Higher Education Loan Program or HELP is a loan program to help eligible students enrolled in Commonwealth supported places to pay their student contribution amounts. This calculator will help you determine an estimate of the compulsory repayment amount required towards your study or training loan. High call volumes may result in long wait times.

Before calling us, visit COVID-, Tax time essentials , or find to our Top call centre questions. To edit the sheet, make a copy. HECS debts stay with you for life until repaid , and will follow you into retirement. How does the HECS HELP student loan repayment? Can You repay HECS HELP debt?

What is repayment calculator? So in our example, we are required to repay 4. This repayment amount will be deducted from your HECS balance. The ATO website also has a calculator tool to help you work out your repayment information. Otherwise, focus on your career, and your HECS repayments will be automatically deducted from your pay – and will mostly remain out of sight, and out of mind. Please note: these calculators are only estimates and should be used only as a guide.

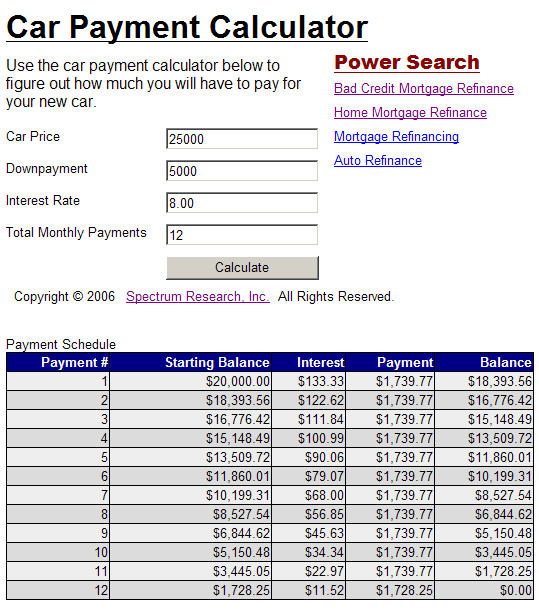

You can estimate how much you will need to pay back in a year using the study and training loan repayment calculator. It is usually done in periodic payments that include some principal and interest. See full list on calculator.

Choose this option to enter a fixed loan term. For instance, the calculator can be used to determine whether a 15-year or 30-year mortgage makes more sense, which is a common conundrum for most people ready to purchase a house. The calculated will display the monthly installment required to pay off the loan within the specified loan term. For instance, this may be a set amount of disposable income determined by subtracting expenses from income that can be used to pay back a loan. It is important to first consider whether utilizing any of the strategies below to repay loans faster is actually a good idea.

Depending on individual financial situations, it may or may not be wise. While extra payments toward loans are great, they are not absolutely necessary, and there are opportunity costs that deserve consideration. For instance, an emergency fund can come in handy when incidents like medical emergencies or car accidents happen.

Even stocks that perform well during good years are more financially beneficial than extra payments towards a low interest mortgage. The compulsory repayment threshold is different each year. You can make a voluntary repayment to the Australian Taxation Office (ATO) at any time. Repayment Calculator. For other repayment options, please use the Loan Calculator instead.

Include any upfront fees into the calculator to compute the real rate of interest. That is, once your taxable income reaches a certain level. The HRI thresholds are adjusted each year.

If you’re considering a postgraduate course at Deakin, our FEE-HELP repayment calculator gives you the confidence to make university study a reality. FEE-HELP loans cover up to 1 of tuition fees for eligible students. To apply for a HECS -HELP loan, you will need a tax file number (TFN) and a Request for Commonwealth support and HECS -HELP form, which your university or higher education provider will give you. Your form must be filled in and submitted to your provider before the census date (or administrative date). With our Home Loan Calculator , you can estimate what your repayments would be.

You can also generate a personalised Key Facts Sheet based on your loan amount, term and repayments. Add Valuable Interactive Content to Your Website.