Do I really need to register for GST? When must a business register for GST? Should you register for GST? Is it necessary to do GST registration? SecureKey Concierge (Banking Credential) access.

Personal Access Code (PAC) problems or EI Access Code (AC) problems. Social Insurance Number (SIN) validation problems. Other login error not in this list. You are not a small supplier.

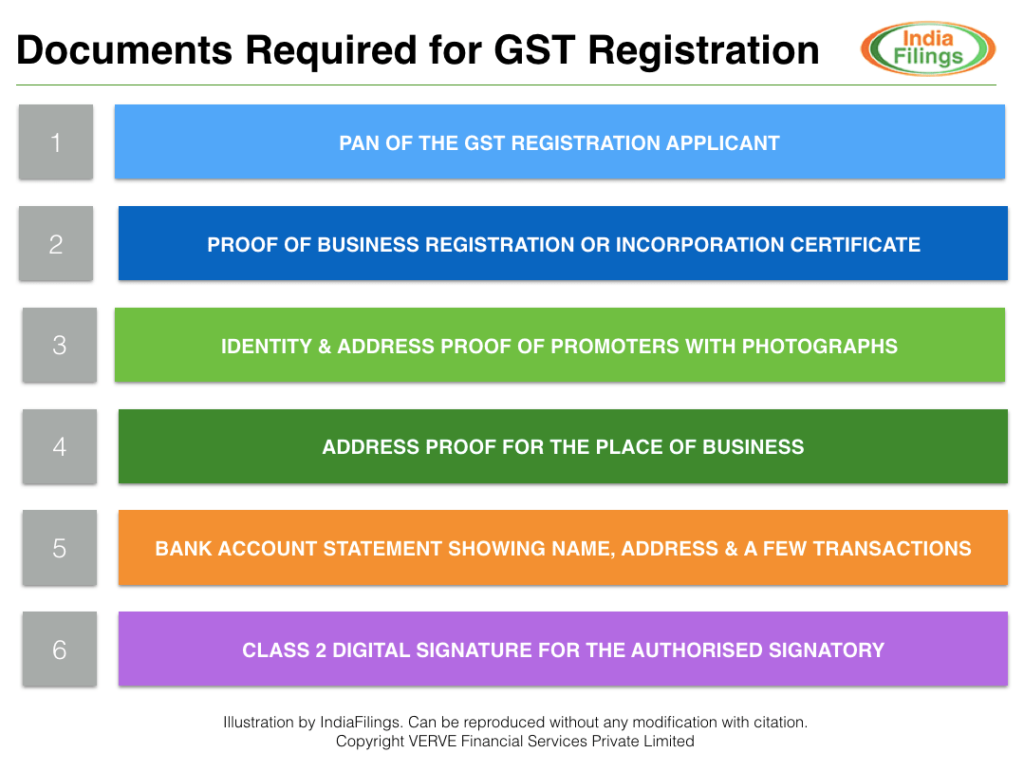

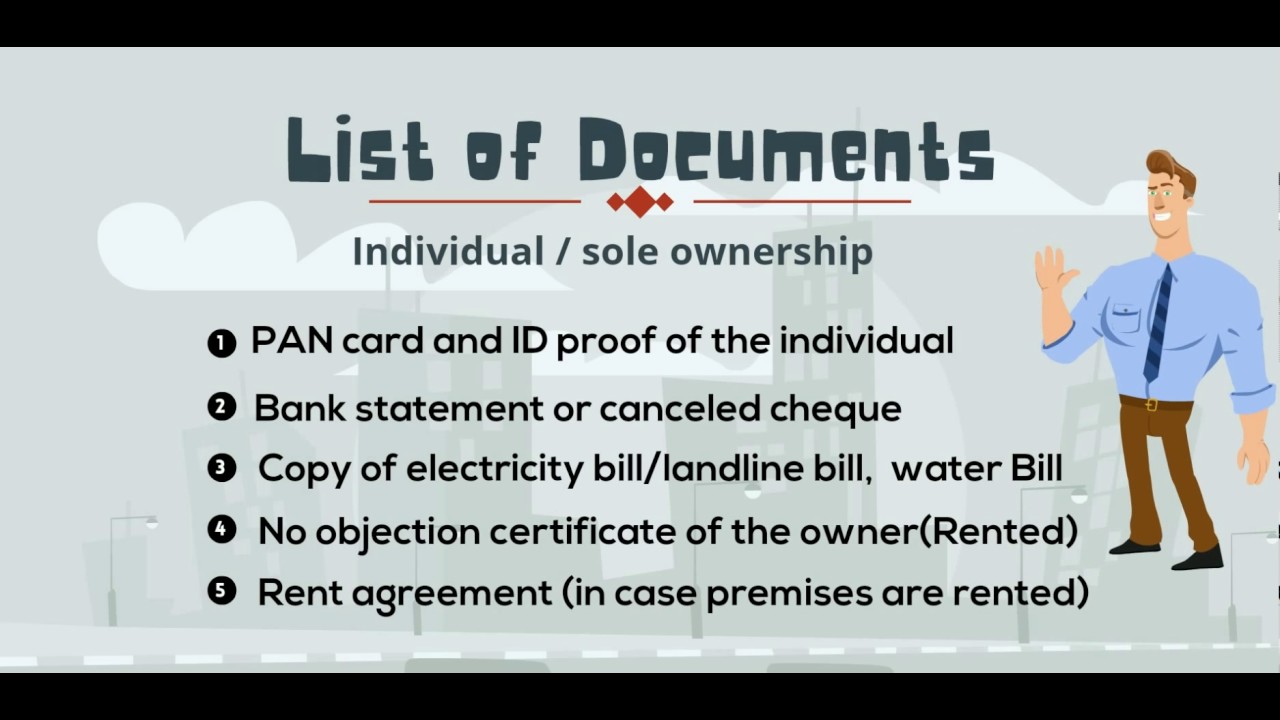

Rented office – Rent agreement and No objection certificate (NOC) from the owner. PAN Card: Any form of GST registration will require the PAN (Permanent Account Number) of the authorized. You must register for goods and services tax ( GST ) within days of your GST turnover reaching the threshol or if you provide taxi travel for passengers.

See full list on iras. If at any time, you can reasonably expect your taxable turnover in the next months to be more than S$million. You must have supporting documents to support your forecast value of $1million. Signed contracts or agreements 2. Accepted quotations or confirmed purchase orders from customers 3. Invoices to customers with fixed monthly fee charged 4. For example, you made a forecast based on market assessment, business plans or sales targets. Your taxable turnover is wholly or mainly from zero-rated supplies and you can choose to apply for exemption from registration.

You will not be required to register for GST if: a. The taxable turnover is projected to be lower due to specific circumstances(e.g. large-scale downsizing of business) 3. You may also be liable for registration: 1. GST-registere or 2. Singapore that are not registered for GST. For more information on the requirement to register for GST under these regimes, please refer to GST on Imported Services. The effective date of registration is as follows: 1. IllustrationThere are serious consequences for late registration : 1. Your date of registration will be backdated to the date that you were liable to be registered. Prosecution action may ap. You must first be authorised in CorpPass by the business to be able to access the GST registration e-Service on myTax Portal.

How do I register with GST ? Lodge your Grievance using self-service Help Desk Portal. STEP – SUBMIT PROMOTER INFORMATION The next tab asks for details of the promoters and directors. Who needs to register for GST ? Provide your ARN number and attach supporting documents whereever necessary. In case additional information is require fill the automatically generated GST REG-form. After all the information submitted is verifie a certificate of registration will be issued within working days.

Below mentioned documents are required for GST registration for a Sole proprietorship: PAN Card of Owner PAN cards can be applied online as well as offline. For applying, you need a scanned photograph, identity proof, and address proof. The applicant needs to provide below documents as a proof of address for applying for New GST Registration.

Also, it requires a change in the existing address. Proof of Principal Place of business (Any One) -Consent Letter. You do not have to register GST just because you start a business or organisation.