Letters – View Templates Online. Digital automated income and employment verification is 3x more successful. How do you write an income verification letter? What is income verification? How to verify income for self-employed?

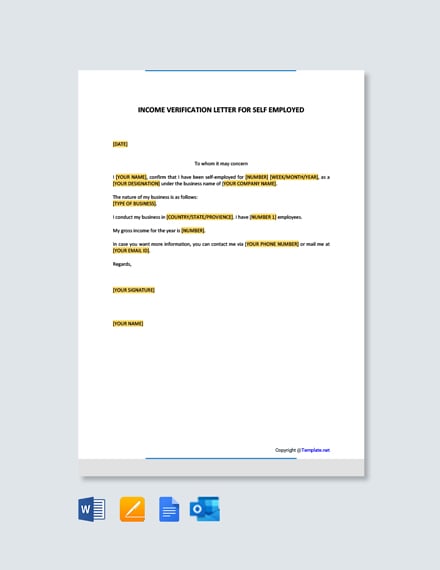

EXPLAIN YOUR PURPOSE OF LETTER: Explaining your purpose for writing this letter is important and you have to do this in. Here is a high quality and printable template for creating an income verification letter for self-employed individuals. This template is easy to edit and fully customizable in multiple formats. Download now for free. These guidelines will be valuable as you write the proof of income letter.

At that top of the letter , include your contact details and address. For the self-employed individuals, the business name should feature in this section. After your address include the current date.

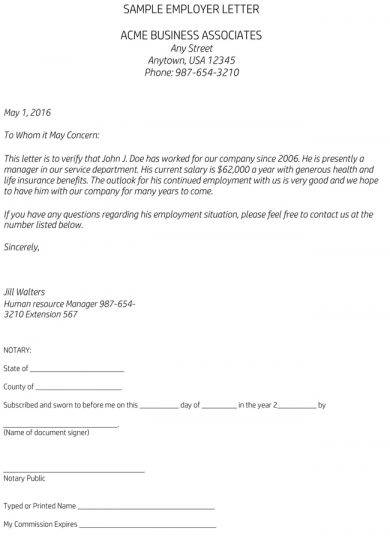

The recipient’s address should follow the date. Every State has a Secretary of State’s officeor equivalent that allows a user to search its database to lookup the principals of the business entity. Have the individual you’ve requested to obtain an employment verification letter from the Principal or Owner of the business. See full list on eforms.

In order to ensure that the employer actually signed the letter , it is best to call during business hours. If the person that signed is not available it is best to ask for a call-back or to ask for someone else who may be able to verify furthermore of the verification. When asking for the letter it may be best to ask for the past pay stubs from the employer.

If this is not available then it is best to request the bank statement of the past month from the individual. This will give you not only their income but also show their spending habits and prove if they are capable of being financially responsible. Often times individuals are paid with cash or they are self-employed. In these instances, it is best to get, at the very least, the past years of income taxes. Everyone in the United States is required to pay taxes to the federal government.

Therefore, if the individual is making any kind of money there will be a return on file that they can easily obtain. This takes about business day and is free. If none of the above solutions seem promising it is best to obtain a credit report from the individual. This can be easily completed by either collecting the person’s information through the Background Check Authorization Form.

Once you have all the necessary information you can perform the lookup through Equifax, Experian, or Transunion. This sort of verification letter is frequently used when somebody seeks housing or is making use of for a loan. An employment verification letter is an instrument of formal business communication. Verify all self-employment income and business expenses.

Publications and Forms for the Self-Employed More In File. If you receive income from Social Security due to retirement or disability, then the Social Security Administration can provide you with a benefits statement rather than an income verification letter. ROE Secure Automated Transfer – Ceridian Canada Ltd.

Easily confirm employees’ salaries when they apply for loans, credit cards, housing, and mortgages. An income verification letter is an important document that verifies and testifies to the legitimacy of a borrower’s capacity to pay loans and debts. Therefore, you as an employer, must be willing to provide such vital document. The letter is often provided by an accountant, an employer, or anyone authorized to access your personal data. But if you happen to be self – employed , then the task must be taken into your own hands.

Collection of self employment verification letter template that will perfectly match your demands. When creating a formal or organisation letter , presentation style as well as layout is key to earning an excellent initial impact. Other documents that can verify your small- business- self -employment income include balance.