property, that is an inter vivos transfer and that property would not be part of your probate estate when you die because, obviously, you no longer own it.

However, there is an exception for inter vivos gifts and transfers in trust. Not only is an inter vivos gift or transfer one that is made when the person making the gift or transfer is living, it also provides that the gift or transfer will take effect. Inter vivos trust refers to a trust created and executed during the life time of a testator.

It is a revocable trust created to hold property for the benefit of another person. The term inter vivos trust is used to describe living organ donation, in which one patient donates an organ to another while both are alive. A VALID GIFT Often when there is a transfer of an asset for estate planning purposes the transfer is gratuitous, as in the grantor does not accept any payment (or token payment) from the grantee.

As an example of a taxable termination, consider a transferor who establishes an. Sometimes even if property is immovable, it is not governed by TPA e. Lacking the contract to make the gift vali Anglo-American law has long puzzled over the donative conveyance of movables. Traditional doctrine holds that there has to be delivery, a transfer of possession of the thing accompanied by donative intent on the part of the donor, and acceptance by the donee. Roughly translated inter vivos means ‘between the living’.

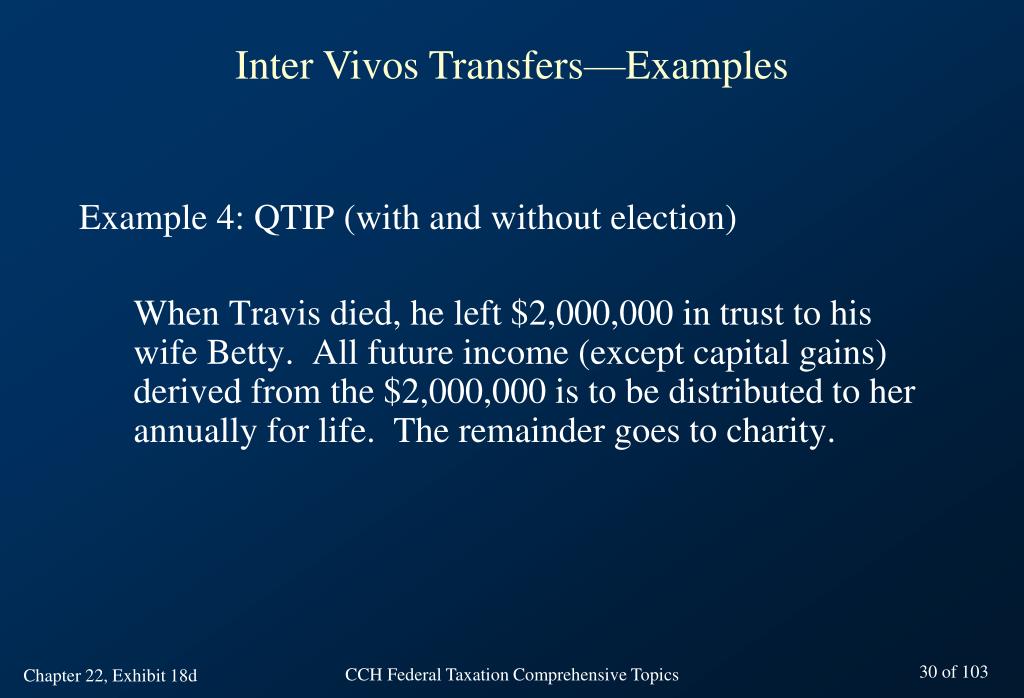

In the financial world a gift inter vivos policy relates to an insurance policy used to cover the inheritance tax liability that can arise when your client makes a gift to another person whilst they are alive an absent of any other exemption, potentially liable to inheritance tax for the next years. Example 1: Grandfather gives $100to his granddaughter. A transfer made to a trust in which all beneficiaries are skip persons is also a direct skip. If the transfer is made during the settlor’s lifetime, the trust is an “ inter vivos ” or “living” trust.

Annotations for Introductory Paragraph and Paragraph Funding of Trust, of the Sample Trust. Factors concerning qualification of trust. We have been talking so far about living trusts, i. The gift then becomes irrevocable, and the recipient has full legal ownership of the property.

The second aspect of revocability with causa mortis gifts is that there are situations where a gift can be automatically revoked. Inter Vivos Transfer of Farm Property to Child. Florida Statutes 732.

Donor’s Tax is a tax on a donation or gift, and is imposed on the gratuitous transfer of property between two or more persons who are living at the time of the transfer. It shall apply whether the transfer is in trust or otherwise, whether the gift is direct or indirect and whether the property is real or personal, tangible or intangible. Act and to complete the stock transfer.

Where a taxpayer makes an inter vivos transfer of farm property pursuant to subsection 73(3) for a stipulated sale price, any subsequent forgiveness of part or all of the debt obligation arising on the transfer will bring section into play unless one of paragraphs 80(1)(c) to (h) applies. IT-293R deals with the application of section 80. There have also been changes in tax rates over time and changes in the relative prices of inter vivos gifts and bequests, both of which provide strong incentives for changes in the timing of taxable giving.

The legal requirements for general inter vivos gifts are as follows: 1. The donor needs to have mental capacity and a degree of understanding to make the gift. The degree of understanding should correspond with the value of the gift. For example , a gift of an expensive car would require a higher degree of understanding than a gift of a cheap watch. However, an interspousal transfer deed is a special kind of transfer that is exempt from transfer taxes and ultimately a cost-effective method of transferring property between spouses.

Quit claim deeds are very simple and use a form that is easy to find online or at office supply stores.