How to draft an indemnity agreement? Can any agreement include an indemnification clause? What does indemnity mean on a managing agency agreement? An indemnity agreement is a contract that ‘holds a business or company harmless’ for any burden , loss , or damage.

Other articles from blog. They frame various clauses which help to define the indemnity agreement terms and conditions effectively. It is to have an indemnity clause in place in services agreements. This agreement contract form can be associated and used together with other documents such as business contracts, sale contracts.

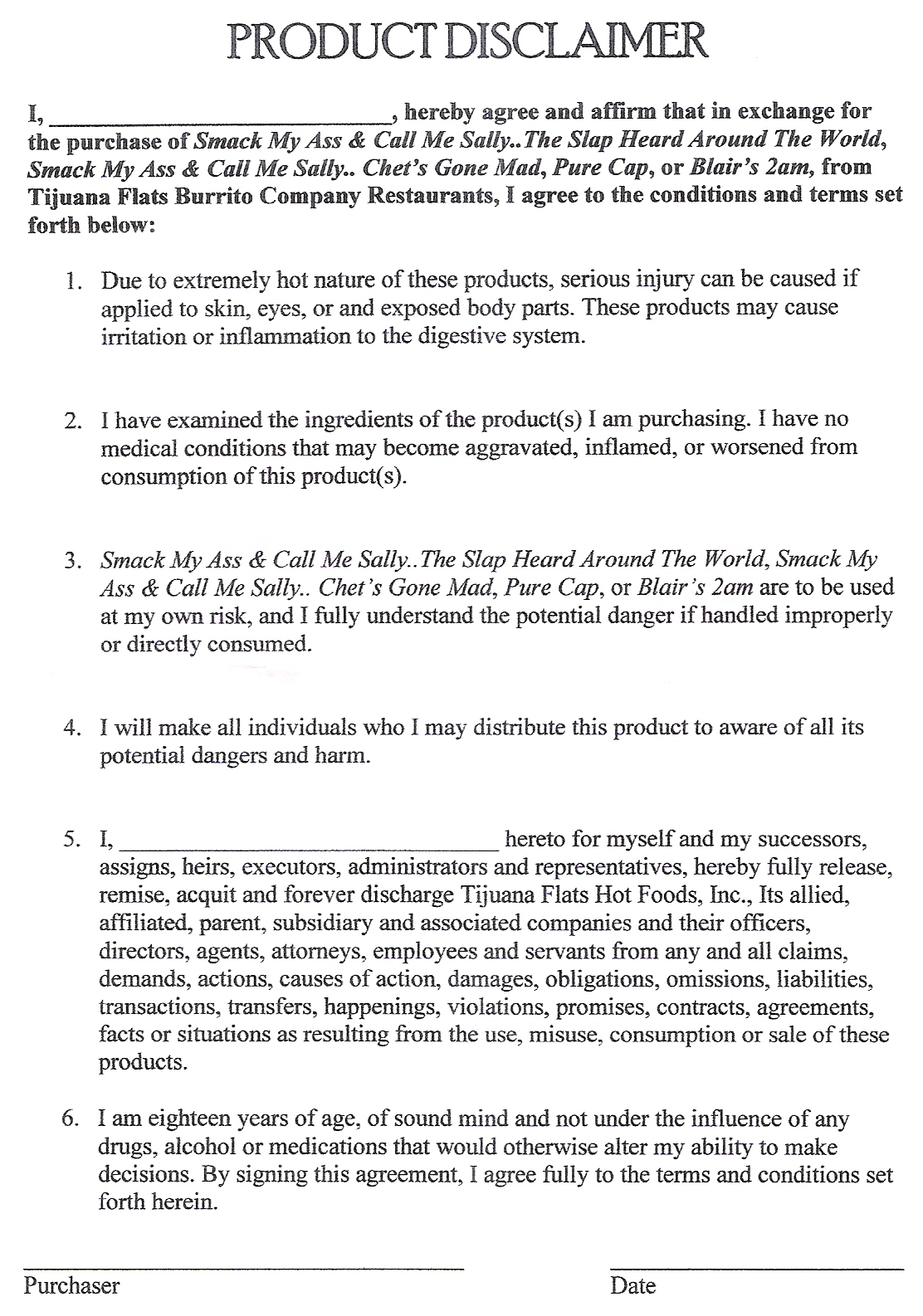

The Promisor promises to indemnify or hold the Promisee harmless against future claims, losses or damages related to a particular activity. Promisor: the name and address of the person or corporation making the promise to indemnify 2. Promisee: the name and address of the person or corporation re. Indemnity Agreement Template. All activities come with a certain amount of risk. It acts as a form of insurance and also incentivizes parties to enter into contracts they wouldn’t otherwise enter into.

For example, if you wanted to remodel your kitchen, you may be reluctant to hire a contractor to come into your home for fear that if the contractor or one of his employees gets injured in. This agreement allows all parties to a contract to know who will bear the responsibility if something goes wrong and prepare accordingly. See full list on legaltemplates. Without it, you may get sued or be responsible for damages that were not your fault.

Or you may have no incentive to do your job with reasonable care. Who is the Promisor and Promisee 2. What is the activity giving rise to the indemnity 3. Where are the Promisor and Promisee located 4. When is the effective date of the agreement 5. Why might the Promisor not be obligated to indemnify the Promisee 6. This agreement shall be unlimited as to amount or duration, and it shall be binding upon and inure to the benefit of the parties, their successors, assigns and personal agents and representatives. The agreement may describe consideration (this would usually come in the form of a sum of money that has to be paid) that will be used to secure the agreement.

If you’re going to be making this type of agreement, then the two of you will need to state the specific terms in which the indemnitee will be held harmless. A simple indemnification agreement template (also known as a hold harmless agreement ) Sections to hold harmless a company or business for any burden, loss, or damage. Created (and approved) by legal experts. At present, states have some kind of state laws that limit the inclusion of indemnity clauses or agreements.

An indemnity operates as a transfer of risks between the parties, and changes what they would otherwise be liable for or entitled to under a normal damage claim. An indemnity requested by a title insurance company from either a borrower or a seller to minimize its risk during the time between closing a real estate transaction and the actual recording of the instrument. Broad form indemnity agreements (this is also commonly refererred to as the “no-fault” agreements), is always common among construction contracts wherein any instances of damages or injuries will be placed on to the sub-contractors.

In this context, there are several types: 1. When you start a business venture through a contract with someone else, that venture may come with any number of damaging things that might happen. Insurance contracts are a very common example of indemnity agreements. In the event any claim or suit is brought against Promisee within the scope of this Agreement , Promisor shall pay for legal counsel chosen by Promisee to defend against the same. You can understand this agreement by assuming that you are landlord and when a new tenant moves into your building, you ask him to sign the indemnity agreement. The indemnification agreement protects the Board Directors against liabilities, losses, and lawsuits that may result from serving on the board of the company.

It is completely separate from your insurance coverage. The party that has agreed to assume liability must do so regardless of whether they have insurance to cover the incident. A: A surety bond indemnity agreement is a contract between the principal and the surety company, that transfers risk from the surety to the principal.

While the bond itself is created by the obligee, an indemnity is a separate agreement that the surety requires the principal to sign prior to issuing the bond that guarantees the principal is responsible for repaying any money paid by the surety in the process of settling a claim. A title insurance company usually obtains a gap indemnity when there is a sit down closing because there is a gap of time between closing the real estate transaction and recording the instruments.