Steps to apply for certificate of tax exemption. What qualifies you to be tax exempt? What does it mean to be tax exempt? How many exemptions can I legally claim?

How to become a tax-exempt business?

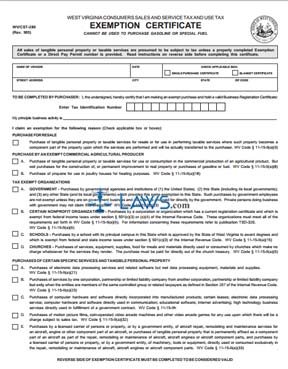

Purchases or leases of. Once your application has been submitte your documents will be reviewed and a determination made whether your application for exemption is approved. To check the status of your application , click on Tax-Exempt Program , and then click Tax-Exempt Application.

Your status will show: In Progress or Accepted or Rejected. Don’t know where your RDO is? Proceed to the Taxpayer Service Section and submit the requirements for the certificate of tax exemption.

Pay the certification fee.

Include a copy of the exemption determination letter issued by the IRS , including any addenda. Enter your 11-digit taxpayer number and WebFile number (if applicable). Your county appraiser determines whether your farm or ranch qualifies for either. To apply for an entity exemption certificate is a two-step process.

First you will be directed to Ks WebTax to to the system. If you do not have a Ks WebTax account, register by providing some basic information and create your own User ID and Password. Some of the information provided will be used in the exemption certificate application. Sign-in or register with the Kansas Department of Revenue Customer Service Center. Select one of the below exemption certificate types.

Complete and submit an exemption certificate application. If you are registered with the IRS and have received a 501(c) letter, you must attach a copy of the most current letter of exemption issued to you by the IRS. This list of exemptions and descriptions should only be used for general information. Please refer to the regulation or statute referenced in the right‑hand column for more detailed definitions, explanations, and limitations. Commercial Agriculture Tax Exemptions.

Business Across State Lines Tax Exemptions.

To gain tax -exempt status, you must apply with the Internal Revenue Service (IRS) and receive approval. When approve the nonprofit will not be required to pay federal income taxes. At the state level, some states offer tax -exempt status as well, meaning the net profit will be exempt from state income tax payments. Use the Amazon online tool: Most states in the U. For each state where you’ll make purchases, or where you’ll have orders shipped.

Tax – exempt refers to income or transactions that are free from tax at the federal, state, or local level. This includes most tangible personal property and some services. A purchaser must give the seller the properly completed certificate within days of the time the sale is made, but preferably at the time of the sale.

These exemptions apply to sales of building materials, machinery and equipment when sold to qualified businesses. The sale must be made directly to the qualified businesses or company and payment therefore made by them in order for the exemption to apply. We’ve highlighted many of the applicable exemption certificates in the listing below.

Also, exemptions may be specific to a state, county, city or special district. Exemption certificates can also be found in our Forms Library.