What is example of notes payable? Where is notes payable on the balance sheet? How to calculate bonds payable? Mailing address where each payment is mailed to.

Note payable are more formal than accounts payable in that they are usually in writing and are issued for periods shorter than year (usually). To find Notes payable remember the basic accounting equation.

Liability Classifications. Suppose a note payable for $ 0is issued at discount price of $9and pays percent annual interest. Each year, the interest recorded is $plus one-fifth of the discount, or $10. Under this agreement, a borrower obtains a specific amount of money from a lender and promises to pay it back with interest over a predetermined time period. Southern Company an amount of fifty thousand dollars plus interest after six month of the date of preparation of the note.

The maturity is years. Smith who is the treasurer of the company. See full list on accountingformanagement.

Therefore, it should be charged to expense over the life of the note rather than at the time of ob.

Required:For National Company, prepare: 1. Firstly, the company puts notes payable as a short-term liability. As we see from the above example, CBRE has a current portion of notes of 133. At the end of the month term the total interest of 3would have been accrued. Mortgages, auto, and many other loans tend to use the time limit approach to the repayment of loans.

Some examples include: 1. Choosing a shorter mortgage term because of the uncertainty of long-term job security or preference for a lower interest rate while. This method helps determine the time required to pay off a loan, and is often used to find how fast the debt on a credit card can be repaid. This calculator can also estimate how early a person who has some extra money at the end of each month can pay off their loan. It is possible that a calculation may result in a certain monthly payment that is not enough to repay the principal and interest on a loan. When using a figure for this input, it is important to make the distinction between interest rate and annual percentage rate (APR).

By definition, the interest rate is simply the cost of borrowing the principal loan amount. On the other han APR is a broader measure of the cost of a loan, and rolls in other costs such as broker fees, discount points, closing costs, and administ. When it comes to loans, there are generally two available interest options to choose frovariable (sometimes called adjustable or floating), or fixed. Examples of variable loans include adjustable-rate mortgages, home equity lines of credit (HELOC), and some personal and student loans.

In variable rate loans, the interest rate may change based on indices such as inflation or the central bank rate (all of which are usually in movement with the economy ). Federal Reserve or the London Interbank Offered Rate (Libor). Suppose for example, a business issues a note payable for 10due in months at simple interest in order to obtain a loan, then the total interest due at the end of the months is.

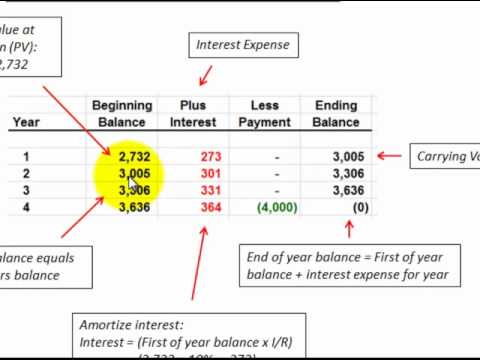

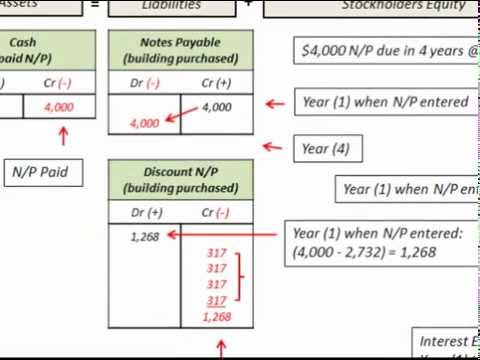

Discount amortization transfers the discount to interest expense over the life of the loan. This means that the $0discount should be recorded as interest expense by debiting Interest Expense and crediting Discount on Note Payable. Notes Payable : 1000: To record 90-day bank loan. Notes payable is a liability that represents the total amount of promissory notes that a company has issued but not yet paid. It is reported as a current liability when it is due within a year of the balance sheet date.

Notes payable that are not due within one year are considered a long-term debt or non-current liability. Calculate and account for amounts related to notes payable that include level payments of principal and interest over their life. Know that electronic spreadsheets frequently include functions that can be used to calculate note payments.

Series A share for convertible note holders. Current liabilities are short-term liabilities of a company. In this example that works out to $3.